Section 10A and 10B: A post-mortem by CBDT

AUGUST 23, 2013

SECTION 10A, introduced vide Finance Act 2000, was made non-operational with effect from Assessment Year 2012-13. The Central Board of Direct Taxes, after operation of more than a decade and after making it non-operational, suddenly realised the necessity of providing some clarification on the nature of relief that the section provides (better late than never??). The circular was issued on the sixteenth of July this year which "clarified" that irrespective of their continued placement in Chapter III, Sections 10A and 10B as substituted by Finance Act, 200 0 provide for deduction of the profits and gains derived from export of articles or things or computer software. So, why is this perplexing?

Background of legal provisions

Sections 10A & 10B were originally incorporated in 1981 to provide a fillip to the export oriented industries in Free Trade Zones with a view towards bolstering India's foreign exchange reserves and to attract investment for industrial growth. These Sections were strategically incorporated in Chapter III as they were purported to exclude any income arising there from, from the computation of total income as defined under the Act. The income of units specified in these Sections was not to be reckoned with while computing the total income of the assessee. The benefit under these Sections was slowly extended to units set up in export processing zones, electronic hardware technology parks and software technology parks etc.

Sub- section( 6) in Section 10A & 10B was also incorporated whereby unabsorbed depreciation, losses etc. were not allowed to be carried forward or set off.

The judicial opinion framed in CIT vs Canara Workshops (P.) Ltd. [1986] 161 ITR 320 (SC) was that the profit earned by one eligible unit (pertaining to one priority industry) should not be reduced by loss incurred in another eligible unit (pertaining to another priority Industry) for the purpose of arriving at the deduction eligible for apriority industry. The court also drew a distinction between (a) cases where loss pertains to same industry for which the profit is eligible for tax holiday and (b) cases where loss is incurred in different industry even if that other industry is also an eligible / priority industry.

Amendment in year 2000 and its effect

In the year 2000, the two sections were revamped whereby the legislature had skillfully changed the phraseology in the beginning of the section to provide for a "deduction" out of the total income of the assessee. What was originally outside the ambit of the scope of "Total Income"of the assessee was now eligible for a deduction from the same. By Finance Act 2003 w.e.f 1/4/2001 the operation of Section 10A( 6) was also restricted to Assessment Years ending before the 1 st day of April 2001. Undeterred the assessee's have been agitating before various forums that since these sections were originally inserted in Chapter III of the Act, they will continue to remain outside the scope of Total Income under the Act. However certain assessees who incurred loss in eligible units made attempts to set off such loss against other incomes on the ground that the section is no longer an exemption section.

The Hon'ble Karnataka High Court in CIT vs Yokogawa India Ltd, (2011-TIOL-711-HC-KAR-IT) had held that the provisions of Section 10A to be an exemption provision. The taxpayer had suffered a loss in the non-eligible unit and earned profit in the eligible unit. The court observed that though the Section provides for deduction from total income, the amount of total income is the amount on which tax rate is applied so as to determine the tax liability, hence there is no question of any deduction there-from. Accordingly the court concluded that the profit earned by the eligible unit is excluded from the scope of total income at the threshold itself before any of the provisions of set off of losses or depreciation could be applied. This interpretation worked in favor of the taxpayer before Karnataka High Court.

The Hon'ble Bombay High Court however in the following cases, held the Section to be a deduction provision so as to allow set off of loss incurred in eligible unit against other taxable income:-

Hindustan Unilever Ltd. v. Dy. CIT (2010-TIOL-239-HC-MUM-IT)CIT v. Galaxy Surfactants Ltd. (2012-TIOL-142-HC-MUM-IT)CIT v. Black & Veatch Consulting (P.) Ltd (2012-TIOL-318-HC-MUM-IT)

The Hon'ble Bombay High Court was concerned in all the three cases with a claim of the Assessee for set off the eligible unit loss against the profits of the non-eligible unit. The claim of the Assessee was allowed holding that the provisions of Section10A/10B of the Act were deduction provisions and therefore the loss or profit in eligible business will enter the computation of total income which the court accepted. If the Hon'ble Karnataka High Court decision was to be followed, then the loss would not have entered the computation of income at all and thus not available for set off. To this extent there remained a conflict of opinion between the Hon'ble Karnataka High Court and the Hon'ble Bombay High Court.

In a recent decision of the Hon'ble Delhi High Court in ITA No.347/2001 & 2067/2010 dated 27.8.2012 - (2012-TIOL-691-HC-DEL-IT), this conflict has been noticed and the Hon'ble Delhi High Court has agreed with the view of the Hon'ble Karnataka High Court that the provisions of Section 10A/10B are exemption provisions and not deduction provisions. However, the Hon'ble Delhi High Court was also concerned with the loss incurred in non-eligible unit wherein the claim of the Assessee was that deduction u/s.10A of the Act should be allowed without setting off the loss from non-eligible unit against the profits of the eligible unit. The following were the relevant observations of the Hon'ble Court:

"... In interpreting sub-Section (1) of Section 10A after the amendment made by the Finance Act, 2000 w. e. f. 01.04.2001, one cannot deny that there is ambiguity or doubt, because of the language used, as to whether the sub-Section provides for an exemption or a deduction. We have earlier referred to the difficulty caused by the language which says that the deduction shall be made from the total income, when the Act contains no provision to allow any deductions from the total income. The Section has been interpreted by the Karnataka High Court (supra) as an exemption provision whereas the Bombay High Court has understood the same as a deduction Section, though the ultimate result did not make any difference to the assessee's claim in Black & Veatch Consulting (supra). Therefore, it cannot be denied that there is uncertainty and lack of clarity or precision in the language employed in sub-Section (1). It is, therefore, not impermissible to rely on the heading or title of Chapter III and interpret the Section as providing for an exemption rather than a deduction"

The Bangalore Bench of the Income Tax Appellate Tribunal in the case of Karle International Private Ltd. vs ACIT [2013-TIOL-32-ITAT-BANG] after examining the controversy noticed, that the Bombay High Court reached the same conclusion which the Karnataka High Court reached in the case of CIT v. Yokogawa (supra), in its judgments in Hindustan Unilever Ltd. (supra) and CIT v. Black & Veatch Consulting Pvt. Ltd. (supra), despite taking the view that the Section provides for a deduction and not an exemption.

These decisions had put the taxpayers in a win-win situation. Those incurring losses in non-eligible units claimed full tax holiday claiming the provisions to be exemption provision and those incurring losses in eligible units were able to salvage these losses on the premise that the relief under the Section is 'deduction' in nature.

Circular and its effect

As per the circular, the income computed under various heads of income in accordance with the provisions of Chapter IV of the IT Act shall be aggregated in accordance with the provisions of Chapter VI of the IT Act, 1961. This means that first the income/loss from various sources i.e. eligible and ineligible units, under the same head are aggregated in accordance with the provisions of Section 70 of the Act. Thereafter, the income from one head is aggregated with the income or loss of the other head in accordance with the provisions of Section 71 of the Act. If after giving effect to the provisions of Section 70 and 71 of the Act there is any income (where there is no brought forward loss to be set off in accordance with the provisions of Section 72 of the Act) and the same is eligible for deduction in accordance with the provisions of Chapter VI-A or Section 10A, 10B etc. of the Act, the same shall be allowed in computing the total income of the assessee.

If after aggregation of income in accordance with the provisions of Section 70 and 71 of the Act, the resultant amount is a loss (pertaining to AY 2001-02 and any subsequent year) from eligible unit it shall be eligible for carry forward and set off in accordance with the provisions of Section 72 of the Act.

The implication can be better understood with following illustrations

Case 1

Eligible undertaking | Profit in INR 10, 00, 000 |

Non-eligible undertaking | Loss in INR 8, 00, 000 |

Assume that eligible undertaking is entitled to 100% deduction on account of meeting export obligation fully.

| Quantum of eligible deduction | INR 10, 00, 000 |

| Quantum of Total income | INR 2, 00, 000 |

Deduction restricted by the circular to | INR 2, 00, 000 |

Case 2

Eligible undertaking Profit in | INR 10, 00, 000 |

Non-eligible undertaking Loss in | INR 8, 00, 000 |

Income from other sources Profit | INR 7, 00, 000 |

Assume that eligible undertaking is entitled to 100% deduction on account of meeting export obligation fully.

