WHAT IS FRAUD?

Introduction to fraud

Fraud encompasses a variety of irregularities and illegal acts characterized by intentional deception. The elements of fraud are:

- A representation about a material fact

- Which is false

- And made intentionally, knowingly, or recklessly

- Which is believed

- And acted upon by the victim

- To the victim's damage

Employees who commit fraud generally are able to do so because there is opportunity, pressure, and a rationalization. Opportunity is generally provided through weaknesses in the internal controls. Some examples include inadequate or no:

- Supervision

- Separation of duties

- Management approval

- System controls

Pressure can be imposed due to:

- Personal financial problems

- Personal vices such as gambling, drugs, extensive debt, etc.

- Unrealistic deadlines and performance goals

Rationalization occurs when the individual develops a justification for the fraudulent activities. The rationalization varies by case and individual. Some examples include:

- "I really need this money and I'll put it back when I get my paycheck." In many cases they replace the money only to take more later and not repay it.

- "I'd rather have the company on my back than the IRS."

- "I just can't afford to lose everything – my home, car, everything."

- "Besides, the company owes me."

Who is responsible for deterring fraud?

Management. Internal Audit is responsible for examining and evaluating the adequacy and the effectiveness of actions taken by management to fulfill this obligation. Deterrence consists of actions taken to discourage fraud and limit financial losses if it does occur. The principal mechanism for deterring fraud is strong internal controls (i.e., policies and procedures, segregation of duties, account reconciliations, etc.).

Who is responsible for detecting fraud?

Fraud should be detected by personnel in the normal course of performing their duties, if strong controls exist. Internal auditors should have sufficient knowledge of fraud to ensure that they may identify indicators that fraud might have been committed. If significant control weaknesses are detected, additional tests conducted by internal auditors should include tests directed toward identification of other indicators of fraud. Internal auditors are not expected to have knowledge equivalent to that of a person whose primary responsibility is to detect and investigate fraud. Audit procedures alone, even when carried out with due professional care, do not guarantee that fraud will be detected.

Who is responsible for reporting suspected or actual fraud?

Anyone within the University who has reasonable suspicions of an alleged fraud or actual evidence of a fraud. All employees have an obligation to ensure that the University is a well controlled environment free from wrongdoing or criminal activities.

How should I report an alleged fraud?

An alleged fraud or financial misconduct should be reported to the supervisor, department head, or the Director of Internal Audit. Any individual concerned with reprisals may report alleged financial misconduct anonymously and confidentially by contacting the fraud hotline at 1-800-445-7068 or at: https://secure.ethicspoint.com/domain/en/report_custom.asp?clienid=13821.

Fraud Red Flags

Fraud Definition

Reasons Fraud Is Committed

Impact of Fraud

Fraud Prevention

Fraud Detection

Reporting and Investigating Fraud

Identifying Fraud Red Flags

Definition of Fraud TOP

Fraud may be defined as an intentional act or omission designed to deceive others, resulting in the victim suffering a loss and or the perpetrator achieving a gain. According to the Association of Certified Fraud Examiners, the typical organization loses 5% of its annual income to fraud. www.acfe.com

Fraud encompasses an array of irregularities and illegal acts characterized by intentional deception. The elements of fraud are:

- A representation about a material fact

- Which is false

- And made intentionally, knowingly, or recklessly

- Which is believed

- And acted upon by the victim

- To the victim's damage

Why do people commit Fraud? TOP

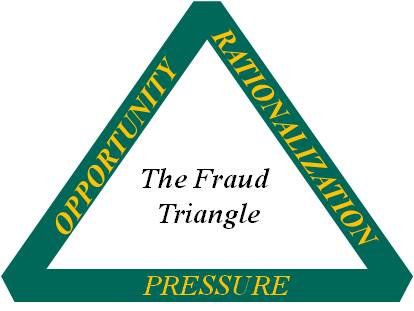

Employees who commit fraud generally are able to do so because there is opportunity, pressure and rationalization. The phases of fraud are best illustrated by The Fraud Triangle below.

Opportunity is generally provided through weaknesses in the internal controls such as inadequate or lack of:

- Supervision and review

- Separation of duties

- Management approval

- System controls

Pressure can be imposed due to:

- Personal financial problems

- Personal vices such as gambling, drugs, extensive debt, etc.

