Time limit on Claiming CENVAT Credit: Major Implication

Ankit Bidasaria, CA & CS

Rule 4 of the CENVAT Credit Rules, 2004 ("CCR") provides the conditions for availment of credit. Amendment rules inserted a new proviso after the second proviso in Rule 4(1). The new proviso shall be inserted with effect from first day of September, 2014. The proviso has been reproduced as under:

Rule 4 of the CENVAT Credit Rules, 2004 ("CCR") provides the conditions for availment of credit. Amendment rules inserted a new proviso after the second proviso in Rule 4(1). The new proviso shall be inserted with effect from first day of September, 2014. The proviso has been reproduced as under: "Provided also that the manufacturer or the provider of output service shall not take CENVAT credit after six months of the date of issue of any of the documents specified in sub- rule (1) of rule 9."

Thus, now there is a restriction introduced under the CCR that credit of the duty paid in inputs or input services should be availed with 6 months from the date of relevant document specified in Rule 9(1) of the CCR.

In Rule 4(7), as we know, there is a proviso clause that in case the payment of the value of input service and the service tax thereon is not made within 3 months from the date of the invoice ("or any relevant document as per Rule 9(1)") the manufacturer of Service provider who has taken credit of such input service shall pay an amount equal to the Cenvat credit taken on such input service. Now, Rule 4(7) has been amended to make it clear that after the lapse of 6 months Credit cannot be claimed.

Now in a case where the payment to the service provider is not made within 3 months from the date of invoice, then the CENVAT credit so taken by the Service recipient has to be reversed. The credit of input tax amount can be taken by the service recipient once the payment has been made. There was no time limit on such re-credit. But now, since after the amendment no credit can be taken after six month from the date of invoice the re-credit cannot be taken. Further, there is no specific mention that the restriction clause of 6 months is only for the availment of first credit and the restriction does not covers re-credit availment.

Assume a case, where the assessee receives the service provider's invoice on October 31, 20X4 which is dated October 01, 20X4. As per the amended Rule 4(1) the assessee can claim the input service tax till March 31, 20X5. Suppose he claims the credit on October 31st itself. Now, as per Rule 4(7) the assessee shall be required to make payment by December 31, 20X4. In case the assessee fails to make the payment to service provider, he shall be required to reverse the credit of input service tax so taken. Now, there can be two cases, the assessee might make the payment before the elapse of 6 months from the date of invoice (i.e. before March 31, 20X5) or he makes the payment after 6 months from the date of invoice (i.e. after March 31, 20X5).

CASE I: The assessee makes the payment before 6 months from the date of invoice (i.e. before March 31, 20X5)

In this case the assessee shall enjoy the benefit of availing the input tax credit as six months have not elapsed from the date of invoice.

CASE II: The assessee the payment after 6 months from the date of invoice (i.e. after March 31, 20X5)

In this case since as per Rule 4(1) the last date of availing the Input credit being March 31, 20X5 the assessee shall not be able to claim the input tax.

Therefore, we see that the benefit of 3 months time frame for payment of the value of the input service, vis-à-vis availment of CENVAT credit, would be subject to the overall limit of 6 months fixed for availment of credit by the new amendment.

Further, if any assessee fails to discharge the tax liability in the past and the assessee discharges the same after receiving a notice from the department he shall not be eligible to claim the input tax credit as the specified time limit of 6 months would have already lapsed.

Since the introduction of the CENVAT credit procedure over many years, there has never been prescribed a time limit for availing CENVAT Credit. This restriction is also unreasonable to the extent that authorities are entitled to adjudicate tax shortfalls and demands for the past five years in most cases.

(Author may be contacted at bidasaria_a@yahoo.co.in)

Fund Raising In Pvt Ltd Co Under Companies Act 2013

CA Gaurav Mittal

FUND RAISING IN PVT LTD CO UNDER COMPANIES ACT 2013

Under Companies Act,2013 A company can raise funds via 3 means :-

1) Deposits.

2) Loans.

3) Capital.

The Deposits and loans has already been discussed earlier on this website

Deposits : - Acceptance Of Deposits Under Section 73 – 76

Now we will discuss the third method i.e. Raising of Capital

Under Companies Act 2013, A Private Limited Company can raise funds via Capital in 3 Ways :-

1) Private Placement/ Preferential Allotment.

2) Right Issue/preferential Allotment.

3) Bonus Issue.

PRIVATE PLACEMENT.

Issuing shares to a select group of people like friends & family, angels or VC?

Brace up, the new Companies Act 2013, provides for lengthy compliance procedures.

Unlike before, even a private limited company has to follow the processes for private placement of securities. Securities means equity shares, preference shares and debentures, convertible instruments, redeemable instruments.

"Private Placement" means any offer of securities or invitation to subscribe securities (equity or securities that convert to equity) to a select group of persons by a company, other than by way of public offer, through issue of a private placement offer letter. (Section 42 of Companies Act 2013 and Rule 14 under Companies (Prospectus and Allotment of Securities) Rules 2014)

These guidelines are applicable if the offer is made to a person who is currently not an equity shareholder in the company.

KEY CONDITIONS

A) An offer can be made under a Private Placement Offer Letter to not more than 200 people

Not just the limitation of allotment to 200 people but even an invitation to subscribe cannot be made to more than 200 people.

The 200 people limit excludes Qualified Institutional Buyers and Employees.

VARIOUS KNOW HOW TO OFFER LETTER

1) Offer letter in PAS 4 + application form serial numbered + addressed to specific person – to be sent in writing or electronic mode.

2) While passing special resolution – basis or justification of pricing (including premium) to be made in explanatory statement.

3) Offer per person cannot be for less than Rs. 20,000

A person cannot apply for shares of Less than Rs 20,000 Face Value.

4) Payment to be made from bank A/c of person subscribing.

5) Company to keep record of such Bank A/c.

6) To maintain complete record in PAS – 5 and PAS 4 to be filed with ROC

WHAT OFFER LETTER SHOULD CONTAIN

1) Business carried out by Co & subsidiaries.

2) Management's perception of risk factors.

3) Details of default including interest – statutory dues, deposit, loan, etc.

4) Time schedule for which offer is valid.

5) Price of offer and its justification.

6) Name & Address of the valuer who did valuation.

7) Purpose and object of offer.

8) Contribution by promoters or directors.

9) Disclosure of interest of director, promoter or KMP.

10) Details of litigation pending.

11)Remuneration of directors for current + last 3 yrs.

12)Related party transaction for last 3 years relating to loans, guarantee or securities.

13)Auditors' reservations or qualifications or adverse remarks for last 5 years – its impact on FS & corrective action taken / proposed for each comment.

14)Material frauds last 3 years

Financial position –

1) Capital structure before & after;

2) Profit before & after tax for 3 years

3) Dividend last 3 years

4) Interest coverage ratio for last three years (Cash profit after tax plus interest paid/interest paid).

5) Summary of financial position including Cash Flows – last 3 years – audited

6) Change in accounting policies in last 3 years and its effect on profits & Reserves.

7) Declaration by director of compliance.

B) The money so received shall be kept in a separate bank account of the company and utilized only for allotment (or repayment).

KEY POINTS UNDER THIS

1) On allotment file PAS -3 in 30 days.

2) Detail to include PAN & e-mail id of each member to whom share allotted.

3) Share Allotment cannot be in cash now.

4) If not followed – Penalty of amount involved or 2 Cr, whichever is high+ to refund the money.

5) Effective from 01.04.2014.

6) Share to be allotted within 60 days of receipt of allotment money.

PROCEDURE FOR PRIVATE PLACEMENT

- Check Provision in Article regarding Private Placement

- Call Board Meeting:

• To Prepare Offer Letter

• Make Proposal for Private Placement

• Prepare list of persons to whom option will be given

- Call EGM:

• Pass SR- will be valid for 12 month

• If not completed PP in 12 Month pass another SR

• Approve Draft Offer Letter by SR

- File MGT-14 with ROC

Attachments: -

Notice of EGM

CTC of SR

Minutes - Issue offer letter in PAS-4 within 30 days of record of name of persons:

• Application form serially numbered

• Address to the persons to whom the offer is made

- Prepare complete record of Private Placement in PAS-5

- File PAS-4 + PAS-5 with ROC within 30 days of issue of offer letter in GNL-2

- Make Allotment of shares within 60 days of receipt of Money from the persons to whom right was given.