Quantum of eligible deduction | INR 10, 00, 000 |

Quantum of Total income | INR 9, 00, 000 |

Deduction restricted by the circular to | INR 9, 00, 000 |

Note: Even if the loss is brought forward loss and as per Section 72 it cannot be set off against 'income from other sources' nonetheless the amount of total income would be INR 9 , 00, 000 only in the above example and quantum of deduction under Section 10A would therefore not undergo any change.

The working in the above illustration is purely based on the language employed in the Section and the circular, however it is hard to accept on conceptual note that that deduction is effectively being granted from income from other sources.

The above awkward situation in our view cannot be avoided in the absence of a provision similar to that embodied in Section 80AB.

Binding nature of circular

In Hindustan Aeronautics Ltd. vs CIT (2002-TIOL-154-SC-IT) honourable Supreme Court held that when the Supreme Court or High Court has declared the law on the question arising for consideration then it will not be open to a court to direct that a circular should be given effect to and not the view expressed in such decisions. Further in Keshaviji Ravji vs (2002-TIOL-129-SC-IT) the court observed that CBDT cannot pre-empt a judicial interpretation of the scope and ambit of a section by issuing circulars as the task of interpretation is exclusive domain of courts. It further added that circulars do not bind the tribunals and courts.

In view of the above decisions, it appears that position in Delhi and Karnataka would continue to be that Section 10A and 10B are exemption provisions while in Bombay the provisions would be treated as deduction in nature till the controversy is settled by the Apex Court. Even in other jurisdictions the benches of ITAT are likely to follow their own earlier orders hence at this juncture the intervention of CBDT is itself perplexing.

2013-TIOL-735-ITAT-AHM

IN THE INCOME TAX APPELLATE TRIBUNAL

BENCH 'D' AHMEDABAD

BENCH 'D' AHMEDABAD

ITA. No. 2718 & 2719/AHD/2012

Assessment Year: 2009-2010

Assessment Year: 2009-2010

DCIT

CENTRAL, CIRCLE -4, ROOM NO 508,

AAYAKAR BHAVAN, MAJURA GATE,

SURAT- 395001

CENTRAL, CIRCLE -4, ROOM NO 508,

AAYAKAR BHAVAN, MAJURA GATE,

SURAT- 395001

Vs

RIVAA EXPORTS LTD

RIVAA HOUSE, UDHNA DARWAJA,

RING ROAD, SURAT. 395002

PAN: AAACE 8331P

RIVAA HOUSE, UDHNA DARWAJA,

RING ROAD, SURAT. 395002

PAN: AAACE 8331P

DCIT

CENTRAL, CIRCLE -4, ROOM NO 508,

AAYAKAR BHAVAN, MAJURA GATE,

SURAT - 395001

CENTRAL, CIRCLE -4, ROOM NO 508,

AAYAKAR BHAVAN, MAJURA GATE,

SURAT - 395001

Vs

SHRI HARIKISHAN S VIRMANI,

RIVAA HOUSE, UDHNA DARWAJA,

RING ROAD, SURAT. 395002

PAN: AAJPV 4754H

RIVAA HOUSE, UDHNA DARWAJA,

RING ROAD, SURAT. 395002

PAN: AAJPV 4754H

G C Gupta Vice Presient And Shri Chaturvedi, AM

Dated: June 7, 2013

Appellant Rep by: Shri K.H Shah A.R.

Respondent Rep by: Shri T Sankar Sr. D.R.

Respondent Rep by: Shri T Sankar Sr. D.R.

Income Tax - Sections 132(4), 271AAA(2) - Whether the CIT(A) is justified in deleting the penalty levied u/s 271AAA on the finding that the statement recorded u/s. 132(4) has not asked any further question but was satisfied with the manner the income was earned by the Assessee and was satisfied about substantiating the manner in which the undisclosed income was earned and Revenue has not brought any material on record to controvert the findings of CIT(A).

During the course of search action at the premises of Assessee unrecorded cash of Rs. 6.5 lacs was found which was admitted by the Assessee to be unrecorded sale for F.Y. 08-09. The Assessee had disclosed Rs. 75 lacs on account of various discrepancies found (it included Rs. 6.5 lacs unrecorded sale). Assessee thereafter filed return of income on 26.9.2009 showing total income of Rs. 2,27,56,330/-. The return filed by Assessee was accepted without any change. Thereafter on the undisclosed income of Rs. 75 lacs. AO levied penalty u/s 271AAA of Rs. 7,50,000/- as he was of the view that the income disclosed during the course of search falls under the definition of "undisclosed income" and the assessee had not substantiated the manner of deriving the unaccounted income and therefore the assessee did not fulfill the condition specified u/s 271AAA (2) for exemption from penalty. The CIT(A) deleted the penalty.

Having heard the parties, the Tribunal held that,

++ the CIT(A) by well reasoned order while deleting the penalty has noted that the bifurcation of disclosure of undisclosed income was admitted by the Assessee and also filed. He has also noted that the authorised officer did not ask any specific question on substantiating the manner in which income was derived. He has further noted that in the statement recorded u/s. 132(4) has not asked any further question but was satisfied with the manner the income was earned by the Assessee and was satisfied about substantiating the manner in which the undisclosed income was earned. He has further noted that the assessee had paid tax along with interest on undisclosed income admitted during the course of search.. Revenue has not brought any material on record to controvert the findings of CIT(A). We therefore find no reason to interfere with the order of CIT(A).

During the course of search action at the premises of Assessee unrecorded cash of Rs. 6.5 lacs was found which was admitted by the Assessee to be unrecorded sale for F.Y. 08-09. The Assessee had disclosed Rs. 75 lacs on account of various discrepancies found (it included Rs. 6.5 lacs unrecorded sale). Assessee thereafter filed return of income on 26.9.2009 showing total income of Rs. 2,27,56,330/-. The return filed by Assessee was accepted without any change. Thereafter on the undisclosed income of Rs. 75 lacs. AO levied penalty u/s 271AAA of Rs. 7,50,000/- as he was of the view that the income disclosed during the course of search falls under the definition of "undisclosed income" and the assessee had not substantiated the manner of deriving the unaccounted income and therefore the assessee did not fulfill the condition specified u/s 271AAA (2) for exemption from penalty. The CIT(A) deleted the penalty.

Having heard the parties, the Tribunal held that,

++ the CIT(A) by well reasoned order while deleting the penalty has noted that the bifurcation of disclosure of undisclosed income was admitted by the Assessee and also filed. He has also noted that the authorised officer did not ask any specific question on substantiating the manner in which income was derived. He has further noted that in the statement recorded u/s. 132(4) has not asked any further question but was satisfied with the manner the income was earned by the Assessee and was satisfied about substantiating the manner in which the undisclosed income was earned. He has further noted that the assessee had paid tax along with interest on undisclosed income admitted during the course of search.. Revenue has not brought any material on record to controvert the findings of CIT(A). We therefore find no reason to interfere with the order of CIT(A).

Revenue's appeal dismissed

ORDER

Per: Anil Chaturvedi:

1. These appeals are filed by the Revenue against the order of Ld. CIT(A)-II, Ahmedabad dated 28.9.2012 for assessment year 2009-2010 whereby penalty of Rs. 7,50,000/- levied by Assessing Officer u/s 271AAA was deleted

2. At the outset, both the parties before us submitted that the facts in both the appeals are identical except for the amount. It was further submitted that CIT(A) has passed a consolidated order for both the assessees. It was further submitted that the submissions made in one case would be equally applicable to the other case.

3. The facts as culled out from the orders of the lower authorities are as under.

ITA No. 2718/Ahd/ 2012:- ( Rivaa Exports)

4. In this case during the course of search action at the premises of Assessee unrecorded cash of Rs. 6.5 lacs was found which was admitted by the Assessee to be unrecorded sale for F.Y. 08-09. Assessee had disclosed Rs. 75 lacs on account of various discrepancies found (it included Rs. 6.5 lacs unrecorded sale). Assessee thereafter filed return of income on 26.9.2009 showing total income of Rs. 2,27,56,330/-. Assessment was framed u/s 143(3) vide order dated 31.12.2010 and the return filed by Assessee was accepted without any change. Thereafter on the undisclosed income of Rs. 75 lacs. Assessing Officer levied penalty u/s 271AAA of Rs. 7,50,000/- vide order dated 20.6.2011 as he was of the view that the income disclosed during the course of search falls under the definition of "undisclosed income" and the assessee had not substantiated the manner of deriving the unaccounted income and therefore the assessee did not fulfill the condition specified under Section 271AAA (2) for exemption from penalty.