- Unrealistic deadlines and performance goals

Rationalization occurs when the individual develops a justification for their fraudulent activities. The rationalization varies by case and individual. Some examples include:

- "I really need this money and I'll put it back when I get my paycheck"

- "I'd rather have the company on my back than the IRS"

- "I just can't afford to lose everything – my home, car, everything"

TOP

How does fraud impact the University?

Fraud hurts everyone. Fraud is a common risk that should not be ignored. Failure to do so will eventually result in damaging morale, jeopardizing the reputation of the university and raise questions about its fiduciary duties regarding funds provided by donors, government agencies, students, and parents. Fraud costs everyone through direct influence or indirectly through increased taxes and costs of products and services.

Common fraud schemes which occur at universities include the misuse of procurement cards ("p-cards"), padding expense accounts, listing fictitious vendors, rigging vendor bids, taking kickback and abusing payroll and overtime by fraudulent reporting of hours worked.

TOP

Fraud Deterrence and Prevention

The key deterrent of fraud is awareness and prevention. Processes which are deemed most effective for fraud prevention are denial of opportunity, effective leadership, auditing and employee screening. Denial of opportunity may be translated in the form of internal controls and consistently adhering to clearly defined University procedures established by leadership.

Internal Audit's strategy to examining the effectiveness of internal controls, policies and procedures leadership has established consist of annual fraud risk assessments are performed and periodically revisit them; implementing fraud prevention and detection strategies; developing response strategies for the frauds they aren't able to prevent.

TOP

Who is responsible for detecting fraud?

Fraud should be detected by personnel in the normal course of performing their duties, if strong controls exist. Internal auditors should have sufficient knowledge of fraud to ensure that they may identify indicators that fraud might have been committed. If significant control weaknesses are detected, additional tests conducted by internal auditors should include tests directed toward identification of other indicators of fraud. Internal auditors are not expected to have knowledge equivalent to that of a person whose primary responsibility is to detect and investigate fraud. Audit procedures alone, even when carried out with due professional care, do not guarantee that fraud will be detected.

The Office of Internal Audit is developing a fraud Awareness Program designed to increase your level of fraud awareness as it relates to your roles and responsibilities here at Wayne State University.

TOP

Reporting Fraud

Fraud is a common risk that should not be ignored. All employees have an obligation to report any suspicions or allegations of fraud. to protect the reputation and integrity of the University. Strong fraud prevention processes help increase the confidence students,donors, regulators, board members and the general public have in the integrity of our University and its ability to manage its fiduciary responsibilities.

Fraud Awareness Education is the foundation of preventing and detecting occupational fraud, within the Schools, Colleges and Divisions of Wayne State University. Students, Faculty and Staff members must be educated in what constitutes fraud, how it hurts everyone at WSU and how to report any questionable activity.

Who should I call about an alleged fraud?

If you suspect fraud, any suspicious activity misuse, misappropriation, etc., please contact the Office of Internal Audit Fraud Hotline at 313-577-5138. For Online Reporting submit an Anonymous Tips Form. If the fraud involves stolen or misappropriated assets (e.g., cash, property, equipment, etc.), you should also call Public Safety at 7-2222 to file an incident report.

If you suspect fraud, any suspicious activity misuse, misappropriation, etc., please contact the Office of Internal Audit Fraud Hotline at 313-577-5138. For Online Reporting submit an Anonymous Tips Form. If the fraud involves stolen or misappropriated assets (e.g., cash, property, equipment, etc.), you should also call Public Safety at 7-2222 to file an incident report.

What will happen if I report an alleged fraud?

All information related to the specific situation is confidential. Employees are not singled out as "whistle-blowers", however, management is notified of the particular situation in order that a full investigation may be conducted.

All information related to the specific situation is confidential. Employees are not singled out as "whistle-blowers", however, management is notified of the particular situation in order that a full investigation may be conducted.

How is a fraud investigation conducted?

