Sections 153A & 153C - Whether any addition can be made under the new provision of assessment pertaining to search and seizure if no proceedings are pending and no incriminating material is found during search.

2013-TIOL-747-ITAT-DEL

IN THE INCOME TAX APPELLATE TRIBUNAL

BENCH 'E' NEW DELHI

BENCH 'E' NEW DELHI

ITA Nos.4212 & 4213/DEL/2011

Assessment Year: 2004-05 & 2005-06

Assessment Year: 2004-05 & 2005-06

MGF AUTOMOBILES LTD

4/17-B, MGF HOUSE,

ASAF ALI ROAD, NEW DELHI

PAN NO:AABCM4248A

4/17-B, MGF HOUSE,

ASAF ALI ROAD, NEW DELHI

PAN NO:AABCM4248A

Vs

ACIT

CENT CIRCLE-7, NEW DELHI

CENT CIRCLE-7, NEW DELHI

Rajpal Yadav, JM And T S Kapoor, AM

Dated: June 28, 2013

Appellant Rep by: Shri V K Aggrawal, AR

Respondent Rep by: Shri Gunjan Prasad, CIT (DR).

Respondent Rep by: Shri Gunjan Prasad, CIT (DR).

Income Tax - Sections 153A & 153C - Whether any addition can be made under the new provision of assessment pertaining to search and seizure if no proceedings are pending and no incriminating material is found during search.

Assessee is in this case was searched by the revenue and thereafter the notices under section 153A was issued and served. Accordingly the assessee filed it's ROI. Thereafter assessment under section 153A read with 143(3) of the Act was framed. Assessee challenged the validity of assessment before the CIT(A) on the ground that no proceedings were pending before the AO and hence no additions could be made without the support of incriminating material- CIT(A) rejected the contention of assessee-Matter reached to the ITAT wherein the AR of the assessee reiterated the submissions made before the CIT(A).

After hearing the parties the ITAT held that,

++ in the present case it is apparent that on the date of search be on 12/09/2007, the assessments for assessment year 2004-05 & 2005-06 were already completed. There was no incriminating material found during search for these years as is apparent from arguments of Ld. AR and from records and Ld. Departmental Representative did not bring to our notice regarding any incriminating material having been found during search. Therefore following the Judicial Precedents, we are of the opinion that though assessments for the above year were bound to be reopened but additions could be made only if some incriminating document was found during search.

Assessee is in this case was searched by the revenue and thereafter the notices under section 153A was issued and served. Accordingly the assessee filed it's ROI. Thereafter assessment under section 153A read with 143(3) of the Act was framed. Assessee challenged the validity of assessment before the CIT(A) on the ground that no proceedings were pending before the AO and hence no additions could be made without the support of incriminating material- CIT(A) rejected the contention of assessee-Matter reached to the ITAT wherein the AR of the assessee reiterated the submissions made before the CIT(A).

After hearing the parties the ITAT held that,

++ in the present case it is apparent that on the date of search be on 12/09/2007, the assessments for assessment year 2004-05 & 2005-06 were already completed. There was no incriminating material found during search for these years as is apparent from arguments of Ld. AR and from records and Ld. Departmental Representative did not bring to our notice regarding any incriminating material having been found during search. Therefore following the Judicial Precedents, we are of the opinion that though assessments for the above year were bound to be reopened but additions could be made only if some incriminating document was found during search.

Assessee's appeal allowed

ORDER

Per: T S Kapoor:

These are two appeals filed by the assessee against the order of the Commissioner of Income Tax (Appeals)-I, New Delhi both dated 18.07.2011 for the assessment years 2004-05 & 2005-06. The grounds taken by the assessee are as under:

Grounds for Assessment year: 2004-05

"1. Under the facts and circumstances of the case, the appellate order passed by the Ld. CIT (A) is illegal being against the principles of natural justice and against the provisions of IT Act, 1961especially in view of the following:-a) That neither any valuable article or thing nor any incriminating document was found during the search and hence section 153A was not applicable.b) That the cases laws relied upon by the appellant were not considered.c) That he has relied upon the judgment of Hon'ble ITAT, Delhi in the case of Shivnath Rai Hrnarain (India) Ltd. Vs. DCIT, (2009) 17 ITD 74 without appreciating the fact that the same has been overruled by Hon'ble ITAT, Delhi in its later judgment in the case of Shri Anil Kumar Bhatia & Ors. Vs. ACIT, (2010) 1ITR (Trib) 484 (Del) which was brought to his notice vide appellant's letter dated 8/6/2010.The Ld. CIT (A) has grossly erred on facts as well as in law in confirming the disallowance of set off of Rs.1,65,09,929/- on account of accumulated losses including unabsorbed depreciation of M/s Compact Motors Ltd., the amalgamating company, especially in view of the following:-a) In ignoring the specific provisions of scheme of amalgamation which was duly approved by the jurisdictional High Court regarding accumulated losses and unabsorbed depreciation and directed to be binding on all concerned.b) In relying on the case law which is not applicable to the appellant.3. The Ld. CIT (A) has grossly erred on facts as well as in law in confirming the charging of interest under various sections of the IT Act, 1961.4. The appellant craves leave to add, alter, modify and withdraw any ground of appeal before or during the appellate proceedings."Ground For Assessment year: 2005-06"1. Under the facts and circumstances of the case, the appellate order passed by the Ld. CIT (A) is illegal being against the principles of natural justice and against the provisions of IT Act, 1961especially in view of the following:-a) That neither any valuable article or thing nor any incriminating document was found during the search and hence section 153A was not applicable.b) That the cases laws relied upon by the appellant were not considered.c) That he has relied upon the judgment of Hon'ble ITAT, Delhi in the case of Shivnath Rai Hrnarain (India) Ltd. Vs. DCIT, (2009) 17 ITD 74 without appreciating the fact that the same has been overruled by Hon'ble ITAT, Delhi in its later judgment in the case of Shri Anil Kumar Bhatia & Ors. Vs. ACIT, (2010) 1ITR (Trib) 484 (Del) which was brought to his notice vide appellant's letter dated 8/6/2010.2. The Ld. CIT (A) has grossly erred on facts as well as in law in confirming the disallowance of set off of Rs.15,22,410/- on account of accumulated losses/ unabsorbed depreciation of M/s Compact Motors Ltd., the amalgamating company, especially in view of the following:-a) In ignoring the specific provisions of scheme of amalgamation which was duly approved by the jurisdictional High Court regarding accumulated losses and unabsorbed depreciation and directed to be binding on all concerned.b) In relying on the case law which is not applicable to the appellant.3. The Ld. CIT (A) has grossly erred on facts as well as in law in confirming the charging of interest under various sections of the IT Act, 1961.4. The appellant craves leave to add, alter, modify and withdraw any ground of appeal before or during the appellate proceedings."

2. The brief facts of the case are that search and seizure operation u/s 132 of the Income Tax Act, was carried out in the case of assessee on 12.09.2007 and, therefore, notice u/s 153 A of Income Tax Act dated 17.10.2008 was issued to the assessee requiring it to file income tax returns. The assessee filed returns of income for assessment year 2004-05 and assessment year 2005-06 declaring Nil income in respect of assessment year 2004-05 and income of Rs.50,04,700/- for assessment year 2005-06. Both the returns were same as were filed originally u/s 139 (1) of the Act, on 30.10.2004 and 27.10.2005 respectively. Notices u/s 143(2) and 142(1) along with questionnaires were issued to the assessee on 18.09.2009 requiring the assessee company to file necessary details and in response, the Ld. AR of the assessee company filed various details and attended the proceedings from time to time.

3. During the assessment proceedings, the Assessing Officer observed that assessee was dealing in the business of car dealership and service stations. He further observed that during the assessmsent year 2004-05 the assessee had entered into an amalgamation agreement with M/s Compact Motors Ltd. pursuant to the scheme of amalgamation of the erstwhile M/s Compact Motors Ltd. with the assessee company. He further observed that assessee had prepared amalgamated accounts with effect from appointed date i.e. 1st April, 2003 and all assets and liabilities of M/s Compact Motors Ltd. were incorporated in the books of assesssee at their book values. He further observed that assessee had set off an amount of Rs.1,65,09,929.93 against its business income for A. Y 2004-05 and it was mentioned that the loss belonged to M/s Compact Motors Ltd. since merged with the assessee vide order of Delhi High Court dated 27.09. 2004. In the A. Y. 2005-06, the assessee had set off the balance unadjusted carried forward loss of earlier year.