5. Aggrieved by the order of Assessing Officer, Assessee carried the matter before CIT(A). CIT(A) after considering the submissions made by the assessee deleted the penalty by holding as under:-

[5.1] The Assessing Officer has levied the penalty u/s 271AAA of the Act because the first two conditions of section 271AAA(2) are not fulfilled by the appellant. The three conditions provided in sub section (2) of section 271AAA are reproduced as under:[i] In the course of search, in a statement under sub-section (4) of section 132, admits the undisclosed income and specifies the manner in which such income has been derived.[ii] Substantiates the manner in which the undisclosed income was derived; and[iii] Pays the tax together with interest, if any, in respect of the undisclosed income.Clause (i) lays down the first condition that undisclosed income should have been admitted by the assessee in the statement u/s 132(4) and assessee should specify the manner in which it has been derived. Shri Harikishan Virmani, in the statement recorded on 28-01-2009, in the course of search stated in reply to questions nos. 6 to 14 that he was disclosing Rs. 2.50 crores in financial year 2008-09 representing undisclosed income earned from unaccounted trading on behalf of himself and his group. He further submitted in reply to Q.No.13 that break up will be given after getting the copies of his statement, copies of the seized material and copies of statement of his staff. Shri Hrikishan virmani filed bifurcation of disclosure of undisclosed income admitted in the statement recorded on 28.01.2009 for Rs.2.50 crores. As per this bifurcation, income of Rs. 1,75,00,000/- was admitted in his personal case and Rs.75.00.000/- was admitted in the case of Rivaa Exports Ltd. The bifurcation of corresponding assets was also filed. The details of undisclosed assets corresponding to the admitted undisclosed income was as under:-

M/s.Rivaa Exports Ltd. Abhinav Fabrics :Cash paid for purchase of plot at Apparel Park Unaccounted Stock Unaccounted Cash Sundry Receivables Total

Harikishan S.Virmani Sundry Receivables Oraments/Jewellery Total

6. Aggrieved by the aforesaid order of CIT(A), the Revenue is now in appeal before us.

7. Before us, the learned D.R. relied on the order of Assessing Officer whereas the learned A.R. supported the order of CIT(A).

8. We have heard the rival submissions and perused the material on record. It is an undisputed fact that in case of Assessee disclosure of Rs. 75 lacs was made and the same was also offered for tax and tax was also paid. It is also a fact that in the statement recorded u/s. 132(4) Assessee had submitted that the unaccounted income was earned from undisclosed income. CIT(A) by well reasoned order while deleting the penalty has noted that the bifurcation of disclosure of undisclosed income was admitted by the Assessee and also filed. He has also noted that the authorised officer did not ask any specific question on substantiating the manner in which income was derived. He has further noted that in the statement recorded u/s. 132(4) on 28.01.2009, has not asked any further question but was satisfied with the manner the income was earned by the Assessee and was satisfied about substantiating the manner in which the undisclosed income was earned. He has further noted that the assessee had paid tax along with interest on undisclosed income admitted during the course of search. CIT(A) after relying on the decisions in the case CIT vs. Mahendra C. Shah (2008) 299 ITR 305 (Guj) and CIT vs Radha Kishan Goel (2005) 278 ITR 454 has deleted the penalty. Revenue has not brought any material on record to controvert the findings of CIT(A). We therefore find no reason to interfere with the order of CIT(A). Thus the ground of Revenue is dismissed.

ITA No. 2719/Ahd/2012. (Shri Hari Kishan Virmani)

9. Before us both the parties have admitted that the facts of this case are identical to that of 2718/Ahd/2012. We therefore for reasons given while disposing the appeal in ITA No. 2718/Ahd/2012 also dismiss this appeal of Revenue.

10. Thus both the appeals of the Revenue are dismissed.

(Order pronounced in Open Court on 07.06.2013)

2013-TIOL-734-ITAT-DEL

IN THE INCOME TAX APPELLATE TRIBUNAL

BENCH 'F' NEW DELHI

BENCH 'F' NEW DELHI

ITA No.2637/Del/2010

Assessment Year: 2003-2004

Assessment Year: 2003-2004

ASSTT COMMISSIONER OF INCOME TAX

CENTRAL CIRCLE-4, ROOM NO 318

IIIrd FLOOR, ARA CENTRE

JHANDEWALAN EXTN, NEW DELHI

CENTRAL CIRCLE-4, ROOM NO 318

IIIrd FLOOR, ARA CENTRE

JHANDEWALAN EXTN, NEW DELHI

Vs

PACL INDIA LTD

22, 3rd FLOOR, AMBER TOWER

SANSAR CHAND ROAD, JAIPUR

PAN NO:AAACP4032A

22, 3rd FLOOR, AMBER TOWER

SANSAR CHAND ROAD, JAIPUR

PAN NO:AAACP4032A

R P Tolani, JM and B C Meena, AM

Dated: June 20, 2013

Appellants Rep by: Shri D C Aggarwal, Adv. & Ms Sudha Gupta, Adv.

Respondent Rep by: Mrs Vibha Bhalla, CIT-DR

Respondent Rep by: Mrs Vibha Bhalla, CIT-DR

Income tax - Sections 132(1), 143(1) & (2), 153A & C - Whether when the assessment is completed u/s 143(1) and there are no incriminating documents found during search proceedings, AO has no jurisdiction to make or to resort to roving and fishing inquiries to find out whether any income has escaped assessment during these reassessment proceedings.

Assessee is engaged in the business of development of farm land and sale thereof. A search was conducted on assessee and by that time period for issuance of notice u/s 143(2) expired. As a result of search return was filed u/s 153A. Again a search took place later on. Proceedings u/s 153A were abated after second search. In either of the two search carried out by revenue no material was found which could indicate that any part of Land Development Expenses (LDE) was not genuine. However, AO carried out some enquiries according to which his inspector reported that 8 parties to whom LDE was paid were not found at the given addresses. Hence, AO reached on conclusion that claim was not genuine.

CIT (A) deleted the disallowance observing that in search not a single piece of evidence was found which depicts that any income which had been earned by the assessee had not been disclosed. Since regular return of income was filed which was processed u/s 143(1)(a), no assessment was pending on the day of search. Once no assessment was pending the completed assessment shall not abate. Revenue contended that on the basis of the report of inspector AO correctly held that the very genuineness of the expenses claimed by the assessee becomes doubtful and added the amount to the income of assessee.

Assessee contended that the time period for issuing notice u/s 143(2) expired prior to the first search. In both the searches no incriminating material/ documents were found and seized in respect of land development expenses. Jurisdiction to issue notices u/s 153A / 153C cannot be quoted with scope of assessment under section 143(3). Where incriminating material relating to earning of income not declared to the department is found in the search than there is no dispute as to the jurisdiction as well as scope of assessment. Where an assessment for any particular A.Y. is pending on the date of the search than proceedings relating to that assessment will abate. Where no incriminating material is found in the search relating to an A.Y. and proceedings for that A.Y. are completed that is not pending on the date of the search than no addition on the issues which pertain to the original assessment cannot be raised like those which could be raised when such assessments were pending and abated. It is only where original assessment proceedings are pending on the date of the search, the issues outside of the scope of search material can be raised as those original assessment proceedings stand merged/abated in the proceedings u/s 153A and have to be completed considering those issues. An assessment under section 143(1) comprises computation of income and computation of tax on such income. Under section 153A, however, AO has been given the power to assessee or reassess the 'total income' of the six assessment years in question in separate assessment orders. This means that there can be only one assessment order in respect of each of the six assessment years, in which both the disclosed and the undisclosed income would be brought to tax. Where an assessment order had already been passed in respect of all or any of those six assessment years, either u/s 143(1)(a) or Section 143(3), AO is empowered to reopen those proceedings and reassess the total income taking note of the undisclosed income, if any, unearthed during the search. There can be cases where at the time when the search is initiated or requisition is made, the assessment or reassessment proceedings relating to any assessment year falling within the period of the six assessment years mentioned above, may be pending. In such a case, the second proviso to sub section (1) of Section 153A says that such proceedings "shall abate". Under Section 153A, there is no room for multiple assessment orders in respect of any of the six assessment years under consideration. Once those proceedings abate, for the AO to pass assessment orders for each of those six years determining the total income of the assessee which would include both the income declared in the returns, if any, furnished by the assessee as well as the undisclosed income, if any, unearthed during the search or requisition. If assessment orders had been passed and such orders are subsisting at the time when the search or the requisition is made, there is no question of any abatement since no proceedings are pending. In such case AO will reopen assessment for the income escaped assessment.

