Press ? for Keyboard Shortcuts.

Your screen elements are hidden from view. Press Esc or move the cursor to the centre of the screen to return to Mail.

Press Esc or move cursor here to return to Mail.

HC restrains Audi from using 'TT' trademark; IiAS slams vague resolutions on related party deals

HC restrains Audi from using 'TT' trademark; IiAS slams vague resolutions on related party deals

CBDT Hauls Up Officers & Staff For Leaving Early, Coming Late & Harassing Taxpayers

The CBDT has issued a stern Office Memorandum dated 07.08.2015 stating that officers/staff of the income Tax Department are leaving their stations/headquarters early on Fridays, during weekend and holidays and joining their duties late on next working day. It is further stated that many a times no permission is being taken from the superior controlling authorities before leaving location/headquarters as required under the rules. It is stated that apart from disturbing decorum and office discipline, this practise of leaving stations/headquarters by the officers /staff without prior permission and not observing the office timings, is causing inconvenience to the taxpayers and members of public who visit income tax offices in connection with their tax matters either by prior appointment or otherwise. This has been viewed adversely by the Chairperson, CBDT. The CBDT has warned that failure to obtain permission of competent authority before leaving station/headquarters is to be viewed seriously and may entail disciplinary action. It is also stated that Article 56 of the Civil Service Regulations also provides that no officer is entitled to pay and allowance for any time he may spend beyond the limits of his charge without authority

SEBI amends ICDR Regulations, modifies fast track issues' eligibility criterias & disclosure norms

SEBI amends Issue of Capital and Disclosure Requirements, Regulations (ICDR Regulations); Amends eligibility criteria for fast track issues, which includes: (i) Reduction in limit of average market capitalisation of public shareholding of issuer company to Rs. 1000 crore (earlier, Rs. 3,000 crore), (ii) Imposition of only monetary fines by stock exchanges not a ground for ineligibility for undertaking issuances, (iii) Issuer Co. / Promoter / Promoter group / director has not settled any alleged violation of securities laws through consent / settlement mechanism with SEBI during immediately preceding 3 years; With respect to rights issue, SEBI introduces a condition that promoters & promoter group shall mandatorily subscribe to their rights entitlement and shall not renounce their rights, except where renunciation is within promoter group or for complying with minimum public shareholding norms; Amends provisions for interim use of funds for rights issue and its disclosure, states that net issue proceeds pending utilization shall be deposited only in scheduled commercial banks; Amends provisions for interim use of funds for Indian Depository Receipts issue, issuer co. shall keep funds in Bank having credit rating of 'A' or above by an international CRA: SEBI

Click here to read more.

DIPP lists major initiatives taken for improving 'ease of doing business'

DIPP prescribes major initiatives taken by Govt. of India on improving 'Ease of Doing Business' in India; States that series of measures have been taken to improve ease of doing business, with an emphasis on simplifying and rationalizing rules, introducing information technology for making governance more efficient and effective; States 27 measures taken by Govt. as on August 11, 2015, which includes online application for industrial license, integrated process for company incorporation, simplification of application forms for industrial entrepreneur memorandum, adoption of NIC Code with advanced version of industrial classification, merging of registration process of VAT and Professional tax into single process, etc.: DIPP

Click here to read more.

Govt. invites applications for 18 posts of Judicial Member, NCLT

Govt. invites applications for filling up of 18 posts of Judicial Member of National Company Law Tribunal u/s 408 of Companies Act, 2013; States that the selected candidates will be required to serve any of the NCLT Benches which are to be constituted at different parts of India in phased manner and the appointment of NCLT Member carries all India transfer commitment; States that the qualification of the member shall be as laid down in Section 409(2), prescribes terms of appointment; Clarifies that rules relating to service conditions of NCLT Members will be notified soon; Prescribes format for application and documents required to be submitted by the applicant: MCA

Click here to read more.

Govt. invites applications for 2 posts of Technical Member, NCLT

Govt. invites applications for filling up of 2 posts of Technical Member of National Company Law Tribunal u/s 410 of Companies Act, 2013; States that the selected candidates will be required to serve any of the NCLT Benches which are to be constituted at different parts of India in phased manner and the appointment of such Member carries all India transfer commitment; States that the qualification of the member shall be as laid down in Section 411(3) read with Supreme Court ruling on May 14, 2014, prescribes terms of appointment; Clarifies that rules relating to service conditions of NCLT members will be notified soon and will be applicable to candidates; Prescribes format for application and documents required to be submitted by the applicant: MCA

Click here to read more.

Clandestine goods selling a 'cause-of-action' to invoke Court's jurisdiction; Rejects trademark non-registration defence

HC dismisses revision petition challenging jurisdiction of the Court to grant injunction in a passing off suit filed by Kalsi Metal Works Pvt Ltd ('Kalsi Metal') against Raj Son Agro Engineers (petitioners), alleging passing off of its trademark 'Kalsi'; Petitioner contended that since it did not reside within jurisdiction of the Court, the Court could not entertain the civil suit u/s 20 of CPC (which empowers Courts to entertain suit where defendant resides or cause of action arises), as well it submitted that only because Kalsi Metal resided within Court's jurisdiction, Court could not try the suit u/s 134 of Trademark Act (which empowers Courts to entertain suit where plaintiff resides) as Kalsi Metal's trademark was not registered for alleged agricultural spray goods; HC notes that in instant case, petitioner sold goods in Jalandhar, within jurisdiction of P&H HC, in clandestine manner without issuing invoices, thus, 'cause of action' u/s 20 of CPC arose in its jurisdiction; Holds that "the expression cause of action shall always be understood as a bundle of causes. It must include a particular cause of the defendant'selling the goods in clandestine manner at Jalandhar"; Rejects petitioner's reliance on SC ruling on Dhodha House & Karnataka HC ruling in Property Developers Vs. Prestige Estates Projects Pvt. Ltd, as distinguishable on facts:Punjab & Haryana HC

The order was passed by Justice K. Kannan.