Fraud investigations may be conducted by or involve the participation of the Office of Internal Audit, Public Safety, General Counsel, C&IT Security, and other areas of the University as appropriate. The Office of Internal Audit will assess the facts known relative to all fraud investigations in order to:

- Determine the need to implement or strengthen controls

- Design audit tests to identify similar frauds in the future

The Office of Internal Audit may:

- Conduct inquiries to obtain an understanding of the situation

- Review supporting documentation

- Request or confirm information with outside parties such as banks

- Review departmental and university policies and procedures

- Make recommendations to management to change areas of noncompliance or strengthen controls

- Contact Public Safety if a crime has been committed

TOP

Identifying the "Red Flags" of fraud

Red Flags within an organization are related to the structure of the organization and the manner in which its policies and procedures are implemented. Understanding symptoms of fraud is the key to detecting fraud. A symptom of fraud may be defined as a condition which is directly attributable to dishonest or fraudulent activity. It may result from the fraud itself or from the attempt to conceal the fraud.

Factors contributing to fraud: TOP

- Lax or ineffective internal controls

- Ineffective management

- Management or control overrides

- Collusion among employees over whom there is little to no supervision

- Lack of account review reconciliation

- When significant policies are absent or outdated (e.g.,code of ethics,transparency, periodic monitoring of business and academic performance indicators,management systems,internal audit procedures and annual external financial audits)

- The presence of unethical behavior poses significant risk to any organization

Embezzlement "Red Flags" TOP

- Borrowing money from co-workers

- Creditors or collectors appearing at the workplace

- Gambling beyond the ability to stand the loss

- Excessive drinking or other personal habits

- Easily annoyed at reasonable questioning

- Providing unreasonable responses to questions

- Refusing vacations or promotions for fear of detection

- Bragging about significant new purchases

- Carrying unusually large sums of money

- Rewriting records under the guise of neatness in presentation

Common Forms of Fraud in Higher Education TOP

- Personal purchases on the procurement card

- Inappropriate charges to a travel or account payable voucher

- Theft of inventory items

- Theft of cash from deposits

- Falsifying time card with time not worked

- Misappropriation of Assets

- Compliance

- Conflict of Interest

- Unauthorized System Changes

- Forgery

- Identity Theft

- Kickbacks

- Bribery

- Misrepresentation/Concealment of material facts

- Theft of money or property

- Theft of trade secrets or intellectual property

- Breach of fiduciary duty

- Rumors of conflicts of interest

- Using duplicate invoices to pay vendors

- Frequent use of sole-source procurement contracts

- No supporting documentation for adjusting entries

- Incomplete or untimely bank reconciliations

- Increased customer complaints

- Write-offs of inventory or cash shortages with no attempt to determine the cause

Danger Signs of Fraud TOP

- High personnel turnover

- Low employee morale

- No supporting documentation for adjusting entries

- Incomplete or untimely bank reconciliations

- Increased customer complaints

- Write-offs of inventory shortages with no attempt to determine the cause

- Unrealistic performance expectations

- Rumors of conflicts of interest

- Using duplicate invoices to pay vendors

- Frequent use of sole-source procurement contracts

- Unreconciled accounts

- Dormant accounts

- Failure to deactivate or terminate access after employees have separated from a position, unit or the university

Am I at risk for identity theft?

How do hackers gain access to my information?

1. Fake loan applications

Hackers can easily gain access to your bank account and social security numbers by attracting you to apply for a fake loan. These websites appear professional, authentic, and promise low-rate loans to US residents. Hackers have even been known to purchase your personal information from legitimate marketing firms that operate loan application services. In reality, the loan does not exist and your information becomes at risk for future identity theft.

2. By hacking online stores

Major stores like Target and Home Depot, as well as banks including Chase, were victims of major hacks last year alone. Reports state that over 150 million personal information files had been compromised by hackers from around the world. One out of every two consumer's personal information now lies in the hands of hackers after this major scam.

3. Phishing email scams

One classic scam involves hackers posing as representatives from legal institutions or banks sending fraudulent emails to unsuspecting consumers. These official-looking messages claim that your account has been compromised and needs additional verification before you can access your information. Hackers will direct you to a identical looking fake website to enter information such as your log-in name, password, or even social security number. After hackers receive your information, you will be notified that your access has been granted once again. Sadly, the process has been a complete scam and hackers now possess your personal information to use in identity theft.