- Called BM for allotment of shares

- File PAS-3 with Roc within 30 days if Allotment. Attachments: – List of Allottees – BR for allotment of share

- File Form MGT-14 along with Resolution pass in Board meeting for allotment of shares.

12. Issue Share Certificates.

RIGHT ISSUE/ PREFERENTIAL ALLOTMENT

Preferential Offer means an issue of shares or other securities, by a Company to any select person or group of persons on a preferential basis and does not include shares or other securities offered through a public issue, rights issue, employee stock option scheme, employee stock purchase scheme or an issue of sweat equity shares or bonus shares or depository receipts issued in a country outside India or foreign securities.

Essentials:

- For a pro-rata issuance of equity and securities converting into equity, to current equity shareholders in the company, then the shareholders of the company has to approve through a special resolution, at least 3 days prior to such offer. The Articles of Association has to have an enabling provision.

- The price for the security offered has to be supported by a valuation report by a Registered Valuer.

– The validity for such Special resolution is 12 months, within which the company has to complete the allotments.

– The securities allotted has to be fully paid-up (i.e. it cannot be partly-paid for).

- When obtaining the shareholder approval, the below details has to be decided and included in the disclosures:

- the objects of the issue;

- the total number of shares or other securities to be issued;

- the price or price band at/within which the allotment is proposed;

- basis on which the price has been arrived at along with report of the registered valuer;

- relevant date with reference to which the price has been arrived at;

- the class or classes of persons to whom the allotment is proposed to be made;

- intention of promoters, directors or key managerial personnel to subscribe to the offer;

- the proposed time within which the allotment shall be completed;

- the names of the proposed allottees and the percentage of post preferential offer capital that may be held by them;

- the change in control, if any, in the company that would occur consequent to the preferential offer;

- the number of persons to whom allotment on preferential basis have already been made during the year, in terms of number of securities as well as price;

- the justification for the allotment proposed to be made for consideration other than cash together with valuation report of the registered valuer.

- The pre issue and post issue shareholding pattern of the company.

PROCEDURE FOR PREFERENTIAL ALLOTMENT

a. Check Provision in Article regarding Preferential Allotment

a. Check Provision in Article regarding Preferential Allotment

b. Call Board Meeting:

• To Prepare Offer Letter

• Make Proposal for Preferential Allotment

• Prepare list of persons to whom option will be given

• Call EGM

• To Prepare Offer Letter

• Make Proposal for Preferential Allotment

• Prepare list of persons to whom option will be given

• Call EGM

c. Call EGM:

• Pass SR- will be valid for 12 month

• If not completed PP in 12 Month pass another SR

• Approve Draft Offer Letter by SR

• Pass SR- will be valid for 12 month

• If not completed PP in 12 Month pass another SR

• Approve Draft Offer Letter by SR

d. File MGT-14 with ROC

Attachments: -

Notice of EGM

CTC of SR

Minutes

Attachments: -

Notice of EGM

CTC of SR

Minutes

e. Issue offer letter in PAS-4 within 30 days of record of name of persons:

• Application form serially numbered

• Address to the persons to whom the offer is made

• Application form serially numbered

• Address to the persons to whom the offer is made

f. Prepare complete record of Preferential Placement in PAS-5

g. File PAS-4 + PAS-5 with ROC within 30 days of issue of offer letter in GNL-2

h. Make Allotment of shares within 60 days of receipt of Money from the persons to whom right was given.

i. Called BM for allotment of shares

j. File PAS-3 with Roc within 30 days if Allotment. Attachments: – List of Allottees – BR for allotment of share

k. File Form MGT-14 along with Resolution pass in Board meeting for allotment of shares.

l. Issue Share Certificates.

(Author may be contacted at mittalgaurav05@gmail.com)

Much needed Clarifications on matters relating to Related Party Transactions

General Circular No. 30/2014, Dated: 17th July 2014

Subject: Clarifications on matters relating to Related Party Transactions.

Government has received representations from stakeholders seeking certain clarifications on related party transactions covered under section 188 of the Companies Act, 2013. These representations have been examined and the following clarifications are given:-

1. Scope of second proviso to Section 188(1) :- Second proviso to subsection (1) of section 188 requires that no member of the company shall vote on a special resolution to approve the contract or arrangement (referred to in the first proviso), if such a member is a related party. It is clarified that `related party' referred to in the second proviso has to be construed with reference only to the contract or arrangement for which the said special resolution is being passed. Thus, the term 'related party' in the above context refers only to such related party as may be a related party in the context of the contract or arrangement for which the said special resolution is being passed.

2. Applicability of Section 188 to corporate restructuring, amalgamations etc. :- It is clarified that transactions arising out of Compromises, Arrangements and Amalgamations dealt with under specific provisions of the Companies Act, 1956/Companies Act, 2013, will not attract the requirements of section 188 of the Companies Act, 2013.

3. Requirement of fresh approvals for past contracts under Section 188. :- Contracts entered into by companies, after making necessary compliances under Section 297 of the Companies Act, 1956, which already came into effect before the commencement of Section 188 of the Companies Act, 2013, will not require fresh approval under the said section 188 till the expiry of the original term of such contracts. Thus, if any modification in such contract is made on or after 1st April, 2014, the requirements under section 188 will have to be complied with.

4. This issues with approval of the competent authority.

No. 1/32/2013- CL-V (Pt)

Yours Failthfully

(KVS Narayanan)

Assistant Director (Policy)

Ph: 23387263

Assistant Director (Policy)

Ph: 23387263

ALLAHABAD, JULY 18, 2014: THE issues before the Bench are - Whether, based on a subsequent decision of the Supreme Court which was not available at the time of decision given by the Tribunal, a rectification application u/s 254(2) is maintainable and Whether in the event of closure of a firm, stock of the said firm would be carry forward to the newly formed company, at cost only. And the verdict goes against the Revenue.

Facts of the case

The assessee is an individual. In the AY 1990-91, the Tribunal while allowing the appeal of the Revenue, had observed it was clear that whatsoever may be the mode of dissolution or closure of the business of the firm, the profits had to be ascertained only by taking the closing stock at market value. The accounts had to be worked out on that basis upto the date of dissolution or prior to it. The situation that the firm came to an end by way of liquidation or partners dissolved the firm for distributing the assets of the firm, or dissolved and closed the firm with a view to form a company or otherwise, were not relevant because the accounts of the outgoing entity, i.e., the firm, were to be prepared properly, may be the business remained the same and stock was also taken over by the new entity i.e., the company. For tax purposes, the profit and loss of the outgoing entity, i.e., the firm had to be properly and separately worked out and was not to be mixed up with the new entity, i.e., the company. The plea of the counsel for the assessee that in a case of conversion of a firm into a company, the business was not continued and, therefore, same method of valuation of closing stock should be applied, was not acceptable. This view of the tribunal was made on the basis of the decision SC in A.L.A. Firm's Vs. CIT 2002-TIOL-868-SC-IT-LB, in which it was held that if the partnership was dissolved, the valuation of the closing stock had to be valued at market price.

The assessee being aggrieved filed an application u/s 254(2) for rectification of the mistake contending that there was apparent on the face of the record. During the pendency of this application, the SC delivered a decision in Sakthi Trading Co. Vs. CIT 2002-TIOL-569-SC-IT holding that where the business continued and the firm was reconstituted, the valuation of the closing stock would have to be determined at cost price or market price, whichever was lower. In the light of this decision, which was brought to the knowledge of the Tribunal, the application of the assessee u/s 254(2) was allowed and the necessary rectification was made.

Before the HC, the assessee had contended that a substantial question of law arose namely that since the Tribunal had passed the order on merits after considering the pros and cons of the matter, it had no jurisdiction to rectify its mistake u/s 254(2) and in as much as the said rectification amounted to a review of its decision, which was not permissible u/s 254(2).