Advocate Amit Jhanji argued on behalf of petitioner.

Late Filing Fee u/s 234E – Judicial Interpretation – Hon'ble High Court of Bombay – February 6, 2015

Dear Deductor,

Section 234E of the Income-tax Act, 1961 inserted by the Finance Act, 2012 provides for levy of a fee of Rs. 200/- for each day's delay in filing the statement of Tax Deducted at Source (TDS) or Tax Collected at Source (TCS). The provision for Levy of Late filing fee was introduced to improve Filing Compliance and to avoid subsequent inconvenience to the taxpayers due to inordinate delays in availability of taxCREDITS in their 26AS Statements.

in their 26AS Statements.

in their 26AS Statements.

in their 26AS Statements.This assumes further significance in view of the decision of the Hon'ble High Court of Bombay, dated February 6 2015, upholding the validity of the Levy for Late Filing u/s 234E. The court has observed the following in its decision in the case of Rashmikant Kundalia vs. UOI:

Immediate Attention:

- The late filing of TDS returns by the deductor causes inconvenience to everyone and s. 234E levies a fee to regularize the said late filing.

- The fee is not in the guise of a tax nor is it onerous.

- The levy is constitutionally valid.

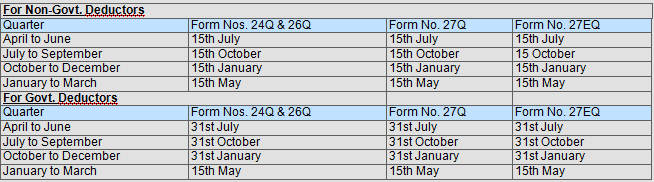

CPC (TDS), in its endeavor to strengthen TDS Compliance, is reaching out to you to reiterate the essence of timely filing of Quarterly TDS Statements. Section 200(3) of theINCOME TAX Act, 1961 read with Rule 31A of the Income Tax Rules, 1962, prescribes the following due dates for filing of TDS Statements:

Act, 1961 read with Rule 31A of the Income Tax Rules, 1962, prescribes the following due dates for filing of TDS Statements:

Act, 1961 read with Rule 31A of the Income Tax Rules, 1962, prescribes the following due dates for filing of TDS Statements:

Act, 1961 read with Rule 31A of the Income Tax Rules, 1962, prescribes the following due dates for filing of TDS Statements:

Where the TDS Statements are not filed within the due date, CPC (TDS) sends Intimations u/s 200A of the Act that includes Levy under section 234E. Your attention is hereby drawn towards the provisions of section 234E of the Act (Levy for Late filing of TDS Statement), which reads as follows:

- Without prejudice to the provisions of the Act, where a person fails to deliver or cause to be delivered a statement within the time prescribed in sub-section (3) of section 200 or the proviso to sub-section (3) of section 206C, he shall be liable to pay, by way of fee, a sum of two hundred rupees for every day during which the failureCONTINUES

.

. - The amount of fee referred to in sub-section (1) shall not exceed the amount of tax deductible or collectible, as the case may be.

- The amount of fee referred to in sub-section (1) shall be paid before delivering or causing to be delivered a statement in accordance with sub-section (3) of section 200 or the proviso to sub-section (3) of section 206C.

- The provisions of this section shall apply to a statement referred to in sub-section (3) of section 200 or the proviso to sub-section (3) of section 206C which is to be delivered or caused to be delivered for tax deducted at source or tax collected at source, as the case may be, on or after the 1st day of July, 2012.

Action to be taken in case of Levy intimated u/s 234E:

- Please download the Justification Report from our portal TRACES to view your latest outstanding demand. Please click here for assistance onDOWNLOADING

the Justification Report.

the Justification Report. - Use Challan ITNS 281 to pay the Levy with your relevant Banker, if there are no challans available for consumption.

- Please use the Online Corrections facility on TRACES to submit corrections, to payoff the demand. To avail the facility, please Login to TRACES and navigate to Defaults tab to locate Request for Correction from the drop-down list. You can refer to our e-tutorials for necessary help.

- Alternatively, you may also download the Conso File from our portal provided there are no ShortPAYMENT

Defaults.

Defaults.- Prepare a Correction Statement using the latest Return Preparation Utility (RPU) and File Validation Utility (FVU).

- Submit the Correction Statement at TIN Facilitation Centre.

For any assistance, you can write to ContactUs@tdscpc.gov.in or call our toll-free number 1800 103 0344.

CPC (TDS) is committed to provide best possible services to you.

CPC (TDS) TEAM

__._,_.___

Posted by: Dipak Shah <djshah1944@yahoo.com>

receive alert on mobile, subscribe to SMS Channel named "aaykarbhavan"

[COST FREE]

SEND "on aaykarbhavan" TO 9870807070 FROM YOUR MOBILE.

To receive the mails from this group send message to aaykarbhavan-subscribe@yahoogroups.com

No comments:

Post a Comment