There are three possible circumstances emerge on the date of initiation of search under section 132(1) of the Income Tax Act, (a) proceedings are pending; (b) proceedings are not pending but some incriminating material found in the course of search, indicating some income and/or assets not disclosed in the return and (c) proceedings are not pending and no incriminating material has been found.

In case where there is no abatement, total income has to be determined by clubbing together the income already determined in the original assessment order and the income that escaped assessment. In the circumstance in hand, there are finalized assessment proceedings and no incriminating material indicating any escaped income. In such case, on clubbing, what remains is the income originally determined or assessed (i.e. income originally determined + Zero = income originally determined - as there was no incriminating material). In view of the same, no addition can be made as no incriminating material has been found in the search regarding non genuineness of LDE.

After hearing both the parties, the ITAT held that,

++ both searches on assessee did not yield any incriminating material on the basis of which it can be said that assessee was indulgent in debiting bogus land development expenses in its books of account. There is no reference of any material found in the search for making assessment u/s 153A of the Act. Thus the basic controversy is about the scope of assessment u/s 153(A) when the return has been accepted u/s 143(1)(a) and time period for issuing notice u/s 143(2) has elapsed. There is no doubt that once the proceedings u/s 143(3) are completed and concluded then there is nothing which will abate as per provisions of section 153A of the Act. Section 153A referred to pending assessment or reassessment and not assessment orders. The assessment may not be pending even though there is no formal order u/s 143(1)(a). The moment return is filed and acknowledgement or intimation issued, the proceedings initiated by filing the return are closed, unless they are again triggered by issuing notice u/s 143(2). In the case under consideration, the period for issuing the notice u/s 143(2) elapsed. The process has attained the finality which can only be assailed u/s 148 or 263 of the IT Act. Such proceedings can never be initiated u/s 143(2) when the time period for issuing notice u/s 143(2) has expired;

++ the issues arises from those processed return can be raised only when some materials found against the assessee. The expiry of time for issuing notice u/s 143(2) of the Act takes away the jurisdiction of the AO for issuing notice u/s 143(2). It is jurisdictional power available with the AO to be exercised in a given period. Once, it is exercised then it can be completed only by making order u/s 143(3) of the Act within the time available u/s 153(1) of the Act. Once search takes place u/s 132(1) of the Act and completion of proceeding is pending on that date then such proceedings abate. Thus, the scope of assessment u/s 153A depends upon whether any assessment or reassessment proceedings were pending or completed on the date of the search. Whenever the abated proceedings are merged with the proceedings u/s 153A then scope of assessment is vide and it will cover all issues arising from the original return and issue arising on the basis of incriminating documents, and assets found and seized during the search. Wherever the proceedings are completed prior to the search then nothing merges with proceding u/s 153A of the Act and nothing abates. In such a situation, the AO has to respect the completeness of the proceedings. Admittedly, in the case of assessee, no incriminating documents were found and seized. The provisions of section 153A give power to assessing officer to assess and reassess the income. The assessing officer is empowered to make addition on account of undisclosed income or income escaped assessment. In the case under consideration, there is no incriminating material found during the course of search relating to the assessment year under consideration. The time period for issuing notice u/s 143(2) was already expired prior to the date of search. Therefore, the proceedings do not get abated by virtue of proviso to Section 153A;

++ the question arises whether AO can make any addition in the reassessment proceedings u/s 153(A) after making inquiries which are not suggested by any document or asset seized during the search. It depends on the nature of addition. The facts and circumstances of the assessee clearly show that no incriminating document found relating to the land development expenses debited in the books of accounts. No material was on the record on that basis which income of assessee could be further assessed by AO. Therefore, AO has no jurisdiction to make or to resort to roving and fishing inquiries to find out whether any income has escaped assessment during these reassessment proceedings. Particularly, when there is no incriminating material found and seized during the course of search u/s 132(1) of the Act and nothing is available in record to reassess the income of assessee. Thus, the addition is deleted.

There are three possible circumstances emerge on the date of initiation of search under section 132(1) of the Income Tax Act, (a) proceedings are pending; (b) proceedings are not pending but some incriminating material found in the course of search, indicating some income and/or assets not disclosed in the return and (c) proceedings are not pending and no incriminating material has been found.

In case where there is no abatement, total income has to be determined by clubbing together the income already determined in the original assessment order and the income that escaped assessment. In the circumstance in hand, there are finalized assessment proceedings and no incriminating material indicating any escaped income. In such case, on clubbing, what remains is the income originally determined or assessed (i.e. income originally determined + Zero = income originally determined - as there was no incriminating material). In view of the same, no addition can be made as no incriminating material has been found in the search regarding non genuineness of LDE.

After hearing both the parties, the ITAT held that,

++ both searches on assessee did not yield any incriminating material on the basis of which it can be said that assessee was indulgent in debiting bogus land development expenses in its books of account. There is no reference of any material found in the search for making assessment u/s 153A of the Act. Thus the basic controversy is about the scope of assessment u/s 153(A) when the return has been accepted u/s 143(1)(a) and time period for issuing notice u/s 143(2) has elapsed. There is no doubt that once the proceedings u/s 143(3) are completed and concluded then there is nothing which will abate as per provisions of section 153A of the Act. Section 153A referred to pending assessment or reassessment and not assessment orders. The assessment may not be pending even though there is no formal order u/s 143(1)(a). The moment return is filed and acknowledgement or intimation issued, the proceedings initiated by filing the return are closed, unless they are again triggered by issuing notice u/s 143(2). In the case under consideration, the period for issuing the notice u/s 143(2) elapsed. The process has attained the finality which can only be assailed u/s 148 or 263 of the IT Act. Such proceedings can never be initiated u/s 143(2) when the time period for issuing notice u/s 143(2) has expired;

++ the issues arises from those processed return can be raised only when some materials found against the assessee. The expiry of time for issuing notice u/s 143(2) of the Act takes away the jurisdiction of the AO for issuing notice u/s 143(2). It is jurisdictional power available with the AO to be exercised in a given period. Once, it is exercised then it can be completed only by making order u/s 143(3) of the Act within the time available u/s 153(1) of the Act. Once search takes place u/s 132(1) of the Act and completion of proceeding is pending on that date then such proceedings abate. Thus, the scope of assessment u/s 153A depends upon whether any assessment or reassessment proceedings were pending or completed on the date of the search. Whenever the abated proceedings are merged with the proceedings u/s 153A then scope of assessment is vide and it will cover all issues arising from the original return and issue arising on the basis of incriminating documents, and assets found and seized during the search. Wherever the proceedings are completed prior to the search then nothing merges with proceding u/s 153A of the Act and nothing abates. In such a situation, the AO has to respect the completeness of the proceedings. Admittedly, in the case of assessee, no incriminating documents were found and seized. The provisions of section 153A give power to assessing officer to assess and reassess the income. The assessing officer is empowered to make addition on account of undisclosed income or income escaped assessment. In the case under consideration, there is no incriminating material found during the course of search relating to the assessment year under consideration. The time period for issuing notice u/s 143(2) was already expired prior to the date of search. Therefore, the proceedings do not get abated by virtue of proviso to Section 153A;

++ the question arises whether AO can make any addition in the reassessment proceedings u/s 153(A) after making inquiries which are not suggested by any document or asset seized during the search. It depends on the nature of addition. The facts and circumstances of the assessee clearly show that no incriminating document found relating to the land development expenses debited in the books of accounts. No material was on the record on that basis which income of assessee could be further assessed by AO. Therefore, AO has no jurisdiction to make or to resort to roving and fishing inquiries to find out whether any income has escaped assessment during these reassessment proceedings. Particularly, when there is no incriminating material found and seized during the course of search u/s 132(1) of the Act and nothing is available in record to reassess the income of assessee. Thus, the addition is deleted.