Held that,

++ we find that the Central Board of Direct Taxes has issued a Circular No. 68 explaining as to when a mistake apparent from the record could be corrected in the event of a subsequent decision delivered by the Supreme Court of India. In ACIT Vs. Saurashtra Kutch Stock Exchange Ltd. 2008-TIOL-170-SC-IT, the SC held that the rectification of an order stems from the fundamental principle that justice is above all and that it has to be exercised to remove the error and achieve the finality. The Supreme Court held that an error apparent on the record means an error which strikes one on mere looking and does not need a long drawn out process of reasoning on points on which there may be conceivably two opinions. The Supreme Court, in the said case, found that the decision of the Appellate Tribunal was rendered without noticing the decision of the High Court. The Supreme Court held that there was an error apparent on the record, which could be rectified by a miscellaneous application being filed under section 254(2). Similarly, in Shahbad Co-operative Sugar Mills Ltd. Vs. DCIT [2011] 336 ITR 0222, the Punjab and Haryana High Court held that recourse to rectification proceedings would be taken once the Supreme Court rendered its decision clarifying the earlier decision passed by it and that such rectification was permissible under section 154;

++ we find that pursuant to the decision given by the Supreme Court in Sakthi Trading Co., as a result of subsequent interpretation of law by the Supreme Court, fairly indicating that where the business continued, the valuation of the closing stock would have to be determined either at cost price or market price, whichever is lower. Such decision passed by the Tribunal based on an earlier decision of the Supreme Court is a mistake apparent from the record and consequently a rectification application under section 254(2) is maintainable. We are of the opinion that the Tribunal was justified in passing the order under section 254(2). In view of the aforesaid, we do not find that any substantial question of law arises for consideration. The appeal fails and accordingly dismissed.

(See 2014-TIOL-1153-HC-ALL-IT)

Bulk e-filing services of XMLs for Tax professionals

Posted In Income Tax | No Comments »

Bulk e-filing services of XMLs for Tax professionals

As you are ware, the income tax department has restricted the use of a single email id to a maximum of 10 accounts on the e-filing portal. A lot of tax professionals have already started experiencing issues in e-filing clients' tax returns.

H&R Block, an e-return intermediary registered with the income tax department, is offering bulk-efiling services to mitigate these issues.

In fact this service has a lot more features than just bulk-filing.

Below is the list of important features:

i) A single account to e-file all your clients' tax returns

ii) E-file multiple XMLs just at a click of a button

iii) Track ITR V status and refund status in a single screen

iv) 26AS comparison

'Annual subscription fee for the same is just Rs. 500 for unlimited filings round the year!!

Ashwani Dhingra vs Addl. CCIT S. 234A/B/C - Interest is mandatory, but it cannot be charged retrospectively when there was no receipt in the hands of assessee. No law is applicable retrospectively unless specified in the statute. The assessee is primarily an agriculturist. His land was acquired by the Government and he got compensation under Section 23 of the Land Acquisition Act. The assessee has also received interest on additional compensation and solatium. The assessee has declared the amount of compensation and solatium under VDIS, 1997, but interest on additional compensation received under Section 23(1A) was not declared by the assessee for the purpose of tax. P & H High Court judgment dated 17.8.2000 in the case of Union of India v Birla held that interest would also be payable on additional amount determined under Section 23(1A) of the Land Acquisition Act. Hon'ble Apex Court has confirmed the same in the case of Sundar Vs. Union of India dated 9th September, 2001. Resultantly, the assessee has received the interest on the amount of additional compensation, which was spread over during the assessment year under consideration. On 20th November, 2003 the A.O. has issued a notice under Section 148 of the Act. Being aggrieved, the assessee filed a writ petition before Hon'ble Allahabad High Court, which was dismissed vide order dated 31st August, 2004. On 11th October, 2004 the assessee filed returns of income declaring an income of Rs. 6,53,760/- being taxable income in each of the six years the tax was paid under Section 140A of the I.T. Act, 1961. Whether chargeability of the interest under Section 234A, 234B, 234C for the assessment year under consideration. The A.O. has charged the interest. Ld. CIT(A) & ITAT confirmed the order. Hon`ble High court observed that, no doubt the charging of the interest is mandatory, the assessee is liable to pay the advance tax and on delay/failure, interest is chargeable. In the instant case, the assessee has received compensation and interest thereupon only after the judgment of the Hon'ble Supreme Court in the year 2001. Only due to judicial pronouncement, the assessee has become entitled to receive the additional compensation and interest thereupon. The interest can be charged only on the income. No interest can be charged on notional interest. In the Case of CIT Vs. ICD, Syndicate, 285 ITR 310 Karnataka, it was held that no interest can be charged when there is no real income. In the instant case, the interest would be charged in the year when the real income was received by the assessee and certainly, not during the year when the land wasacquired. Thus, the interest will have to be charged only on the interest earned on additional compensation which was received after the year 2001. So, the interest will have to be charged in the year. When income was earned as per the ratio laid down in the case of Ghanshyam [2009] 315 ITR 1 (SC), it cannot be charged retrospectively when there was no receipt in the hands of assessee. Needless to mention that no law is applicable retrospectively unless specified in the statute. Interest is compensatory in nature as per the ratio laid down in the case of CIT Vs. Pranoy Roy, 309 ITR 231 Sc. Interest on advance tax is also compensatory in nature as per the ratio laid down in the case of CIT Vs. Insilco Ltd. (2010) 321 ITR 105 Delhi. Hon`ble High court directed the A.O. to charge the interest under Section 234A, 234B, 234C of the Act, as per the law in the assessment year when the interest earned on the additional compensation was actually received. | |||

| |||

| | |||

| | |||

| | |||

| |||

| | |||

| | |||

|

Budget 2014 -ECS, RTGS, NEFT etc. proposed to be allowed as permissible U/s. 269SS & 269T

Mode of acceptance or repayment of loans and deposits

ECS, RTGS and NEFT etc. are now proposed to be allowed as permissible mode to accept or repay the deposit or loan specified under section 269SS and 269T respectively.

The existing provisions contained in section 269SS of the Act, inter alia, provide that no person shall take from any other person any loan or deposit otherwise than by an account payee cheque or account payee bank draft, if the amount of such loan or deposit or aggregate of such loans or deposits is twenty thousand rupees or more. Similarly, the existing provisions of section 269T of the Act, inter alia, provide that no loan or deposit shall be repaid otherwise than by an account payee cheque or account payee bank draft, if the amount of such loan or deposit together with interest or the aggregate amount of such loans or deposits together with interest, if any payable thereon, is twenty thousand rupees or more.

In the present times many banking transactions take place by way of internet banking facilities or by use of payment gateways. Accordingly, it is proposed to amend the provisions of the said sections 269SS and 269T so as to provide that any acceptance or repayment of any loan or deposit by use of electronic clearing system through a bank account shall not be prohibited under the said sections if the other conditions regarding the quantum etc. are satisfied.

These amendments will take effect from 1st April, 2015 and will, accordingly, apply in relation to assessment year 2015-16 and subsequent assessment years.

'Annual information return' prposed to be named as statement of 'Financial Transaction or Reportable Account'

Obligation to furnish statement of Information

Name of annual information return is proposed to be substituted with statement of financial transaction or reportable account in view of amendment to section 285BA.

The existing provisions of section 285BA of the Act provide for filing of an annual information return by specified persons in respect of specified financial transactions which are registered or recorded by them and which are relevant and required for the purposes of the Act to the prescribed income-tax authority.

With a view to facilitate effective exchange of information in respect of residents and non-residents, it is proposed to amend the said section so as to also provide for furnishing of statement by a prescribed reporting financial institution in respect of a specified financial transaction or reportable account to the prescribed income-tax authority. It is further proposed that the statement of information shall be furnished within such time, in the form and manner as may be prescribed.

It is further proposed to provide that where any person, who has furnished a statement of information under sub-section (1), or in pursuance of a notice issued under sub-section (5), comes to know or discovers any inaccuracy in the information provided in the statement, then, he shall, within a period of ten days, inform the income-tax authority or other authority or agency referred to in sub-section (1) the inaccuracy in such statement and furnish the correct information in the manner as may be prescribed.