Lock your identity from unauthorized changes. Free for 30 days.

Where does my personal information go?

1. Hackers may use your personal information for identity theft in a few ways. First, scammers may sell and even re-sell your personal information to black markets online operating on an invitation-only basis.

3. Hackers may use your information to apply for loans and credit cards, leaving you with the staggering bill and a completely destroyed credit score.

3. Hackers may even use your information to create a fake identity for themselves or another United States resident by applying for a state ID or drivers license in your name.

When can I expect identity theft to occur?

It's difficult to determine the amount of time that it takes before your personal information is used in identity theft. Hackers possess a large amount of US resident's personal information, so identity theft could happen as soon as tomorrow, or years from the day your personal data has been stolen.

How can I undo damages caused by identity theft?

We suggest your next course of action is to hire a knowledgeable attorney to help you fight your identity theft. However, an experienced attorney could take six months to a year and cost upwards of $10,000 in legal fees to assess and undo identity threat damages.

How can I prevent identity theft before it occurs?

You can easily protect yourself from identity theft just like covering yourself with health or life insurance. LifeLock is a popular and effective company dedicated to preventing identity theft. For less than $10 a month, consumers receive up to $1,000,000 in coverages. LifeLock offers a 30-day free trial to begin your protection plan within minutes.

We at ScamGuard recommend that you start your free trial by activating an account at LifeLock immediately. Half of the United States' population has their personal information in hacker's hands, so your quick protection is necessary to prevent identity theft.

Top 10 Scams of 2015

Attention US Residents: Personal data, including social security numbers and residential addresses of over 100 million consumers has been stolen this year in the United States alone. Scammers trade information through black markets to use in future identity theft operations.

The criminals use your identity in order to obtain credit cards, fake mortgages, loans, and cash advances. Once an identity theft occurs, it is a very difficult task to undo the damage. It often costs upwards of $10,000 in legal fees just to clean up the mess created by these criminals.

We strongly recommend that you follow these steps to prevent identity theft:

1. Please consider obtaining identity theft protection services. We highly recommend using the LifeLock. They provide up to $1 million coverage against identity theft for less than $9 per month. Additionally, the 30 day trial allows you to immediately activate protection without paying. Activate the 30 day trial here.

2. To understand the general precautionary measures to keep your identity safe, please read the following article: www.scamguard.com/identity-theft/

Jump to scams: Tech Support Scams, Fake/Counterfeit Merchandise, Pets-for-Sale Scams, Grant Scams, Collection Agency Scams, Property Rental Scams, Payday Loan Scams, Timeshare Scams, Dating Scams, Work From Home Scams, Fake Check Scams.

#1. Tech Support Scams

Reported countries: India and Pakistan. In many cases, scammers used U.S. VOIP phone numbers.Damages reported: $100-$1000 and the cost of real technical support after to fix the damaged computer. As scammers usually ask for payment via credit card, many victims have also reported having their identities stolen afterward.

It's rare that any technician from a PC manufacturer or tech support company would cold call non-client computer users and tell them that there's an immediate threat to their computers and that the company needs remote access to fix the problem. Yet, many people fall for this scam.

Operating usually out of India, scammers call victims and allege that they're with a big name tech company. Victims are told that their computers are either already infected or about to become infected with malware that can cause significant damage, such as operating system corruption or identity theft. The "technicians" then urge users to allow them to have remote access to troubleshoot and fix related issues. Scammers use these opportunities to infect systems with malware or perform other damage; or send users to third-party websites that cause damage. All of these actions are focused on the singular goal of giving scammers access to computers so they can cause errors and then charge for unnecessary repair services.

ScamGuard advice: Never give anyone remote access to your computer. Instead, hire a local computer repair service whenever necessary.Example complaints: Complaint #4644, Complaint #1316, Complaint #2856.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#2. Fake/Counterfeit Merchandise Scams

Reported countries: China

Damages reported: $100-$1000. As scammers usually ask for payment via credit card, victims have also reported identity theft at a later time.

Damages reported: $100-$1000. As scammers usually ask for payment via credit card, victims have also reported identity theft at a later time.