Revenue's appeal dismissed

Case laws followed:

ACIT Vs. Pratibha Industrialist Ltd (2013-TIOL-50-ITAT-MUM)

CIT Vs. Anil Kumar Bhatia (2012-TIOL-641-HC-DEL-IT)

ORDER

Per: B C Meena:

This is the appeal emanates from the order of the CIT (A)(III) Delhi dated 03.03.2010. The revenue has taken the following grounds of appeal :-

1. Whether on the facts and in the circumstances of the case, the CIT(A) has erred in law and on facts in quashing the assessment made u/s 153A by holding that no document was seized during the search pertaining to this Assessment Year?2. Whether on the facts and in the circumstances of the case, the CIT(A) has erred in interpreting Section 153A of the IT Act?3. Whether on the facts and in the circumstances of the case, the CIT(A) has erred in placing reliance on second proviso to Section 153A(1) ignoring the main Section and the first proviso?4. Whether on the facts and in the circumstances of the case, the CIT(A) has erred in law in not following the Circular No. 7 of 2003 dated 05/09/2003 issued by the CBDT.5. Whether on the facts and in the circumstances of the case, the CIT(A) has erred in law by not appreciating the fact that there is no precondition that documents pertaining to each of the assessment year falling under the provisions of Section 153C/153A should be found ?6. The order of the CIT (A) is perverse and not tenable in law and on facts.7. The appellant craves leave to add, alter or amend any/all of the grounds of appeal before or during the course of the hearing of the appeal."

2. In this revenue's appeal the deletion of Rs. 90,19,000/- made by A.O. out of the land development expenses of Rs. 14,64,30,786/- made during the year incurred by the assessee during the year has been challenged. The brief facts of the case are as under :-

Assessee Company is engaged in the business of development of farm land and sale thereof. The land is mainly purchased in rural areas in different parts of the countries, the original return for the A.Y. 2003-04 was filed on 02.12.2003 showing NIL income but showing income 115JB at Rs. 74,80,591/-. The time period for issuance of notice u/s 143(2) expired as on 31.12.2004 before the date of the first search on 22.09.2005. As a result of search on 22.09.2005 the return was filed u/s 153A on 21.08.2006 declaring same NIL income and income u/s 115JB at Rs. 74,80,951/-. The search u/s 132 of the Act was again conducted at the premises of the Assessee Company on 25.08.2006. The notice u/s 153A was issued on 14.11.2007. The proceedings for assessment initiated u/s 153A as a result of first search were abated when the proceedings u/s 153A were initiated after the second search. In either of the two searched carried out by the department no material was found which could indicate that any part of Land Development Expenses (LDE) was not genuine. However, during the course of assessment proceedings the Ld. AO seems to have carried out some enquiries according to which his inspector has reported that 8 parties to whom Land Development Expenditure (LDE in short) was paid were not found at the given addresses. The details of these 8 parties are mentioned by him in para 5.2 of his assessment order. On this basis he came to the conclusion that LDE to the extent of Rs. 90,19,000/- claimed by the assessee were not genuine. However, no material was found in both the searches which could indicate that any part of land development expenditure was not genuine.

3. The CIT(A) has deleted the addition for the following reasons :-

"i) During the search not a single piece of evidence was found which depicts that any income which has been earned by the appellant has not been disclosed.ii) There is no reference to any material so found while computing the income u/s 153A of the Act.iii) Since the regular return of income was filed on 02.12.2003, this was processed u/s 143(1)(a) of the Act and as such no assessment was pending on the day of search.iv)Once no assessment was pending the completed assessment shall not abate."

4. The CIT(A) has placed the reliance in deleting the addition on the following cases :-

a. "ITAT Jodhpur Bench in the case of Suncity Alloys (P) Ltd. V. ACIT. (2009) 124 TTJ 674(JD)b. ITAT Ahmedabad Bench in the case of Meghmani Organics Ltd. V. DCIT [2010] 129 TTJ 255 (AHD).c. LMJ International Ltd. v. DCIT (2008) 119 TTJ (Kol.) 214d. ITAT Lucknow Bench in the case of Kailash Auto Finance Ltd. v. ACIT [2009] 32 SOT 80 (LUCK).e. ITAT Delhi Bench in the case of Charchit Agrawal v. ACIT 34 SOT 348 ( Del. )f. ITAT Delhi Bench in the case of Sh. Sanjay Kumar Bhatia (ITA No. 2666 to 2672/ Del /2009 dt. 01.01.2010.g. Circular No. 007 of 2003 dt. 5.09.2003 of the CBDT."

5. While pleading on behalf of the revenue, the Ld. DR relied on the order of AO and submitted that assessee is engaged the business of purchase and sale of agriculture land. The assessee has debited land development expenses in its profit and loss account. The assessing officer to verify the genuineness of these land development expenses deputed the inspector to verify the addresses of the contractors. The inspector reported that no such concern or person were available at the given addresses. The assessing officer on the basis of this report held that the very genuineness of the expenses claimed by the assessee becomes doubtful and added the amount of Rs. 90,19,000/- to the income of assessee. The CIT(A) is not justified the deleting the addition which was made on the basis of inquiries conducted by the department. This inquiry has left a shadow of doubt in the genuineness of the expenses. Under these circumstances, the CIT appeal was not justified to delete the addition.

6. On the other hand, the Ld. AR submitted as under that assessee is engaged in the business of development of farm land and sale thereof. The original return of income was filed on 2.12.2003. The time period for issuing notice u/s 143(2) expired on 31st December, 2004. This period was expired prior to the first search conducted on 22.9.2005. The 2nd search was carried out on 25.8.2006 and in both the searches no incriminating material/ documents were found and seized in respect of land development expenses. While supporting the order of the CIT (A). The Ld. AR extended following arguments during the proceedings.