The Assessing Officer disallowed the set off of such losses by holding as under:

The allowability of the accumulated loss and unabsorbed depreciation of the amalgamating company in the hands of amalgamated company, in this case M/s MGF Automobiles Ltd. is governed by the provisions of section 72A of the Income Tax Act. The relevant extracts of provisions of section 72A of the Income Act, as applicable for A. Y. 2004-05 is reproduced below for ready reference:72.A (1) Where there has been an amalgamation of a company owning an industrial undertaking or a ship or a hotel with another company; or an amalgamation of a banking company referred to in clause (c) of section 5 of the Banking Regulation Act, 1949 (10 of 1949) with a specified bank then, notwithstanding anything contained in any other provision of this Act, the accumulated loss and the unabsorbed depreciation of the amalgamating company shall be deemed to be the loss or, as the case may be, allowance for depreciation lands of the amalgamate company. In other words, to avail benefits u/s 72A, the condition that the company should be an "industrial undertaking" has to be fulfilled. Industrial undertaking is defined in clause (aa) of subsection 7 of section 72 A of the Income Tax Act. In case this condition is not complied with then the set off unabsorbed business loss or depreciation will not be allowed. It may be seen from the above that the assessee company is not covered in the definition of "Industrial undertaking" defiled in section 72A(7) (aa) of the Act. Therefore, the company cannot be allowed to set off of accumulated business loss or depreciation of the amalgamating company as stipulated by section 72A of the Act. Hence the entire loss of Rs.1,80,32,339/- incurred by the amalgamating company, M/s Compact Motors Ltd. shall not be set off against the business income of the amalgamated company M/s MGF Automobiles Ltd. for the A. Y.20040-05.4.3 Further, even on merit also, the assessee has failed to retain 3/4th of the book value of assets of the amalgamating company for continuous period of five years from the date of amalgamation. In the A. Y. 2007-08, the company has sold land amounting to Rs.37,93,375/-. The above land was added to the assets of the assesssee company in the scheme of amalgamation. By the above sale the amalgamation company has violated provisions of sub-section (3) of section 72A of the Income Tax Act, 961. Therefore, otherwise also the assessee company is not allowed to set off the accumulated loss and depreciation of the amalgamating company. An amount of Rs.1,65,09,929/- being profit shown in the profit and loss account of the company is treated as the income for the year under consideration. The assessee shall not be allowed to carry forward the accumulated business loss and unabsorbed depreciation of the amalgamating company to the next assessment year."4.4. For A. Y. 2005-06, the Assessing Officer disallowed the carried forward business loss of Rs.15,22,410/-, by holding as under:

4. In the computation of income the assessee has set off an amount of Rs.15,22,410/- as unabsorbed business loss and depreciation which could not be set off during the assessment year 2004-05. In the assessment order for the assessment year 2004-05, the assessee was not allowed to carry forward any amount as business loss to be set off in the next assessment year as the case of the assessee did not fall within the purview of section 72A of the Income Tax Act, 1961. Hence, there is no business loss left in the assessment year 2004-05 for being carried forward to the next assessment year. The set off of Rs.15,22,410/- is disallowed and added to the income of the assessee of the assessee for the assessment year under consideration.

(Addition of Rs.15,22,410/-)"

5. Aggrieved with the additions, the assessee filed appeals before CIT

(A) and submitted as under:

"That the issue of amalgamation was considered in the original assessment and the same cannot be considered again while framing the assessmen afresh u/s 153A unless some incriminating document and material is found during the search and that addition has to be made on the basis of documents found during the search."