It is also proposed that the Central Government may, by rules, specify,- (a) the persons referred to in sub-section (1) of section 285BA to be registered with the prescribed income-tax authority; (b) the nature of information and the manner in which such information shall be maintained by the persons referred to in (a) above; and (c) the due diligence to be carried out by the persons referred in (a) for the purpose of identification of any reportable account referred to in sub-section (1) of section 285BA.

Further, the existing provisions of section 271 FA of the Act provide for penalty for failure to furnish an annual information return. It is proposed to amend the said section so as to provide for penalty for failure to furnish statement of information or reportable account.

It is also proposed to insert a new section 271 FAA so as to provide that if a person referred to in clause (k) of sub-section (1) of section 285BA, who is required to furnish a statement of financial transaction or reportable account, provides inaccurate information in the statement and where, (a) the inaccuracy is due to a failure to comply with the due diligence requirement prescribed under sub-section (7) of section 285BA or is deliberate on the part of the person; or (b) the person knows of the inaccuracy at the time of furnishing the statement of financial transaction or reportable account, but does not inform the prescribed income-tax authority or such other authority or agency; or (c) the person discovers the inaccuracy after the statement of financial transaction or reportable account is furnished and fails to inform and furnish correct information within the time specified under sub-section (6) of section 285BA, then, the prescribed income-tax authority may direct that such person shall pay, by way of penalty, a sum of fifty thousand rupees.

These amendments will take effect from 1st April, 2015.

Levy of penalty U/s. 276D mandatory for willful default U/s. 142(1) or 142(2A)

Failure to produce accounts and documents

Levy of penalty made mandatory. It is proposed to remove the monetary limit of fine and also proposed mandatory levy of fine.

The existing provisions of section 276D of the Act provide that if a person willfully fails to produce accounts and documents as required in any notice issued under sub-section (1) of section 142 or willfully fails to comply with a direction issued to him under sub-section (2A) of section 142, he shall be punishable with rigorous imprisonment for a term which may extend to one year or with fine equal to a sum calculated at a rate which shall not be less than four rupees or more than ten rupees for every day during which the default continues, or with both.

It is proposed to amend the provisions of the said section so as to provide that if a person willfully fails to produce accounts and documents as required in any notice issued under sub-section (1) of section 142 or willfully fails to comply with a direction issued to him under sub-section (2A) of section 142, he shall be punishable with rigorous imprisonment for a term which may extend to one year and with fine.

This amendment will take effect from 1st October, 2014.

Budget 2014 – Period of Provisional attachment U/s. 281B proposed to be extended by prescribed authorities

Provisional attachment under section 281B

The existing provisions of sub-section (1) section 281B of the Act provide that the Assessing Officer, during the pendency of any proceeding for assessment or reassessment, in order to protect the interest of revenue may, with the previous approval of the Chief Commissioner of Commissioner, attach provisionally any property belonging to the assessee in the manner provided in the Second Schedule. Sub-section (2) of the said section provides that the provisional attachment shall cease to have effect after the expiry of six months provided that the Chief Commissioner or Commissioner may extend the period upto a total period of two years.

It is proposed to amend the proviso to sub-section (2) so as to provide that the Chief Commissioner, Commissioner, Director General or Director may extend the period of provisional attachment so that the total period of extension does not exceed two years or upto sixty days after the date of assessment or reassessment, whichever is later.

This amendment will take effect from 1st October, 2014.

T : Where assessee, a NBFC, did not show interest income on loans advanced to two parties on ground that interest remained overdue on it for more than six months, in view of fact that loan in question was a term loan and, moreover, assessee did not demand return of same, it could not be regarded as a non-performing asset and, thus, impugned addition made on account of interest deserved to be confirmed

■■■

[2014] 46 taxmann.com 190 (Kolkata - Trib.)

IN THE ITAT KOLKATA BENCH 'B'

Income-tax Officer, Ward -4(1), Kolkata

v.

Tradelink Securities Ltd.*

ABRAHAM P. GEORGE, ACCOUNTANT MEMBER

AND GEORGE MATHAN, JUDICIAL MEMBER

AND GEORGE MATHAN, JUDICIAL MEMBER

IT APPEAL NO. 1385 (KOL.) OF 2011

[ASSESSMENT YEAR 2006-07]

[ASSESSMENT YEAR 2006-07]

MAY 27, 2014

Section 5 of the Income-tax Act, 1961 - Income - Accrual of (NBFC) - Assessment year 2006-07 - Assessee, a company registered as a non-banking financial company (NBFC) had advanced certain loan to two companies - In return of income, assessee did not show interest income contending that it being NBFC, was bound to follow prudential norms of RBI which prohibited recognition of interest on loans which remained overdue for more than six months - Assessing Officer held that assessee was following mercantile system of accounting, hence, it was bound to show interest accrued on loans - Whether since loans given were terms loans and, moreover, assessee had been unable to produce any document to show that it had made any demand for return of loan, same could not be regarded as non-performing asset- Held, yes - Whether, therefore, assessee could not take refuge under Prudential Norms issued by Reserve Bank of India - Held, yes - Whether, consequently, impugned addition was to be confirmed - Held, yes [Para 11] [In favour of revenue]

FACTS

| ■ | The assessee, a company registered as a non-banking financial company by Reserve Bank of India had filed its return for the impugned assessment year declaring certain taxable income. | |

| ■ | During the course of assessment proceedings, it was noted that assessee had advanced certain amount to two companies. | |

| ■ | The Assessing Officer was in possession of information that the said two companies had in their respective accounts charged interest on the loans taken by them from the assessee. | |

| ■ | The assessee, however, did not show any interest income in its return of income. The assessee's case was that it was a non-banking financial company, and bound to follow prudential norms for recognition of income as directed by the Reserve Bank of India. As per the assessee, the said prudential norms prohibited recognition of interest on loans which remained overdue for more than six months. | |

| ■ | The Assessing Officer opined that since assessee was following mercantile system of accounting, it was bound to show the interest accrued on the loans. In this view of the matter, he held that the interest accrued on the loans given to the two companies was chargeable to tax and an addition was made accordingly. | |

| ■ | The Commissioner (Appeals) was of view that interest income did not accrue even under mercantile system of accounting, once Non-Banking Financial Companies Prudential Norms (Reserve Bank) Directions, 1998 applied. Thus, he deleted the addition made by the Assessing Officer. | |

| ■ | On revenue's appeal: |

HELD

| ■ | Non-Banking Financial Companies Prudential Norms (Reserve Bank) as per the Notification No. DFC.119/DG(SPT)-98 dated 31-1-1998 states at rule 3 that income including interest/discount shall be recognized only when it is actually realised if a loan is considered as non-performing asset. A non-performing asset has been defined as an asset in respect of which interest has remained overdue for a period of six months or more. A demand or loan, which remained overdue for a period of six months or more from the date of demand is also considered as non-performing asset. [Para 9] | |

| ■ | It is an admitted position that the loans were advanced based on Promissory Note. Interest can be considered as overdue only when there is an agreement between the parties wherein a stipulation is there with regard to the date of payment of interest . In the absence of any such stipulation, one can never say that interest has fallen due on a particular date or was overdue. Similarly a loan can be considered as overdue only when it remains unpaid despite lapse of six months from the date of demand of the loan. | |

| ■ | The assessee has been unable to produce any document to show that it had made any demand for return of the loan. There is no claim by the assessee that the loans given were term loan. This being the situation, the loans given by the assessee to the said two companies will not fall within any of the limb of the definition of non-performing asset. | |

| ■ | Even otherwise, the Apex Court had clearly held in the case of Southern Technologies Ltd. v. Jt. CIT[2010] 320 ITR 577/187 Taxman 346 that prudential norms issued by the Reserve Bank of India cannot override the provisions of the Act. As per section 5 of the Act, total income shall include all income from whatsoever source derived by such person, which accrues or arise to him in a given in previous year. The assessee undisputedly was following mercantile system of accounting. By virtue of the application of the accrual principle, interest income had definitely accrued to the assessee. The concerned companies were charging interest in their respective accounts, deducting tax at source and also remitting such tax to the Government account. There is nothing on record to show that possibility of realising the interest was nil. The assessee had admitted that the said companies were having substantial assets with them. | |

| ■ | Hence, one cannot say that interest income was illusory or not real. In such circumstances, the assessee cannot take refuge under the Prudential Norms issued by the Reserve Bank of India and say that principles of accrual of income, when mercantile basis of accountancy was followed would not apply to it. No doubt, section 45Q of the R.B.I. Act is overriding in nature and has to be given primacy. However unless and until an assessee shows that a loan or advance had become a non-performing asset, there can be no question of applying the norms set out for such non-performing asset. Therefore, the Commissioner (Appeals) fell in error in deleting the addition made by the Assessing Officer. [Para 10] | |

| ■ | In the result, appeal of the revenue stands allowed. [Para 11] |

CASES REFERRED TO

Southern Technologies Ltd. v. Jt. CIT [2010] 320 ITR 577/187 Taxman 346 (SC) (para 6) and CIT v.Vasisth Chay Vyapar Ltd. [2011] 330 ITR 440/196 Taxman 169/[2010] 8 taxmann.com 145 (Delhi)(para 7).