"(i) Carrying out search against a person u/s 132 of the Act gives jurisdiction to the AO to issue notices u/s 153A (or u/s 153C as the case may be) for 6 assessment years prior to the A.Y. in which search is carried out.(ii) Hon'ble Delhi High Court in CIT Vs. Anil Kumar Bhatia (2012) 24 Taxmann.com 98 (Del.) = (2012-TIOL-641-HC-DEL-IT) has held that A.O. is bound to issue notice to the Year of the assessee to furnish the returns for six assessment years prior to the year of the search, but at another place, in para 23 it is observed that "we are not concerned with a case where no incriminating material was found during the search conducted u/ s 132 of the Act. We therefore, express no opinion as to whether Sec. 153A can be invoked even in such a situation. That question is therefore left open". In other words, there is a clear doubt in the mind of the Hon'ble High Court as to whether AO has jurisdiction to initiate proceedings u/s 153A if no incriminating material is found in the search. Had it been an open and shut case i.e. acquiring of jurisdiction ufs 153A does not depend upon recovery and seizure of any incriminating material, Hon'ble High Court would not have so commented.(iii) Jurisdiction to issue notices u/s 153Afufs 153C cannot be quoted with scope of assessment under those sections. Where incriminating material relating to earning of income not declared to the department is found in the search than there is no dispute as to the jurisdiction as well as scope of assessment. Where an assessment for any particular A.Y. is pending on the date of the search than proceedings relating to that assessment will abate and scope of assessment will be wide enough to include issues emerging from abated proceedings as well as issues emerging from seized incriminating material.(iv) The scope of expression "abate" has been elaborately discussed by Hon'ble Allahabad High Court in CIT Vs. Smt. Shaila Agrawal (2011) 16 Taxmann.com 232 (All.) = (2011-TIOL-778-HC-ALL-IT). It is held that "The word 'abatement' is preferable to something, which is pending alive, or is subject to deduction. The abatement refers to suspension or termination of the proceedings either of the main action, or the proceedings ancillary or collateral to it."(v) The expression "pending" has also been considered in Kailash Auto Finance Ltd. Vs. ACIT (2009) 32 SOT 80 (Luck.) wherein it is observed that pending means undecided i.e. something which is not concluded. An action is considered as pending from the time of commencement of the proceedings. Thus, a legal proceeding is pending as soon as commenced and until it is concluded. A proceeding must be pending on the date of initiation of the search and before the A.O.(vi) But where no incriminating material is found in the search relating to an A.Y. than scope of assessment will depend whether original assessment is pending or is completed. Where original assessment is pending on the date of the search than the proceedings relating to pending assessments shall abate and proceedings initiated as a result of search will be continued. The scope of assessment will cover issues arising from pending assessment and freshly initiated proceedings will cover issues which could arise from the originally pending proceedings.(vii) Where no incriminating material is found in the search relating to an A.Y. and proceedings for that A.Y. are completed that is not pending on the date of the search than no addition on the issues which pertain to the original assessment cannot be raised like those which could be raised when such assessments were pending and abated.(viii) If issues pertaining to regular assessment or issues which are not based on any material found in the search (as no such material was found in the search) are allowed to be raised in the completed assessment in the same way as in the pending assessment (which would merge/abate in the proceedings initiated u/s 153A) then the provision relating to pending assessment being abated, as contained in second proviso u/s 153A will become otiose. The AO will be free to raise any issue whether within the framework of seized material or outside it.(ix) From this it follows that it is only where original assessment proceedings are pending on the date of the search, the issues outside of the scope of search material can be raised as those original assessment proceedings stand merged/abated in the proceedings u/s 153A and have to be completed considering those issues.(x) The expression "Pending assessment" used in second proviso to section 153A refers to actual pending assessment and not to virtual or deemed or notionally "pending assessment". The concept of "assessment" has been explained by the courts (i) it includes all proceedings starting with the filing of the return or issue of notice and ending with the determination of the tax payable by the assessee (Re: CIT v. Sanjai Kumar Gupta [2005] 276 ITR 0073- (All) (ii) Section 143(1)(a) of the Income-tax Act, 1961, enjoins upon the Income-tax Officer not only a duty to assess the income of an assessee, but also a duty to determine the sum payable or refundable to the assessee on the basis of such assessment. It is, therefore, obvious, that an assessment under section 143(1) comprises computation of income and computation of tax on such income (Re: CIT vs. Swam Taneja (Miss.) [1990] 186 ITR 0348-(MP))The decision of Hon'ble Apex Court in the case of Rajesh Jhaveri Stock Brokers P. Ltd. V. CIT [2007] 291 ITR 0500-(SC) = (2007-TIOL-95-SC-IT) often referred to in support of the argument that intimation issued u/s 143(1)(a) is not an assessment order is really on the proposition that in intimation there is no occasion to frame an opinion by the AO and therefore action u/ s 147 cannot be prohibited on the ground that there was a change of opinion. It does not lay down the proposition that even after issue of intimation (which is also deemed as demand notice) or acknowledgment after filing of return of income assessment proceedings are pending and even if they are pending then how long they will remain pending.(xi) We place reliance on the following judgments in support of our arguments that, no addition can be made u/s 153A or 153C, if no incriminating material is found in the search:(a) Allcargo Global 137 ITD 287 / (2012) 18 ITR (Trib.) 106 (ITAT, Mum (SB)) =(2012-TIOL-391-ITAT-MUM-SB)(b) ACIT Vs. M/s Pratibha Industries Ltd. (ITA No. 2197 to 2199 / Mum / 2008, 2200 to 2201 / Mum / 2008, ITA No. 2202 / Mum 2008 = (2013-TIOL-50-ITAT-MUM)and COs thereon order dated 19.12.2012 (a copy thereof is enclosed).(c) CIT Vs. Priyanka Ship Breaking Co. Ltd. (2012) 26 Taxmann.com 321 (Del.) =(2012-TIOL-815-HC-DEL-IT) to the effect that where no link was established between accommodation entries and seized documents addition on account of undisclosed income in assessee's hands was unjustified.(d) Gurinder Singh Bawa Vs. DCIT (2012) 28 Taxmann.com 328 (Mum) wherein it is held that, where assessments pertaining to 6 immediately preceding assessment years were complete, A.O. cannot make any addition there under unless there is any incriminating material recovered during the search.(e) LMJ International Ltd. Vs. DCIT (2008) 22 SOT 351 (Kol)(f) ACIT Vs. Mrs. Uttara S. Shorewala (2011) 12 Taxmann.com 460 (Mum) wherein it is held that, once revenue has accepted the stand of the assessee and had accepted the order, the A.O. was not justified in repeating the same addition in subsequent search proceedings by merely seeking to rely on statement and affidavit of the third party.(g) S.K. Jain Vs. ACIT Bhopal in IT(SS).A.Nos 210 to 216/Ind/2007 dated 28.01.2010 wherein it is held that, if no incriminating material is found in the search, no addition u/s 153C can be made.(h) CIT Vs. Anil Kumar Bhatia (2012) 24 Taxmann.com 98 (Del.) = (2012-TIOL-641-HC-DEL-IT)(i) CIT Vs. Lachman Das Bhatia (2012) 26 Taxmann.com 167 (Del.) = (2012-TIOL-627-HC-DEL-IT)(J) ACIT v. Asha Kataria (IT.A. Nos. 3105, 3106 & 3107/Del/2011 A.Yrs. : 2002-03, 2003-04 & 2006-07 dt. 20-052013) = (2013-TIOL-420-ITAT-DEL)(k) Kusum Gupta v. DCIT (ITA Nos. 4873/De12009, (2005-06) 2510(A.Y. 2003-04), 3312 (A.Y. 2004-05) 2833/Del/2011 (A.Y. 2006-07) order dt. 28-03-2013)(xii) A gist of following decisions referred above is given as under:(i) Gurinder Singh Bawa Vs. DCIT [2012] 28 taxmann.com 328 (Mum.):In this case, the AO had made assessment on the information/material available in the return of income. The information regarding the gift was available in the return of income as capital account had been credited by the assessee by the amount of gift. Similar was the position in relation to addition under section 2(22)(e). The AO had not referred to any incriminating material found during the search based on which addition had been made. Therefore following the decision of the Special Bench (supra), we hold that the AO had no jurisdiction to make addition under section 153A. The addition made is therefore deleted on this legal ground. On merit also we do not find any case to sustain the addition. The addition made is on account of gift which is nothing but loan taken by the assessee which was converted into gift during the year. Thus source of gift was loan which the AO himself has admitted had been taken by the assessee in the year prior to 2000. Therefore, addition if any could have been made in the year of loan. Similarly, claim of the assessee and finding of CIT(A) that there was no accumulated profit has not been controverted before us. We agree with CIT(A) that current year profit has to be excluded. Therefore, there is no case for any addition under section 2(22)(e). We, therefore, dismiss the appeal of the revenue and allow the appeal filed by the assessee.(ii) CIT Vs. Lachman Dass Bhatia [2012] 26 taxmann.com 167 (Delhi) = (2012-TIOL-627-HC-DEL-IT):Both the Commissioner (Appeals) and the Tribunal have recorded a concurrent finding that there was no basis for making any addition towards low gross profit. They have found that the search on the assessee did not yield any incriminating material on the basis of which it can be said that the assessee was indulging in underinvoicing or suppression of sales. They also found that the documents on which the Assessing Officer has placed reliance, were seized from a different person and not from the assessee and that no nexus between that person and the assessee has been established beyond doubt. In such circumstances, it has been held that the seized material cannot be used against the assessee.(iii) ACIT Vs. Mrs. Uttara S. Shorewala [2011] 12 taxmann.com460(Mum.):In this case, the Assessing Officer had accepted the version of the assessee in the earlier assessment proceedings. However, in the proceedings, as a result of search, he proposed the addition in respect of same issues. It was held that the A.O. was not justified in repeating same additions in subsequent search proceedings by merely seeking to rely on statement and affidavit of a third party, which were nothing but reiteration of stand which he took in earlier reassessment proceedings also.(iv) Suncity Alloys (P) Ltd. Vs. ACIT [2009] 124 TTJ 674(JD):Assessment or reassessment made pursuant to notice under section 153A is not de novo assessment; therefore, there is no merit in ground to make a new claim of deduction or allowance during assessment/reassessment under section 153A as such where admittedly regular assessments are shown as completed assessment on date of initiation of action under section 132.(v) DCIT Vs. Royal Marwar Tobacco Product (P.) Ltd [2009] 29 SOT 53 (AHD.)(URO):Since no material indicating any suppressed sales for assessment years 2000-01 to 2003-04 had been found during course of search for said years, and there was no defect in books of account, Assessing Officer was not. justified, in making addition for said years on basis of material seized relating to assessment year 200405.(vi) CIT Vs. Anil Kumar Bhatia (2012) 24 Taxmann.com 98 (Del.) = (2012-TIOL-641-HC-DEL-IT)Hon'ble Delhi High Court held that A.O. is bound to issue notice to the assessee to furnish the returns for six assessment years prior to the year of the search, but at another place, in para 23 it is observed that "we are not concerned with a case where no incriminating material was found during the search conducted u/s 132 of the Act. We therefore, express no opinion as to whether Sec. 153A can be invoked even in such a situation. That question is therefore left open". In other words, there is a clear doubt in the mind of the Hon'ble High Court as to whether proceedings u/ s 153A can still be initiated if no incriminating material is found in the search. Had it been an open and shut case i.e. acquiring of jurisdiction u/s 153A does not depend upon recovery and seizure of any incriminating material, Hon'ble High Court would not have so commented. In Anil Bhatia's case a document was found in the search which was unsigned and on the basis of which addition was made but deleted by the Tribunal on the ground that document is unsigned but Hon'ble High Court had held that once document was found in the course of the search, Sec. 153A is triggered. Once the section is triggered, it appears mandatory for the A.O. to issue notice u/s 153A calling upon the assessee to file the returns for the six assessment years prior to the year in which the search took place. From these observations, it follows that: (i) if some incriminating material is found irrespective of its effect on any particular assessment year, the A.O. gets jurisdiction to issue notice u/s 153A for all the six assessment years; (ii) if no incriminating material is found in the search, it is doubtful whether Sec. 153A can be invoked.