6. The Ld. CIT (A) after going through the submissions of assessee upheld the disallowance by rejecting the contention of assessee that without incriminating material addition cannot be made and also upheld the addition on merits. The relevant extracts of Commissioner of Income Tax (appeals)'s orders are reproduced as under:

"I have gone through the submission filed by the appellant and do not agree that the said addition arising out of the disallowance of brought forward loss and brought forward depreciation cannot be made u/s 153A. It has been held in the case of Harvey Heart Hospitals Ltd. Asstt. CIT (2010) 130 TTJ (Chennai) 700. "It is clear that section 153C, read with section 153A brings into the purview of assessment both regular and undisclosed income subsequent to action u/s 132 or section 132A upon invocation of section 153A or section 153C. The proviso to section 153A clearly mandates the Assessing Officer to assess or reassess the total income in respect of each assessment year falling within six assessment years. The next proviso further mandates that any assessment or reassessment in respect of any those six years which are pending shall abate. Hence, it is clear that under such circumstances, assessment or reassessment will be done pursuant to section 153A or section 153C. It will not be correct to interpolate that no regular assessment or reassessment can take place u/s 153A and 153C. There is no reference to incriminating search materials as in earlier section 158BB/158BC, to which the assessment has to be confined. Thus, assessment or reassessment u/s 153C/153A does not have to be based on incriminating material found during search."Futher, the Delhi Tribunal in the case of Shivnath Rai Harnarain (India) Ltd. Vs. DCIT (2009) 17 ITD 74 (Delhi) has observed that:"Sec. 153A, r.w.s.132 of the IT Act,1961- Search and seizure- Assessment in case of-Assessment years 1999-2000, 2002-03 and 2003-04- A search and seizure operation u/s 132 was conducted at business premises of assessee- company on 18/06/2003-Subsequently notice u/s 153A was issued to it on 31/05/2005 wherein it was required to file returns for relevant assessment years-Assessee filed returns and assessment were framed thereon-On appeal, assessee contended that as there was no seized material based on which assessment had been completed by Assessing Officer in its case, assessment so framed by Assessing Officer u/s 153A should be held to be null and void- Whether since there is no requirement for an assessment made u/s 153A being based on any material seized in course of search, contention raised by assessee was invalid- Held, yes – Whether, further, under second proviso to sec.153A pending assessment or reassessment proceedings in relation to any assessment year falling within period of six assessment years, referred to in sec,153A(b), shall come to an end (abate), which means that Assessing Officer gets jurisdiction for said six assessment years, for making an assessment or reassessment- Held, Yes- Whether, therefore, Assessing Officer was perfectly justified in framing as assessment u/s 153A for assessment years under consideration- Held, yes."

7. Aggrieved with the decision of CIT (A), the asessee is in appeal before us. At the outset, the Ld. AR submitted that search in this case was conducted on 12.09.2007 & during search neither any undisclosed income/ property nor any undisclosed account book/ documents were found pertaining to the brought forward losses of amalgamating company, which were disallowed by Assessing Officer u/s 153A /143(3). He further submitted that audited balance sheet including auditor's report was submitted along with original return filed on 31.10.2004 and item no.2 to notes to the accounts clearly indicated that pursuant to the scheme of amalgamation of M/s Compact Motors Ltd., the accounts were prepared after giving affect to the scheme of amalgamation and all assets, liabilities and losses were taken over at their book values. Our attention in this respect was invited to paper book page 16 wherein the relevant notes of the accounts were placed. In view of the above, it was pleaded that facts regarding amalgamation and taking over of assets and liabilities including losses of amalgamating company were before Ld. Assessing Officer before the search and before original assessment which was completed u/s 143(3) on 18.12.2006 and in this respect our attention was invited to paper book page 24 where original assessment passed u/s 143(3) was placed. Our attention was specifically invited to paper book page 25 wherein Assessing Officer had allowed the set off of business loss, and unabsorbed depreciation.

8. Continuing his arguments, he submitted that assessment u/s 153 is different from regular assessment and it is made only where a search is initiated u/s 132. Quoting from provisions of section 153A, the Ld. AR submitted that second proviso to section 153A (1) states that assessment or reassessment if any relating to any assessment year falling within the period of 6 assessment years pending on the date of initiation of search shall abate and in view of this provision he argued that completed assessment u/s 143(3) will not abate and in the case of assessee the assessment was not pending as it was already completed on 18/12/2006. He further argued that for assessment u/s 153A purpose of section 132 has to be considered which is that for completed assessments additions can only be made on the basis of undisclosed income or undisclosed property found during search. In view of the above, the Ld. AR argued that basic purpose of assessment u/s 153A is to tax the undisclosed income and not to review/ examine the completed assessments and argued that it is the reason that legislature has not provided for abatement of completed assessments.