Biswanath Das for the Appellant. P.R. Kothari for the Respondent.

ORDER

Abraham P. Geroge, Accountant Member - This appeal filed by the Revenue, directed against an order dated 29.06.2011 of ld. Commissioner of Income Tax (Appeals)-IV, Kolkata. It has raised the following three grounds:—

| (1) | That on the facts and circumstances of the case, ld. CIT(A) erred in law in deciding the issues related to the addition of interest taking the ground that it was receivable and was not actually received. | |

| (2) | That on the facts and circumstances of the case, ld. CIT(A) has erred in law in deleting the addition of Rs.19,00,000/- received by the assessee as interest from M/s. ISG Traders Ltd. and Rs.3,00,000/- received from M/s. Davenport & Co. Pvt. Ltd. | |

| (3) | That the appellant craves for leave to add, delete or modify any of the grounds of appeal before or at the time of hearing. |

2. Issues involved in grounds 1 & 2 are same. Assessee, a Company registered as a non-banking financial company by Reserve Bank of India, had filed its return for the impugned assessment year declaring income of Rs.65,352/-. During the course of assessment proceedings, it was noted that assessee had advanced a sum of Rs.95,00,000/- to one M/s. ISG Traders Limited of Duncans House, 31, Netaji Subhas Road, Kolkata-700 001 and a sum of Rs.25,00,000/- to one M/s. Davenport & Company Pvt. Ltd. of 5 & 7, Netaji Subhas Road, Kolkata-700 001, on which it had not shown any interest income. Assessing Officer was having information that the said two companies had in their respective accounts charged interest on the loans taken by them from the assessee. The amounts shown by them as interest payable came to Rs.24,72,300/-,of which Rs.19,00,000/-was of M/s. ISG Traders Limited and Rs.3,00,000/- was of M/s. Davenport & Company Pvt. Ltd. Assessee was put on notice to explain why interest from M/s. ISG Traders Limited and M/s. Davenport & Company Pvt. Ltd. was not accounted by it. Reply of the assessee was that it had not received any interest from the said two companies. As per the assessee, advance of Rs.95,00,000/- was given to M/s. ISG Traders Limited on 16.05.2002 and the sum of Rs.25,00,000/- was given to M/s. Davenport & Co. Pvt. Ltd. prior to financial year 2001-02. Submission of the assessee was that it had not received any interest from M/s. ISG Traders Limited and had received only negligible interest from M/s. Davenport & Co. Pvt. Ltd. Assessee also stated that it was a Non-Banking Financial Company, and bound to follow prudential norms for recognition of income as directed by Reserve Bank of India. As per the assessee, the said prudential norms prohibited recognition of interest on loans which remained overdue for more than six months. Even otherwise, as per the assessee, there was no real income or notional interest income, accruing to it.

3. However, Assessing Officer was not impressed by the above explanation. According to him, the two companies had taken loan from the assessee and charged interest in their respective accounts and also deducted tax at source thereon. Such tax at source was credited by them into the Government account. Therefore, as per the Assessing Officer, the concerned parties had confirmed, interests due to the assessee. Assessee was following mercantile system of accounting. Hence, it was bound to show the interest accrued on the loans. In this view of the matter, he held that the interest of Rs.22,00,000/- accrued on the loans given to the two companies was chargeable to tax and an addition was made accordingly.

4. In its appeal before the ld. CIT(Appeals), argument of assessee was that it was bound to follow the guidelines issued by Reserve Bank of India which was mandatory. As per the assessee, no income whatsoever was received from the concerned two companies. Though it was following mercantile system of accounting, assessee submitted that only real income could be taxed.

5. Ld. CIT(Appeals) was appreciative of the above contentions. According to him, Prudential norms prescribed by Reserve Bank of India prohibited recognition of interest income on loans and debts where interest or instalments of principal was outstanding for more than six months. As per ld. CIT(Appeals) assessee was required to classify these loans as non-performing assets. Once it was considered as non-performing assets it could not show any accrual of income. As per the ld. CIT(Appeals) interest income did not accrue even under mercantile system of accounting, once Non-Banking Financial Companies Prudential Norms (Reserve Bank) Directions, 1998 applied. In this view of the matter, he deleted the addition made by the Assessing Officer.

6. Now before us, ld. DR strongly assailing the order of ld. CIT(Appeals) submitted that the concerned parties to whom assessee had advanced loans were charging interest in their respective books, deducting tax at source thereon, and crediting such tax to the Government account. Assessee had never made any effort for realizing the amounts due from the concerned companies. Assessee had not recalled the loans. Relying on the decision of the Hon'ble Apex Court in the case of Southern Technologies Ltd. v. Jt. CIT [2010] 320 ITR 577/187 Taxman 346, ld. D.R. submitted that Non-Banking Financial Companies Prudential Norms issued by the Reserve Bank of India would not override the provisions of the Income Tax Act, which stipulated recognition of income on accrual based, once mercantile system was followed. Therefore, according to him, ld. CIT(Appeals) fell in error in deleting the addition.

7. Per contra, ld. AR submitted that the decision of the Hon'ble Apex Court in the case of Southern Technologies Ltd. (supra) was in respect of deductibility of a claim of provisioning made on non-performing assets. But assessee's case, here was not a claim for any such provisioning for non-performing assets. Hon'ble Apex Court only held that RBI regulations on non-performing loans would not have any overriding effect on the provisions of Income Tax Act. It did not deal with accrual of interest on non-performing loans. Relying on the decision of the Hon'ble Delhi High Court in the case of CIT v. Vasisth Chay Vyapar Ltd.[2011] 330 ITR 440/196 Taxman 169/[2010] 8 taxmann.com 145, ld. A.R. submitted that assessee having not received any interest, section 45Q of the Reserve Bank of India Act had to be applied. This section had an overriding effect. Interest not recognized by the assessee, nor accounted by it could not be considered as its income, just because mercantile system of accounting was followed.

8. We have heard the rival contentions and perused the material available on record. During the course of hearing, ld. Counsel for the assessee was asked whether the companies to which loans were given were still functioning or not. To this he replied that the companies were still functioning. Ld. Counsel also stated that the loans were given to the said companies based on promissory note, without any other security. Bench also asked the ld. Counsel whether any efforts were being made by the assessee for recovering the loans, to which ld. Counsel stated that only oral communication was there. What we find from the record is that the loan to M/s. Davenport & Co. Pvt. Ltd. was given prior to financial year 2001-02 and the loan to M/s. ISG Traders Ltd. was given on 16.05.2002. Despite no interest being received by the assessee, it had not taken any legal step for recalling the amounts from the said concerns.