(vii) In this regard, we refer to para 39 - 44 from the decision of Hon'ble ITAT in the case of ACIT Vs. M/s Pratibha Industries Ltd., Mumbai (ITA Nos. 2197 - 2199,2200 -2201/M/2008) = (2013-TIOL-50-ITAT-MUM) date of pronouncement 19.12.2012, in support of our contention.39. the section starts with the non obstante phrase "Notwithstanding ... ", therefore, as soon as the search is concluded, the AO having jurisdiction over the assessee, a jurisdiction is cast upon the AO to issue notices under section 153A( 1), for the preceding six years, calling upon that person to file its returns. As soon as the notices are issued, due process of law shall begin and AO and the assessee are required to follow the same, which shall culminate with the AO to assess or reassess the total income of the searched person in all the six years in question. While casting this jurisdiction over the AO, the legislature, to remove all the difficulties with regard to the multiplicity of proceedings pending on the date of initiation of search, through 2nd Proviso, expunged all those proceedings, so that the assessee and the AO shall deal with only one type of proceedings, wherein the AO shall, as per clause (ii), assess or reassess the total income of the searched person. This barrier has been set up by the legislature only with regard to proceedings that were found pending before the AO on the date of search. Therefore, a proceeding which is pending, only those proceedings shall get abated. In other words, any proceeding that has reached its finality shall not be disturbed, as per the clarification issued by the CBDT, through Circular no. 7, dated 05.09.2003 (supra), unless there are materials found, indicating existence of income embedded in those incriminating document(s).40. This has been explained by the Special Bench in the case of All Cargo Global Logistics Ltd. (supra) (Mum-SB), which states,"58. Thus, question NO.1 before us is answered (a) as under:(a) In assessments that are abated, the A.O. retains the original jurisdiction as well as jurisdiction conferred on him under s. 153A for which assessments shall be made for each of the six assessment years separately;(b) In other cases, in addition to the income that has already been assessed, the assessment under section 153A will be made on the basis of incriminating material, which in the context of relevant provisions means(i) books of account, other documents, found in the course of search but not produced in the course of original assessment, and (i) undisclosed income or property discovered in the course of search.Therefore what emerges is that no doubt 153A shall be initiated, and all the six years shall become subject matter of assessment under section 153A. The AO shall get the free hand, through abatement, only on the proceedings that are/is pending. It is, in these abated proceedings, AO can frame the assessment(s) afresh. But in a case or in a circumstances where the proceedings have reached finality, assessment under section 153A read with 143(3) has to be made as was originally made / assessed and in case where certain incriminating documents have been found indicating undisclosed income, then the addition shall only be restricted to those documents/incriminating material, and clubbed only to the assessment framed originally, as the law does not permit the AO to disturb already concluded issues, whether it pertained to any income or expenditure or deduction, as also observed by the Hon'ble Delhi High Court in the case of Anil Kumar Bhatia (supra)," 18. A perusal of Section 153A shows that it starts with a non obstante clause relating to normal assessment, procedure which is covered by Sections 139, 147, 148, 149, 151 and 153 in respect of searches made after 31.5.2003. These Sections, the applicability of which has been excluded, relate to returns, assessment and reassessment provisions. Prior to, the introduction of these three Sections, there was Chapter XIV-B of the Act, which took care of the assessment to be made in cases of search & seizure. Such an assessment was popularly known as 'block assessment' because the Chapter provided for a single assessment be made in respect of a period of a block of ten assessment years prior to the assessment year in which the search was made. In addition to these ten assessment years, the broken period up to the date on which the search was conducted was also included in what was known as 'block period'. Though a single assessment order was to be passed, the undisclosed income was to be assessed in the different assessment yeas to which it related. But all this had to be made in a single assessment order. The block assessment so made was independent of and in, addition to the normal assessment proceedings as clarified by the Explanation below Section 158BA(2). After the introduction of the group of Sections namely, 153A to 153C, the single block assessment concept was given a go-by. Under the new Section 153A, in a case where search is initiated under section 132 or requisition of books of account, documents or assets is made under Section 132A after 31.5.2008, the Assessing Officer is obliged to issue notices calling upon the searched person to furnish returns for the six assessment years immediately preceding the assessment year relevant to the previous year in which the search was conducted or requisition was made. The other difference is that there is no broken period from the first day of April of the financial year in which the search took place or the requisition was made and ending with the date of search/requisition. Under Section 153A and the new scheme provided for, the AO is required to exercise the normal assessment powers in respect of the previous year in which the search took place.19. Under the provisions of Section 153A, as we have already noticed, the Assessing Officer is bound to issue notice to the assessee to furnish returns for each assessment year falling within the six assessment years immediately preceding the assessment year relevant to the previous year in which the search or requisition was made. Another significant feature of this Section is that the Assessing Officer is empowered assess or reassess the "total income" of the aforesaid years. This is significant departure from .11 ~ the earlier block assessment scheme in which the block assessment ~ roped in only the undisclosed income and the regular assessment proceedings were preserved, resulting in multiple assessments. Under section 153A, however, the Assessing Officer has been given the power to assessee or reassess the 'total income' of the six assessment years in question in separate assessment orders. This means that there can be only one assessment order in respect of each of the six assessment years, in which both the disclosed and the undisclosed income would be brought to tax.20. A question may arise as to how this is to be sought to be achieved where an assessment order had already been passed in respect of all or any of those six assessment years, either under Section 143(1)(a) or Section 143(3) of the Act. If such an order is already in existence, having obviously been passed prior to the initiation of the search/requisition, the Assessing Officer is empowered to reopen those proceedings and reassess the total income taking note of the undisclosed income, if any, unearthed during the search For this purpose, the fetters imposed upon the Assessing Officer by the strict procedure to assume jurisdiction to reopen the assessment under Section 147 and 148, have been removed by the non obstante clause with which sub section (1) of Section 153A opens. The time-limit within which the notice under Section 148 can be issued, as provided in Section 149 has also been made inapplicable by the non obstante clause. Section 151 which requires sanction to be obtained by the Assessing Officer by issue of notice to reopen the assessment under Section 148 has also been excluded in a case covered by Section 153A. The timelimit prescribed for completion of an assessment or reassessment by Section 153 has also been done away with in a case covered by Section 153A With all the stop having been pulled out, the Assessing Officer under Section 153A has been entrusted with the duty of bringing to tax the total income of an assessee whose case is covered by Section 153A, by even making reassessments without any fetters, if need be.21. Now there can be cases where at the time when the search is initiated or requisition is made, the assessment or reassessment proceedings relating to any assessment year falling within the period of the six assessment years mentioned above, may be pending. In such a case, the second proviso to sub section (1) of Section 153A says that such proceedings "shall abate". The reason is not far to seek; Under Section 153A, there is no room for multiple assessment orders in respect of any of the six assessment years under consideration. That is because the Assessing Officer has to determine not merely the undisclosed income of the assessee, but also the total income' of the assessee in whose case a search or requisition has been initiated. Obviously there cannot be several orders for the sane assessment year determining the total income of the assessee in order to ensure this state of affairs namely, that in respect the six assessment years preceding the assessment year relevant to the year in which the search took place there is only one determination of the total income, it has been provided in the second proviso of sub Sub-Section 153A that any proceedings for assessment or reassessment of the assessee which are pending on the date of initiation of the search or making requisition "shall abate". Once those proceedings abate, the decks are cleared, for the Assessing Officer to pass assessment orders for each of those six years determining the total income of the assessee which would include both the income declared in the returns, if any, furnished by the assessee as well as the undisclosed income, if any, unearthed during the search or requisition. The position thus emerging is that where assessment or reassessment proceedings are pending completion when the search is initiated or requisition is made they will abate making way for the Assessing Officer to determine the total income of the assessee in which the undisclosed income would also be included but in cases where the assessment or reassessment proceedings have already been completed and assessment orders have been passed determining the assessee's total income and such orders are subsisting at the time when the search or the requisition is made, there is no question of any abatement since no proceedings are pending. In this latter situation, the Assessing Officer will reopen the assessments or reassessments already made (without having the need to fallow the strict provisions or complying with the strict conditions of Sections 147, 148 and 151) and determine the total income of the assessee. Such determination in the orders passed under Section 153A would be similar to the orders passed in any reassessment, where the total income determined in the original assessment order and the income that escaped assessment are clubbed together and assessed as the total income".41. On going through the provisions of section 153A, clause (b) of section 153A, 2nd Proviso and the various decisions cited before us, three possible circumstances emerge on the date of initiation of search under section 132(1) of the Income Tax Act, (a) proceedings are pending; (b) proceedings are not pending but some incriminating material found in the course of search, indicating some income and/or assets not disclosed in the return and (c) proceedings are not pending and no incriminating material has been found.42. When we tread to trace the correct and logical answers to the above circumstances, circumstance (a) is answered by the Act itself, that is, since the proceedings are still pending, all those pending proceedings are abated and the AO gets a free hand to make the assessment. Circumstance (b) has been answered by the Courts, interpreting 2nd Proviso along with clause (b) to section 153A, wherein the Hon'ble Delhi Court observes and hold, "where the assessment or reassessment proceedings have already been completed and assessment orders have been passed determining the assessee's total income and such orders are subsisting at the time when the search or the requisition is made, there is no question of any abatement since no proceedings are pending. In this latter situation, the Assessing Officer will reopen the assessments or reassessments already made (without having the need to fallow the strict provisions or complying with the strict conditions of Sections 147, 148 and 151) and determine the total income of the assessee. Such determination in the orders passed under Section 153A would be similar to the orders passed in any reassessment, where the total income determined in the original assessment order and the income that escaped assessment are clubbed together and assessed as the total income". But when we come to third circumstance i.e. circumstance (c), we find that this has been left unanswered. Para 23 of the judgment, the Hon'ble Delhi High Court mentions that the issue is left open.43. This, has been explained in the graphic made below and the relevant portion is in italics therein.