9. Reliance in this respect was placed on the case law of All Cargo Global Logistics Ltd. vs. DIT, 2012-TIOL-391-ITAT-MUM -Special Bench, wherein it was held that in case of completed assessments the assessment u/s 153A has to be made on the basis of incriminating material only. The Ld. AR further invited our attention to Hon'ble Delhi High Court's order in the case ofCIT vs Anil Kumar Bhatia, ITA No. 1626/2010 = (2012-TIOL-641-HC-DEL-IT), wherein the issue regarding additions to be made in a completed assessment where no incriminating material was found was left open and in this respect our attention was invited to para 23 of the said order. The Ld. AR further invited our attention to the judgment on this issue by Hon'ble ITAT (M) dated 19.12.2012 in the case of ACIT vs. M/s Pratibha Industries Ltd., ITA No. 2197 to 2199/Mum/ 2008 = (2013-TIOL-50-ITAT-MUM), wherein it was held that in the case of completed assessment where no incriminating material was found, the assessment u/s 153A has to be made on originally assessed income only. In this respect, the Ld. AR read out the relevant extract from this order and in view of that argued that assessment u/s 153A in the case of completed assessment can only be made in case some incriminating document/ material were found during the search. The Ld. AR further relied upon the judgment dated 16.11.2012 from Hon'ble ITAT Mumbai in the case of Shri Gurinder Singh Bawa vs. Dy. CIT, ITA No. 2075/Mum/2010 and submitted that in this case the assessment was completed under summary scheme u/s 143(1) and time limit for issue of notice u/s 143(2) had expired on the date of search and, therefore, Hon'ble Mumbai Tribunal had held that there was no assessment pending and hence there was no abatement, and addition could only be made on the basis of incriminating material found during search.

10. Reliance was further placed in the following case laws:

a) LMJ International Ltd. Vs. DCIT, (2008) 119 TTJ (Kol) 214b) Anil P. Khimani vs. DCIT, 2010-TIOL-177-ITAT-MUM. In view of all these legal arguments, the Ld. AR argued that assessment u/s 153A where no incriminating material was found during search has to be completed on the originally assessed income only.

11. Arguing on the second ground of appeal regarding disallowance of set off of loss despite directions of Hon'ble High Court of Delhi, the Ld. AR read from the order of High Court dated 27.09.2004 and invited our attention to paper book page 45 which read as under:

" That not withstanding anything contained in any provision of the Income Tax Act,1961 the accumulated loss and the unabsorbed depreciation of M/s Compact Motors Ltd. the Transferor Company shall be deemed to be the loss or as the case may be, allowance for depreciation of M/s MGF Automobiles Ltd., the Transferee Company for the year in which the amalgamation is effected from the appointed date w.e.f. 01.04.2003 and other provisions of the Income Tax Act relating to set off and carry forward of loss and allowance for depreciation shall apply accordingly."

In view of these findings of Hon'ble High Court, it was argued that as per scheme of amalgamation the accumulated loses and unabsorbed depreciation of M/s Compact Motors Ltd. were deemed to be loss/ unabsorbed depreciation of appellant for assessment year 2004-05 irrespective of provisions of Income Tax Act. He further argued that Hon'ble High Court has given its sanction to the scheme of amalgamation and therefore its terms of sanction were binding on concerned parties. Our attention was also invited to paper book page 63 where copy of letter written by DCIT, Circle -6(1), New Delhi, conveying it's no objection to the merger was placed.

12. On the other hand, the Ld. Departmental Representative referred to the case law of Anil Kumar Bhatia decided by Hon'ble Delhi High Court and read para 18 to 23 of the said order and relied heavily on it wherein the Hon'ble Court had held that in view of provisions of section 153A the assessment has to be reopened for six years. The Ld. Departmental Representative further relied upon section 72A and argued that assessee was not fulfilling the conditions as it was engaged in the sale and service of vehicles whereas, section 72A is applicable in the case of industrial units only. With respect to no objection issued by Department placed on paper book 63, the Ld. Departmental Representative submitted that Department had no objection to the merger subject to compliance of statutory provisions of Income Tax Act.