9. Non-Banking Financial Companies Prudential Norms (Reserve Bank) as per the Notification No. DFC.119/DG(SPT)-98 dated 31.01.1998 states at Rule 3 that income including interest/discount shall be recognized only when it is actually realised if a loan is considered as non-performing asset. A non-performing asset has been defined as an asset in respect of which interest has remained overdue for a period of six months or more. A demand or call loan, which remained overdue for a period of six months or more from the date of demand is also considered as non-performing asset. For better appreciation it is required to reproduce definition of non-performing asset as per Rule 1, Clause-xii of Non-Banking Financial Companies Prudential Norms (Reserve Bank) Directions, 1998:—

'(xii) With effect from March 31, 2003, "non-performing asset" (referred to in these directions as 'NPA') means :

| (a) | an asset, in respect of which, interest has remained overdue for a period of six months or more; | |

| (b) | a term loan inclusive of unpaid interest, when the instalment is overdue for a period of six months or more or on which interest amount remained overdue for a period of six months or more; | |

| (c) | a demand or call loan, which remained overdue for a period of six months or more from the date of demand or call or on which interest amount remained overdue for a period of six months or more; | |

| (d) | a bill which remains overdue for a period of six months or more; | |

| (e) | the interest in respect of a debt or the income on receivables under the head 'other current assets' in the nature of short term loans/ advances, which facility remained overdue for a period of six months or more; | |

| (f) | any dues on account of sale of assets or services rendered or reimbursement of expenses incurred, which remained overdue for a period of six months or more; | |

| (g) | the lease rental and hire purchase instalments, which has become overdue for a period of twelve months or more; | |

| (h) | in respect of loans, advances and other credit facilities (including bills purchased and discounted), the balance outstanding under the credit facilities (including accrued interest) made available to the same borrower/beneficiary when any of the above credit facilities becomes non-performing asset: |

Provided that in the case of lease and hire purchase transactions, an NBFC may classify each such account on the basis of its record of recovery'.

10. It is an admitted position that the loans were advanced based on Promissory Note. Interest can be considered as overdue only when there is an agreement between the parties wherein a stipulation is there with regard to the date of payment of interest. In the absence of any such stipulation, we can never say that interest has fallen due on a particular date or was overdue. Similarly a loan can be considered as overdue only when it remains unpaid despite lapse of six months from the date of demand of the loan. Assessee here has been unable to produce any document to show that it had made any demand for return of the loan by the concerned creditors. There is no claim by the assessee that the loans given were term loan. This being the situation, the loans given by the assessee to the said two companies will not, in our considered opinion, fall within any of the limb of the definition of non-performing asset. Even otherwise, Hon'ble Apex Court had clearly held in the case of Southern Technologies Ltd. (supra) that prudential norms issued by the Reserve Bank of India cannot override the provisions of the Act. As per Section 5 of the Act, total income shall include all income from whatsoever derived from such person, which accrues or arise to him in a given in previous year. Assessee undisputedly was following mercantile system of accounting. By virtue of the application of the accrual principle, interest income had definitely accrued to the assessee. The concerned companies were charging interest in their respective accounts, deducting tax at source and also remitting such tax to the Government account. No doubt Hon'ble Delhi High Court in the case of Vasisth Chay Vyapar Limited (supra) had held that, once Inter-Corporate Deposits had become non-performing asset and possibility of realising interest was almost nil, no interest could be treated as accrued to the assessee. However, the loans given here by the assessee, were not Inter-Corporate Deposits. There is nothing on record to show that possibility of realising the interest was nil. Ld. Counsel of the assessee had admitted that the said companies were having substantial assets with them. Hence we cannot say that interest income was illusory or not real. In such circumstances, we are of the considered opinion that the assessee cannot take of refuge under the Prudential Norms issued by the Reserve Bank of India and say that principles of accrual of income, when mercantile basis of accountancy is followed would not apply to it. No doubt, Section 45Q of the R.B.I. Act is overriding in nature and has to be given primacy. However unless and until an assessee shows that a loan or advance had become a non-performing asset, there can be no question of applying the norms set out for such non-performing asset. We are, therefore, of the opinion that ld. CIT(Appeals) fell in error in deleting the addition made by the Assessing Officer. We, therefore, set aside the order of ld. CIT(Appeal) and the addition made by the Assessing Officer is restored.

11. In the result, appeal of the Revenue stands allowed.

SUNIL*In favour of revenue.

Clarification of CGHS rates on 2014

F. No. S. 11011/20/2014-CGHS (HEC)

Directorate General of Central Govt. Health Scheme

Ministry of Health & Family Welfare

Directorate General of Central Govt. Health Scheme

Ministry of Health & Family Welfare

Nirman Bhavan, New Delhi

Dated, 16th July, 2014

Dated, 16th July, 2014

CLARIFICATION

It has been brought to the notice of the undersigned that some of the CGHS empanelled Health Care Organizations have started charging new CGHS rates 2014 which have been placed on CGHS website for information and acceptance only. Since these rates have not yet been notified by Ministry of Health and Family Welfare, the empanelled HCOs cannot charge these new rates and CGHS 2010 rates would prevail. Charging these new rates 2014 from CGHS beneficiaries by empanelled health care organizations would amount to overcharging and suitable action including recovery of overcharged amount and forfeiture of performance bank guarantee would be initiated against those HCOs by CGHS.

Dr. (Mrs.) Sharda Verma

Director (CGHS)

Tel. No. 011-23062800

Director (CGHS)

Tel. No. 011-23062800

CBDT has appointed a Committee of 5 Commissioners headed by Rani S Nair, Chief Commissioner, Ahmedabad as Chairperson to appraise the efficacy of existing dispute resolution forums of CsIT (A) & ITAT and to suggest steps to reduce litigation before these forums.

The Committee shall submit its report within 8 weeks and it has a heavy agenda:

(i) To carry out detailed analysis of appellate orders and assessment orders, on various aspects and recommend steps to reduce litigation before the CIT (A).(ii) To study the efficacy of existing system of filing appeals to the ITAT by the Department and suggest steps to reduce litigation before the ITAT.

CBDT wants the Committee to follow the following guidelines:

(i) Sample should be drawn from the orders passed by the 1TAT during the month of June, September, December and March of the FY 2013-14.(ii) (a) Approximately 200 orders should be selected for study from each of the 8 major cities: Delhi, Mumbai, Kolkata, Chennai, Hyderabad, Pune, Ahmedabad and Bangalore.(ii) (b) Approximately 150 orders should be selected for study from each of the stations: Chandigarh, Jaipur, Indore, Lucknow and Kochi.(iii) As far as possible, orders in cases of corporate and non-corporate assessees should be selected in equal numbers, particularly in Metro charges whereas in non-metro, sample of non-corporate assessees may be larger. It must also be ensured that some orders in search cases are in select basket.(iv) As number of appeals filed by the Department before ITAT is much larger than appeals filed by the assessee, the order in appeals filed by the Department and by the assessee may be selected in the ratio of 2:1.

The Board wants the Committee to analyse the following aspects:

(i) Assessment Orders: Nature of additions made in general, guidance of supervisory authorities, sustainability of additions in appeal, quality of addition made and average tax effect of additions.(ii) Orders of CIT (A): Whether relief allowed is based on proper marshalling of facts and legal position. The decisions are also to be analysed in the light of the order of the ITAT.(iii) Authorization by CIT: The filing of second appeal is to be examined as to whether the same is filed mechanically by applying the monetary limits or on sound grounds after examining the merits of each order.(iv) The success rate of appeals filed by the Department / Assessee before the ITAT to be analysed.

Is it possible to undertake such a great study in 8 weeks? And doesn't the Board already know the answers?

Customs - New Exchange Rates from Today

CBEC has notified new exchange rates for Imported Goods and for Export Goods with effect from 18th July 2014. The US Dollar is 60.70 rupees for imports and 59.70 rupees for exports.

The Exchange rates were last notified on 3rd July, 2014.