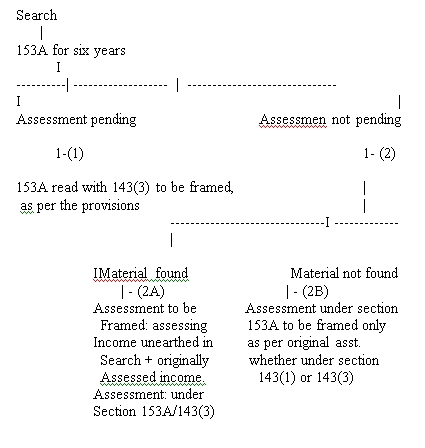

This can be explained through this graphic:

44. To answer the question, as to what shall be the assessment of total income, where there is/are no pending proceedings and no incriminating material, we have to trace out the logical conclusion, by harmonising the legislative intendments and the judicial decisions, as held by the Hon'ble Supreme Court of India in the case of K P Varghese (supra), wherein it was observed, so as to achieve the obvious intention of the Legislature and produce a rational construction. When we look into the decision of the Hon'ble Delhi High Court in Anil Kumar Bhatia's case (supra), we find that the Hon'ble Court has pointed out that in case where there is no abatement, total income has to be determined by clubbing together the income already determined in the original assessment order and the income that escaped assessment (situation 2A in the graphic). In the circumstance, what we are dealing in instantly, there are finalized assessment proceedings and no incriminating material indicating any escaped income (situation 2B in the graphic). Taking a cue from the decision of Hon'ble Delhi High Court in the case of Anil Kumar Bhatia (supra) we can tread on the same premise and hold that on clubbing, what remains is the income originally determined or assessed (i.e. income originally determined + Zero = income originally determined - as there was no incriminating material)."(VIII) In ACIT v. Asha Kataria (I.T.A. Nos. 3105, 3106 & 3107/Del/2011A.Yrs. 2002-03,2003-04 & 2006-07 dt. 20-05-2013) = (2013-TIOL-420-ITAT-DEL): ITAT Delhi bench held as under:"29. We have carefully considered the submissions and perused the records. We find that the value of the property in this case as reflected in the registered sale deed was Rs. 33,00,000/-. Reference u/ s. 142A was made to the DVO by the Assessing Officer. DVO determined the value of the property at Rs. 63,74,700/- as against Rs. 33,00,000/ - shown by the assessee. Hence, there was difference of Rs. 30,74,700/-. This was added to the income of the assessee. However, Ld. Commissioner of Income Tax (A) deleted the addition as there was no evidence of adverse material regarding payment of under hand consideration. Similarly, no other incriminating material was found during the course of search. In our considered opinion, Ld. Commissioner of Income Tax (A) is correct in this regard. Addition in this case has been made pursuant to search on the basis of Valuation Report of the DVO. It has been settled that in case of search in the absence of any incriminating material found during search, no addition can be made on the basis of Report of the DVO. In this regard, the case laws referred by the assessee are germane and support the case of the assessee. We may further refer to the following case laws:-a) C.I.T. vs. Abhinav Kumar Mittal [2013] 351 ITR 20 (DHC) = (2013-TIOL-92-HC-DEL-IT) Held, dismissing the appeal, that there was no material found in the search and seizure operations, which would justify the Assessing Officer's action in referring the matter of the District Valuation Officer for his opinion on valuation of the properties. Therefore, the valuation arrived at by the District Valuation Officer would be of no consequence. In any event, the Tribunal had also, on facts, held that the District Valuation Officer's valuation was based on incomparable sales, which is not permissible in law.b) C.I.T. vs. Mahesh Kumar (2011) 196 Taxman 415 (DHC) = (2010-TIOL-606-HC-DEL-IT) Where no evidence could be gathered that assessee had invested more than value declared in registered sale deed of plots purchase and, comparable instances taken by the Valuation Officer were situated for way, addition made under section 69 on account of unexplained investment with respect of purchase of said plots was not justified.30. From the above, it is evident that in the absence of any evidence that the assessee has invested more than value declared in the registered sale deed of property purchased, the addition in this regard on the basis of Valuation Report by the DVO is not sustainable.31. Furthermore, we find that in this case the assessment was made u/ s. 153A of the I. T. Act. Hence, reliance upon the decision of the Special Bench in the case of All Cargo Global Logistics Ltd. (Supra) is also germane and supports the case of the assessee. As expounded in this case assessment u/ s. 153A can be made only on the basis of incriminating material found during the course of search."(IX) In Kusum Gupta v. DCIT (ITA Nos. 4873/DeI2009, (2005-06) 2510(A.Y. 2003-04), 3312 (A.Y. 2004-05) 2833/Del/2011 (A.Y. 2006l -07) order dt. 28-032013): ITAT Delhi bench also held as under:"10. On perusal of the assessment order for the year under consideration and others in question in the appeals before us, we find substance in the contention of Ld. AR that no incriminating material found or statement recorded during the course of search was there to suggest even prima facie that some undisclosed income was there to attract the invocation of the provisions laid down u/ s 153A of the Act for the addition as per the decision of Special Bench of the Tribunal on the issue in the case of Alcargo Global Logistics Ltd. Vs. DCIT (Supra). As discussed above the ratio laid down is that when no assessment has been abated, addition in the assessment u/ s 153A can be made only on the basis of incriminating material recovered during search. Respectfully following this decision of the Special Bench of the Tribunal we hold that in the A. Y. involved in the appeal since assessment has been abated, addition made in the assessment u/ s 153A, in absence of incriminating material recovered or statement recorded during the search, showing non-genuineness of gifts was beyond jurisdiction, hence addition so made at Rs. 20,00,000/- on account of non-genuineness of the gift which was not made in the original assessment u/ s 153(3) of the Act, was rightly deleted by the Ld. CIT(A) without commenting on merits of it. The same is upheld. The ground is accordingly rejected."In view of above submissions, it is prayed that, legally, no addition can be made as no incriminating material has been found in the search regarding non genuineness of LDE, therefore, sanctity of assessment completed on the return filed on 02-122003 should be upheld as the time period for issuance of notice u/s 143(2) expired before the date of the search on 22-09-2005."