13. We have heard the rival parties and have gone through the material placed on record. We find that the assessment of assessee for assessment year 2004-05 was completed u/s 143 (3) vide assessment order dated 18.12.2006. The search u/s 132 was conducted on 12.09.2007, therefore, assessment for the year under consideration had to be re-opened as per the provisions of section 153A. The proviso to section 153A reads as under:

"Provided that the Assessing Officer shall assessee or reassess the total income in respect of each assessment year falling within such six assessment years:Provided further that assessment or reassessment, if any, relating to any assessment year falling within the period of six assessment years referred to in this ( sub-section) pending on the date of initiation of the search u/s 132 or making of requisition u/s 132A, as the case may be, shall abate."

The above proviso clearly States that assessments for six years pending on the date of initiation of search will be reopened which further implies that assessments not pending or completed assessments will not be reopened. The special Bench, Mumbai decision in the case of All Cargo Global Logistics Ltd. has dealt with this issue and has held that completed assessments falling within six year can only be reopened if some incriminating material is found during search. The Hon'ble Delhi High Court in the case of CIT vs Anil Kumar Bhatia had also considered the same situation and held that assessment for six years has to be re-opened, but left the question regarding additions to be made in a completed assessment where no incriminating material was found. The relevant extract of Hon'ble High Court is as under:

" Where no incriminating material was found during the search conducted u/s 132 of the Act. We therefore, express no opinion as to whether section 153A can be invoked then in such a situation that question is therefore left open."

14. Hon'ble ITAT (Mum) in the case ACIT vs. Pratibha Industries Ltd., ITA No.2197 to 2199/Mum/2008 = (2013-TIOL-50-ITAT-MUM) has considered the case law of Anil Kumar Bhatia as decided by Hon'ble Delhi High Court and after considering the findings of the court has arrived at the following findings in similar situations:

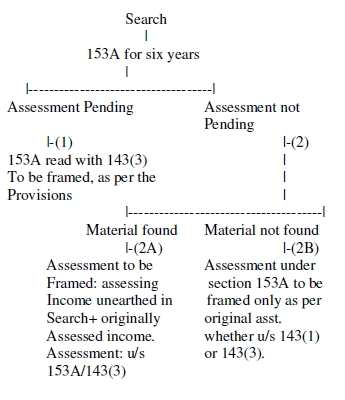

"4.1 On going through the provisions of section 153A, 2nd proviso and the various decisions cited before us, three possible circumstances emerge on the date of initiation of search u/s 132 (1) of the Income Tax Act, (a) proceedings are pending; (b) proceedings are not pending but some incriminating material found in the course of search, indicating some income and/or assets not disclosed in the return and (c) proceedings are not pending and no incriminating material has been found.4.2 When we treat to trace the correct and logical answers to the above circumstances, circumstances (a) is answered by the Act itself, that is, since the proceedings are still pending, all those pending proceedings are abated and the Assessing Officer gets a free hand to make the assessment. Circumstances (b) has been answered by the courts, interpreting 2nd proviso along with clause (b) to section 153A, wherein the Hon'ble Delhi High Court observes and hold, "where the assessment or reassessment proceedings have already been completed and assessment orders have been passed determining the assessee's total income and such orders are subsisting at the time when the search or the requisition is made, there is no question of any abatement since no proceedings are pending. In this latter situation, the Assessing Officer will reopen the assessments or reassessments already made (Without having the need to follow the strict provisions or complying with the strict conditions of section 147, 148 and 151) and determine the total income of the assessee. Such determination in the orders passed u/s 153A would be similar to the orders passed in any reassessment, where the total income determined in the original assessment order and the income that escaped assessment are clubbed together and assessed as the total income. But when we come to third circumstance i.e. circumstance (c), we find that this has been left unanswered. Para 23 of the judgment, the Hon'ble Delhi High Court mentions that the issue is left open.4.3 This, has been explained in the graphic made below and the relevant portion is in italics therein. This can be explained through this graphic:4.4 To answer the question, as to what shall be the assessment of total income, where there is/ are no pending proceedings and no incriminating material, we have to trace out the logical conclusion, by harmonizing the legislative intendments and the judicial decisions, as held by the Hon'ble Supreme Court of India in the case of K P Verghese (Supra), wherein it was observed, so as to achieve the obvious intention of the Legislature and produce a rational construction. When we look into the decision of the Hon'ble Delhi High Court in Anil Kumar Bhatia (Supra), we find that the Hon'ble Court has pointed out that in case where there is no abatement, total income has to be determined by clubbing together the income already determined in the original assessment order and the income that escaped assessment (Situation 2A in the Graphic). In the circumstance, what we are dealing in instantly, there are finalized assessment proceedings and no incriminating material indicating any escaped income (Situation 2B in the graphic). Taking a cue from the decision of Hon'ble Delhi High Court in the case of Anil Kumar Bhatia (Supra) we can tread on the same premise and hold that on clubbing, what remains in the income originally determined or assessed (i.e. income originally determined+Zero= income originally determined- as there was no incriminating material)."