With so many online stores available, it's sometimes very difficult to know the difference between a legitimate e-commerce site and a fake one set up to steal money or a person's identity.

Operating predominantly out of China, scammers set up generic online stores that sell name brand items or mimic the websites of big name brand companies. On these sites, scammers sell fake or counterfeit products at significantly reduced prices designed to attract buyers looking for big deals on name brand merchandise. The over-reaching goal of these scammers is to gain access to the credit card numbers of their victims and then use the numbers to fraudulently make purchases, or make a buck with the information on the black market. In some cases, the criminals even go so far as to send fake or counterfeit products to victims. As the merchandise ships from international locations, victims often remain unaware of any wrong-doing against them until weeks have passed. Although many brand companies discover these sites and shut them down, it's usually too late.

ScamGuard advice: To verify the identity of a website in question, always contact the brand company using the phone number on the company's official Contact Us or similar page. Consumers can also contact ScamGuard on our Contact Us page to verify the legitimacy of any website in question.

Example complaints: Complaint #5730, Complaint #5156, Complaint #6455.

Identity theft risk: Medium - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#3. Pets-for-Sale Scams

Reported countries: UnknownDamages reported: $200-$2000

The promise of cuddly and cute puppies, kittens and other pets is another scam and has harmed a lot of people in 2014.

Pets-for-sale scammers create fake websites that claim to be associated with pet adoption or animal nurseries. On these sites, they offer a wide selection of pets for adoption or sale at prices significantly below the norm. Some sites even offer puppies for free to attract victims. With this scam, victims are told that they must pay for at least the insurance, shipping and other services associated with processing and delivering the pets. Victims are then required to make their purchases and/or pay their fees with non-returnable, cash-like forms of payment, including but not limited to: Moneygram, Western Union, Vanilla prepaid cards or wire transfer to a foreign bank account.

ScamGuard advice: Avoid paying for a pet using any type of cash transfer method. Additionally, contact ScamGuard for more information about any pet breeder in question.Example complaints: Complaint #2176, Complaint #4484, Complaint #1962.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#4. Grant Scams

Reported countries: India and Pakistan

Damages reported: $100-$2000+

Damages reported: $100-$2000+

Representatives of the United States government don't call American citizens with offers to sell them grant money. Operating usually out of India and Pakistan, scammers who deal in selling grants purchase consumer information from legitimate companies that run payday loan affiliate websites. The companies usually have no idea that they're dealing with scammers. Instead, they believe that the scammers can offer some of their payday loan applicants financial assistance. Scammers also acquire consumer personal details from unsuspecting advertising agencies who run lead generation campaigns targeting consumers in need of loans. The scammers then contact the people from these lists and claim they represent the United States government. They advise victims that they can provide access to grant money for a "processing fee". As with the Pets-for-Sale scenarios, scammers require victims to pay via non-returnable payment methods that act like cash.

The processing fee is merely the beginning of the crime. Grant scam artists then use the banking information of their victims to gain access to additional funds or sell the information to the highest bidder on the black market.

ScamGuard advice: Block callers who offer access to grant monies for a fee. If you have been a victim of this type of scam, report it here.Example complaints: Complaint #2723, Complaint #3381, Complaint #3156.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#5. Collection Agency Scams

Reported countries: India and Pakistan

Damages reported: $100-$2000+

Damages reported: $100-$2000+

Some scammers are well aware that collection agencies have the right to contact consumers who owe money to them or companies they represent. Criminals involved with collection agency scams use this knowledge to their advantage to steal money.

Representing a fake collection agency, or even the United States Attorney General's office, scammers make cold calls to victims and threaten lawsuits or embarrassing on-the-job confrontations unless the victims start making payments. Sometimes, the scammers support their claims with real details about outstanding loans. This type of scam can go on for months. After repeated harassment, victims cave to demands and pay a fee. Some time later, the scammers repeat the tactic with the same victims or sell/share the information to other scamming organizations who repeat the vicious cycle. Fee payment is also expected via non-returnable methods, such as Moneygram, Western Union, Vanilla and wire transfer.