Company Law - Related Party Transactions - MoCA Clarifies

MINISTRY of Corporate Affairs clarifies that:

1. Scope of second proviso to Section 188(1): - Second proviso to sub- section (1) of section 188 requires that no member of the company shall vote on a special resolution to approve the contract or arrangement (referred to in the first proviso), if such a member is a related patty. It is clarified that 'related party' referred to in the second proviso has to be construed with reference only to the contract or arrangement for which the said special resolution is being passed. Thus, the term 'related party' in the above context refers only to such related party as may be a related party in the context of the contract or arrangement for which the said special resolution is being passed.2. Transactions arising out of Compromises, Arrangements and Amalgamations dealt with under specific provisions of the Companies Act, 1956/Companies Act, 2013, will not attract the requirements of section 188 of the Companies Act, 2013.3. Requirement of fresh approvals for past contracts under Section 188.:- Contracts entered into by companies, after making necessary compliances under Section 297 of the Companies Act, 1956, which already came into effect before the commencement of Section 188 of the Companies Act, 2013, will not require fresh approval under the said section 188 till the expiry of the original term of such contracts. Thus, if any modification in such contract is made on or after 1st April, 2014, the requirements under section 188 will have to be complied with.

International Competitive Bidding - Sub-contractors too eligible for exemption - Another Problem persists

CBEC had in a recent budget document clarified that exemption is also available to sub-contractors for manufacture and supply of goods for or on behalf of the main contractor (who has won the bid for the project through ICB) for execution of the said project, subject to compliance of conditions specified, if any. (Please see DDT 2396)

But there is a related problem:

The department is denying the exemption on two grounds - 1) The sub-contractor did not participate in ICB and 2) the sub-contractor or Indian main contractor has not fulfilled some of the conditions prescribed at Sl.No. 41, 43 (in case petroleum exploration contracts) and 93 (in case of supplies to Mega Power projects) of the Customs notification. The clarification given only settles the issue relating to the eligibility of sub-contractors in availing the exemption for supplies to mega power projects/petroleum exploration projects. The other issue in the litigation is still open.

The Notification No. 12/12-CE (Currently in force) at Sl.No. 336 exempts goods falling under any chapter if supplied against International Competitive Bidding subject to fulfilment of conditions prescribed at 41.

The condition 41 reads as under

| 336 | Any Chapter | All goods supplied against International Competitive Bidding. |

| 41. | If the goods are exempted from the duties of customs leviable under the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) and the additional duty leviable under section 3 of the Customs Tariff Act, 1975(51 of 1975) | |

Customs Notification No. 12/2012 dated 17.03.2012 at Sl.No. 356 to 359 provide exemption to goods imported in connection with petrol exploration/petroleum operations and at Sl.No 507 exempts goods supplied to Mega power projects as project imports, subject to fulfilment of conditions prescribed at 41,43 and 93 of the Customs Notifications.

Some of the conditions relate to declaration/certification to be submitted with AC/DC before clearance of goods imported as project imports for supplies to petroleum operations/mega power projects. The contention of the department is that since the exemption under Customs is not absolute, but subject to fulfilment of certain conditions specified, even the domestic suppliers availing exemption under Sl.No 336 of Notification No. 12/12-CE are required to fulfil those conditions, as the exemption is linked to exemption provided under Customs Notification.

The assesses availing the said exemption on the other hand argue that since the condition prescribed under Customs Notification at 41, 43 and 93 are in connection with imported goods, they need not fulfill those conditions as no imports are involved.

Tribunal in 2014-TIOL-211-CESTAT-MUM accepted the contention of the appellants with regard to non-requirement of conditions attached to customs notification and allowed the appeals. And as usual the department has not accepted the Tribunal decisions and is pursuing the matter on appeal to higher forums and the litigation continues even though the exemption is in existence for more than a decade.

If the Government is really serious about ending the litigation, it has to go a little further and clarify that the conditions prescribed under Customs notification is not required to be fulfilled by domestic suppliers availing exemption at Sl.No. 336 of Notification No. 12/12-CE. The other alternative is de-link both the notifications by prescribing suitable conditions that may be required for domestic suppliers. Another alternative is that the Government can explore the possibility of putting all the details/permissions/certificates required in connection with the exemption in a website, so that the field formation can allow clearance of goods on verification of details available in the website,

It is hoped that the senior officers at the field, who have been undergoing training at world famous business schools under MACP at the expense of tax payers' money, would apply the knowledge (?) they obtained in training and take a bold decision in dropping further proceedings in all SCNs issued in this regard and not to take litigation any further. At least the Board should expand its clarification to include this issue.

IRS (IT) Probationers with the President

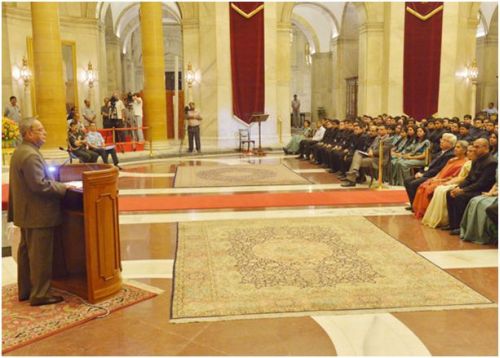

PRESIDENT of India speaking to the 67th batch of IRS (Income Tax) Probationers at Rashtrapati Bhavan yesterday. Senior CBDT officers were also present

DDT Cartoon

Jurisprudentiol - Monday's cases

Customs

Customs Seizure of Gold from under sea - Captain of vessel arrested on charge of throwing gold into sea - Trial court acquits accused - Revenue Appeal Dismissed: HC

THE accused was arrested in May 1987. After seven years, the trial court acquitted him. Customs took the matter in appeal to the High Court which dismissed the appeal in July 2014 - after 27 years!

The statement under section 108 is admissible and it can be relied also. However, if at all it is retracted, then, weightage can be given to it only if there is corroboration on other material particulars. In the present case, as the panchas did not corroborate and the prosecution did not examine the other panch, that material evidence collapsed.

Income Tax

Whether disallowance under section 14A can exceed total administrative expenditure debited by assessee in Profit & Loss account - NO: ITAT

THE assessee is a non-banking financial company deriving interest income from money lending and income from investment. The assessee had shown short term capital gain and long term capital gain from the sale of shares. The assessee, during the course of assessment proceedings, in response to the show cause notice, filed details submissions with regard to the overall transactions of shares, holding period, treatment given in the books, number of transactions undertaken and the history of the assessee's case in the earlier years. Assessing Officer rejected the assessee's contention on the ground that the purchase and sale of shares was not an unrelated activity but incidental to the business of the assessee. The assessee had continuously and systematically carried out the activity of trading in shares over the period of one year and had borrowed funds to fund his activity for purchase and sale of shares. The Assessing officer was of the view that the assessee had shown all the characteristics of a trader rather than an investor. Thus, the profit claimed as capital gain was taxed as business income.

THE issue before the Bench is - Whether disallowance under section 14A can exceed the total administrative expenditure debited by the assessee in the Profit & Loss account. And the answer goes against the Revenue.

Central Excise

Demand of duty on clandestine clearances - findings of Tribunal on suppression of manufacture and removal of dutiable product cannot be faulted - However, MODVAT credit extended on raw materials: HC

THE appellant is a small-scale industrial unit engaged in the manufacture of acid slurry, soap oil and waste weak acid since 1989-90. The main raw materials for manufacture of acid slurry are: linear alkyle benzene (LAB), oleum and water. The appellant was availing Modvat credit of duty paid on the raw materials after filing necessary statutory declarations before the concerned authorities.

There was an inspection at the premises of the appellant by the Directorate General of Anti-Evasion, Hyderabad certain records were seized. Based on the inspection and the information obtained, a show-cause notice was issued alleging that the appellant had not accounted for purchase of raw material namely, LAB made from a public sector organization, M/s.Tamil Nadu Petro Products.

Aggrieved by the order of Commissioner confirming the demand, the appellant filed an appeal before the CESTAT and the same was dismissed vide 2004-TIOL-446-CESTAT-BANG.

The appellant contended that the order of the Tribunal is purely based on surmises and conjectures and there is no material whatsoever evidencing purchase of LAB by the appellant and the same having been received in the Factory by the appellant. There is no material with respect to manufacture of acid slurry, a product which attracts higher rate of duty and also there is no material evidencing clearance of acid slurry from the premises.