15. Similar views were held by ITAT (Mum) in the case of Shri Gurinder Singh Bawa Vs. Dy. CIT, ITA No. 2075/Mum/2010 and LMJ International Ltd. Vs. DCIT,(2008) 119 TTJ (Kol) 214 and in the case of Anil P. Khimani vs. DCIT, 2010-TIOL-177-ITAT-MUM. During proceedings before us the bench had asked a question to Ld. AR as to whether any statement u/s 132(4) was recorded during search to which the Ld. AR replied in negative and Ld. Departmental Representative also showed his ignorance about such statement. This question was asked because the view of the Bench is that if during course of search some statement is recorded u/s 132(4) and, in that statement certain facts are recorded from the interpretation of which Assessing Officer could conclude that there was some undisclosed income, then that statement can be considered as incriminating material. Recently, Hon'ble Rajasthan High Court in judgment delivered on 24.05.2013 in the case of Jai Steel (India) u/s ACIT has also dealt with similar circumstances and has held that where no incriminating document is found during search, addition cannot be made. In this case, on the reopening of cases u/s 153A, the assessee had claimed certain deductions which were not claimed in original assessment proceedings, however Hon'ble Court has held that Assessing Officer is not free to disturb the income, expenditure or deduction de hors any incriminating material while making the assessment u/s 153A. The relevant findings of the court are as under:

"In a case where nothing incriminating is found though s. 153A would be triggered and assessment or reassessment to ascertain the total income is required to be done, the same would not result in any addition and the assessments made earlier may have to be reiterated-Argument of the counsel that the Assessing Officer is free to disturb the income, expenditure or deduction de hors any incriminating material while making the assessment u/s 153A is not borne out from the scheme of the said provisions of ss.153A to 153C cannot be interpreted to be further innings for the Assessing Officer and/or the assessee beyond the provisions of ss.139, 147 and 263-A harmonious construction of the entire provisions of s. 153A would lead to an irresistible conclusion that the word 'assessee' has been used iii the context of abated proceedings and 'reassess' has been used for completed assessment proceedings which do not abate as they are not pending on the date of initiation of the search or making of requisition and can be tinkered only on the basis of incriminating material found during the course of search or requisition of documents therefore, it is not open to the assessee to seek deduction or claim relief not claimed by it in the original assessment which already stands completed in an assessment u/s 153A made in pursuance of a search or requisition."

In the present case it is apparent that on the date of search be on 12/09/2007, the assessments for assessment year 2004-05 & 2005-06 were already completed. There was no incriminating material found during search for these years as is apparent from arguments of Ld. AR and from records and Ld. Departmental Representative did not bring to our notice regarding any incriminating material having been found during search. Therefore following the Judicial Precedents, we are of the opinion that though assessments for the above year were bound to be reopened but additions could be made only if some incriminating document was found during search.

In view of the above, ground no.1 of appeal filed by assessee is allowed and we hold the assessment orders for above years as null and void ab inito.

16. In view of our findings in respect of Ground No.1 of appeals which are in favour of assessee, Ground No.2 becomes infructuous and hence are dismissed. Ground No.3 is consequential and do not require any adjudication. Ground No.4 is general in nature and do no require any adjudication.

In view of the above, the appeals filed by the assessee are partly allowed.

(Order pronounced in Open Court on 28.6.2013)

No comments:

Post a Comment