ScamGuard advice: Unless you have bad debt and owe money to collection agencies who have purchased it, block all collection calls. Additionally, if possible, report collection agency scammers to ScamGuard and/or the appropriate government agency.Example complaints: Complaint #6628, Complaint #6323, Complaint #6224.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#6. House/Vacation Property Rental Scams

Reported countries: Unknown

Damages reported: $500-$3000+

Damages reported: $500-$3000+

After the housing market scandals of the last few years, many consumers have opted to rent home and vacation properties, and scammers have targeted this trend.

Scammers advertise properties that they don't actually own on classified ads websites, such as Craigslist and Backpage, with attractive pictures and detailed descriptions. Typically, they associate the ads with desirable, rich or low crime rate neighborhoods and offer prices that fall well below local rental averages. Instead of in-country phone-based contact, scammers use VOIP numbers from foreign countries and text messaging to communicate with buyers and renters. All payments are requested via non-returnable methods like Moneygram, Western Union, Vanilla and wire transfer.

ScamGuard advice: Always pay rent using a check or a credit card. Checks and credit cards leave paper and electronic trails that law enforcement agencies can track back to criminals. Additionally, if you decide to pay by credit card, the card's issuing bank can perform a transaction chargeback or reversal for up to usually the first six months after the transaction.Example complaints: Complaint #5883, Complaint #3078, Complaint #2191.

Identity theft risk: Low

#7. Payday Loan Scams

Reported countries: India, Pakistan

Damages reported: $500 - $3000+

Damages reported: $500 - $3000+

As previously mentioned, scammers love to pick their victims from those most in need -- people who are willing to take out high-interest payday loans.

Like grant scams, payday loan scams rely heavily on legitimate leads gathered by payday loan affiliate website companies or advertising agencies. Advertising agencies use cleverly designed small websites to entice consumers who have bad debt to apply for payday loans. Once the information is gathered, they sell it to other companies and re-sell it over and over until a scamming company posing as a legitimate company gains access to it. From there, scammers advise payday loan applicants that they qualify for low interest loans that they can also can get immediately with payment of a processing- or security-related fee. For example, some scammers tell victims that the fee helps confirm that the victims have the means to repay their loans when it's time. As with similar scams, payday loan scammers request upfront money through cash-like payment methods or wire transfer and then never follow through with any sort of loans. Sometimes these criminals also ask for the bank account details of their details. They claim that they need the information to direct deposit the approved payday loan amount, but in reality they take the information to steal from the accounts later or to sell it to those who will use it to steal.

ScamGuard advice: Never pay any upfront fees to anyone promising a loan over the phone. If unsure, please ask ScamGuard using the contact us page.

Example complaints: Complaint #4195, Complaint #1121, Complaint #3328.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

Example complaints: Complaint #4195, Complaint #1121, Complaint #3328.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#8. Timeshare Resale Scams

Reported countries: USA, India

Damages reported: $200-$3000+

Damages reported: $200-$3000+

"Don't have the time or money to invest in your timeshare any longer? Need someone to take it off your hands? We have the perfect buyer for you!"

These lines are what scammers want you to believe.

For decades, criminals have taken advantage of the idea of sharing a single property between multiple owners to reduce costs.

Operating usually from within the United States, timeshare resale scammers tell their victims that they have buyers, or in some cases renters, ready to take over any timeshare at a moment's notice. The scam? They require an upfront fee to move forward with the process. Timeshare resale scammers give their victims a wide range of reasons for the fee, including but not limited to: appraisal, marketing analysis and fees related to transfer or closing. Some even claim that any fees pay for marketing and go so far as to mock up a contract that has wording to that effect to reassure their victims.

ScamGuard advice: Never pay upfront fees to anyone promising to sell or rent your timeshare or refer you to buyers or renters. Instead, list your timeshare on free or minimum payment timeshare listings websites such as: Redweek.com, TimeshareMarketplace.com and Tug2.net.

Example complaints: Complaint #3049, Complaint #2066, Complaint #5085.

Identity theft risk: Medium - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

Example complaints: Complaint #3049, Complaint #2066, Complaint #5085.

Identity theft risk: Medium - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#9. Dating and Relationship Scams

For information about dating and relationship scams, please review the following article dedicated to this topic.