Income Tax

Whether disallowance under section 14A can exceed total administrative expenditure debited by assessee in Profit & Loss account - NO: ITAT

THE assessee is a non-banking financial company deriving interest income from money lending and income from investment. The assessee had shown short term capital gain and long term capital gain from the sale of shares. The assessee, during the course of assessment proceedings, in response to the show cause notice, filed details submissions with regard to the overall transactions of shares, holding period, treatment given in the books, number of transactions undertaken and the history of the assessee's case in the earlier years. Assessing Officer rejected the assessee's contention on the ground that the purchase and sale of shares was not an unrelated activity but incidental to the business of the assessee. The assessee had continuously and systematically carried out the activity of trading in shares over the period of one year and had borrowed funds to fund his activity for purchase and sale of shares. The Assessing officer was of the view that the assessee had shown all the characteristics of a trader rather than an investor. Thus, the profit claimed as capital gain was taxed as business income.

THE issue before the Bench is - Whether disallowance under section 14A can exceed the total administrative expenditure debited by the assessee in the Profit & Loss account. And the answer goes against the Revenue.

CBDT appoints Committee to tone up litigation process

CBDT has appointed a Committee of 5 Commissioners headed by Rani S Nair, Chief Commissioner, Ahmedabad as Chairperson to appraise the efficacy of existing dispute resolution forums of CsIT (A) & ITAT and to suggest steps to reduce litigation before these forums.

The Committee shall submit its report within 8 weeks and it has a heavy agenda:

(i) To carry out detailed analysis of appellate orders and assessment orders, on various aspects and recommend steps to reduce litigation before the CIT (A).(ii) To study the efficacy of existing system of filing appeals to the ITAT by the Department and suggest steps to reduce litigation before the ITAT.

CBDT wants the Committee to follow the following guidelines:

(i) Sample should be drawn from the orders passed by the 1TAT during the month of June, September, December and March of the FY 2013-14.(ii) (a) Approximately 200 orders should be selected for study from each of the 8 major cities: Delhi, Mumbai, Kolkata, Chennai, Hyderabad, Pune, Ahmedabad and Bangalore.(ii) (b) Approximately 150 orders should be selected for study from each of the stations: Chandigarh, Jaipur, Indore, Lucknow and Kochi.(iii) As far as possible, orders in cases of corporate and non-corporate assessees should be selected in equal numbers, particularly in Metro charges whereas in non-metro, sample of non-corporate assessees may be larger. It must also be ensured that some orders in search cases are in select basket.(iv) As number of appeals filed by the Department before ITAT is much larger than appeals filed by the assessee, the order in appeals filed by the Department and by the assessee may be selected in the ratio of 2:1.

The Board wants the Committee to analyse the following aspects:

(i) Assessment Orders: Nature of additions made in general, guidance of supervisory authorities, sustainability of additions in appeal, quality of addition made and average tax effect of additions.(ii) Orders of CIT (A): Whether relief allowed is based on proper marshalling of facts and legal position. The decisions are also to be analysed in the light of the order of the ITAT.(iii) Authorization by CIT: The filing of second appeal is to be examined as to whether the same is filed mechanically by applying the monetary limits or on sound grounds after examining the merits of each order.(iv) The success rate of appeals filed by the Department / Assessee before the ITAT to be analysed.

Is it possible to undertake such a great study in 8 weeks? And doesn't the Board already know the answers?

IT : Where no material was found with regard to assessee's ownership of asset found in search, deeming provision in view of Explanation 5 to section 271(1)(c) could not be applied to presume deeming concealment so as to levy penalty

■■■

[2014] 46 taxmann.com 213 (Cochin - Trib.)

IN THE ITAT COCHIN BENCH

Income-tax Officer, Wd.1, Palakkad

v.

V.R. Rathish*

N.R.S. GANESAN, JUDICIAL MEMBER

AND B.R. BASKARAN, ACCOUNTANT MEMBER

AND B.R. BASKARAN, ACCOUNTANT MEMBER

IT APPEAL NOS. 797 AND 798 (COCH.) OF 2013

C.O. NOS. 22 AND 23 (COCH.) OF 2014

[ASSESSMENT YEARS 2005-06 & 2006-07]

C.O. NOS. 22 AND 23 (COCH.) OF 2014

[ASSESSMENT YEARS 2005-06 & 2006-07]

APRIL 25, 2014

Section 271(1)(c), read with section 69B of the Income-tax Act, 1961 - Penalty - For concealment of income (Explanation 5) - Assessment years 2005-06 and 2006-07 - A search was conducted and subsequently, assessee for first time filed returns of income for both relevant assessment years in response to notice issued under sections 153A and 142(1) respectively - During course of assessment proceedings, assessee filed a statement of assets and liabilities of him and his wife and offered shortfall as undisclosed investment under section 69B - Assessing Officer observed that assessee had not disclosed increase in wealth before date of search and, therefore, there was a deeming concealment in view of Explanation 5 to section 271(1)(c) - He, accordingly, levied penalty - However, during course of search proceedings no material was found by Assessing Officer with regard to ownership of any asset by assessee - Whether deeming provision as provided in Explanation 5 to section 271(1)(c) would not apply - Held, yes - Whether order of Commissioner (Appeals) to delete penalty levied by Assessing Officer was justified - Held, yes [Para 8] [In favour of assessee]

FACTS

| ■ | A search was conducted and the assessee filed the return of income for the first time in response to the notice issued by the Assessing Officer under section 153A by disclosing a total income of Rs. 13,30,780 and agricultural income of Rs. 48,000. In the subsequent assessment year, the assessee declared an income of Rs. 9,07,274 along with agricultural income of Rs. 48,000 in response to the notice issued under section 142(1). | |

| ■ | During the course of assessment proceedings, the assessee filed a statement of assets and liabilities of him and his wife and offered the shortfall as income in his hands under section 69B. | |

| ■ | The Assessing Officer after placing reliance on Explanation 5 to section 271(1)(c) found that the assessee had not disclosed the increase in wealth by not filing the return before the date of search therefore, there was a deeming concealment in view of Explanation 5 and, accordingly, he levied penalty under section 271(1)(c) for both the assessment years. | |

| ■ | On appeal, the Commissioner (Appeals) found that the accretion to wealth and, consequential, levy of penalty was not referred to in the assessment order and, therefore, he deleted the penalty which was not justified as per the revenue's contention. | |

| ■ | On appeal: |

HELD

| ■ | In the instant case, it is not the case of the revenue that during the course of search proceedings, the assessee was found to be the owner of any asset, viz. money, bullion, jewellery or other valuable article or things. In the course of assessment proceedings, the assessee filed the statement of assets and liabilities for himself and his wife. To explain the shortfall, the assessee has also offered the shortfall as income under section 69B. The returns filed by the assessee with regard to investment in the assets were accepted by the Assessing Officer without any whisper. The disallowance was made only in respect of agricultural income declared by the assessee to the extent of Rs. 48,000 for each assessment year under consideration. However, this was restricted to Rs. 24,000 for each of the assessment year by the Commissioner (Appeals). [Para 7] | |

| ■ | Section 271(1)(c) is a penal provision, therefore, it has to be construed strictly. When the language employed by the legislature clearly suggests that for the purpose of application of a deeming provision as provided in Explanation 5 to section 271(1)(c) it is necessary to ensure that the asset is found in the course of search proceedings and that the assessee is the owner of the asset. In case, no material is available on record to come to a conclusion that the assessee is the owner of any asset, then, the deeming provision has no role to play. In other words, the deeming provision cannot be applied when no material was found with regard to the ownership of the asset during the course of search proceedings. [Para 8] | |

| ■ | In view of the above, the Commissioner (Appeals) has rightly deleted the penalty levied by the Assessing Officer. There was no infirmity in the order of the Commissioner (Appeals). Accordingly, the same is confirmed. [Para 9] |

K.K. John for the Appellant. Mohanan Kuttickat for the Respondent.

ORDER

N.R.S. Ganesan, Judicial Member -The revenue filed the present appeals against the common order passed by the CIT(A)-V, Kochi dated 08-10-2013 confirming the penalty levied by the assessing officer u/s 271(1)(c) of the Act. Since common issue arises for consideration in the appeals filed by the revenue and the cross objections filed by the assessee, we heard them together and are disposed of by this common order.