#10. Work from Home - Inspecting and Shipping Merchandise

Reported countries: Russia, Ukraine and Eastern Europe

Damages reported: Loss of funds for variable amounts. If not reported to authorities immediately, victims can suffer legal consequences if believed to be part of any criminal activities related to product sales or shipping.

Damages reported: Loss of funds for variable amounts. If not reported to authorities immediately, victims can suffer legal consequences if believed to be part of any criminal activities related to product sales or shipping.

Many people around the world dream of working from home. After all, who wouldn't want to give up the stresses from commuting to work or dealing with co-workers? For some, job ads and websites claiming to offer at-home work opportunities seem like the perfect answer.

In reality, these offers are usually the bait for various types of scams.

One big scam in 2014 involves at-home merchandise inspection and shipping. Scammers set up professional-looking websites and claim that the sites are owned by shipping and logistics intermediaries. Some also set up sites to state that they can offer these work-at-home opportunities because they represent large merchant companies in the United States that don't have international shipping services.

Scammers use job search website ads to attract victims or target victims using job board profiles. They go through the interview process with each victim, usually via an Internet communications application like Yahoo Messenger, and then offer a job to every single person they interviewed. Once they've "hired" their virtual workers, scammers use stolen credit cards to purchase merchandise and then ship it to their new work-at-home "employees" with instructions on how to open the packages, inspect the merchandise and ship it elsewhere.

Not long after, usually a week, the scammers cut all ties with their recent batch of employees or go a step further and attempt to scam their victims with fraudulent paychecks made out for amounts that are much greater than the compensation for time worked. Victims are then advised to deposit their checks and use the overpayment amount to perform a bank transfer of the funds to one or more people who supposedly weren't paid for some type of service, such as document verification or office supplies. The check then bounces and victims to their horror that not only worked for free, but they also lost extra money.

ScamGuard advice: Never agree to receive and ship packages from home. Additionally, never refund money from a paycheck as a bank transfer. Instead, ask the company to re-issue the check for the correct amount.

Example complaints: Complaint #2908, Complaint #4411, Complaint #4772.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

Example complaints: Complaint #2908, Complaint #4411, Complaint #4772.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

#11. Fraudulent/Fake Check Scams

Reported countries: Nigeria, India and USA

Damages reported: $200-$3000+

Damages reported: $200-$3000+

One of the most popular scams involves scammers convincing unwitting victims to accept fraudulent/fake checks.

Victims with banks accounts in the United States receive checks for whatever reason at much higher amounts than expected. Scammers then use a variety of creative, clever stories to explain any compensation discrepancies and convince victim to send back overpayment via cash-like payment methods or wire transfer. When these checks bounce, the victim discover that they have been fleeced. Over the years, this scam has been used with a variety of consumer actions, including purchase of vehicles and renting property.

ScamGuard advice: Never accept checks with amounts over the agreed upon price. Never agree to send money back. Ask the bank if the check has cleared before releasing the merchandise to the alleged buyer.Example complaints: Complaint #5004, Complaint #1401, Complaint #1632.

Identity theft risk: High - If you've been affected by a similar scam, your identity is at risk. We recommend locking your identity from unauthorized changes using Lifelock. To activate your free 30 day trial protection services, click here.

This ratios are used to Merger scheme by Valuation. Keep it in mind.

Sniffing for Cooked Books

|

In June, Alton Sizemore Jr., CFE, CPA, sat down for a conversation with someone he had met before – one of the primary architects of the $2.7 billion financial statement fraud at HealthSouth Corporation, headquartered in Birmingham, Ala. William Owens was president and chief operating officer of the massive conglomerate when the fraud was discovered in 2003 – an astonishing 17 years after it began.

The two men had first become acquainted during the investigation. At the time, Sizemore was the Birmingham FBI office's assistant special agent in charge, and he managed the HealthSouth case.

MANY CHANGES

Seven years later, Owens had lost his license to practice accounting before the U.S. Securities and Exchange Commission (SEC) and was an ex-convict and an ex-CPA who'd served a five-year prison term for securities fraud. Numerous other executives also were convicted of taking part in the fraud, and the former CEO was in prison for bribing a past governor of Alabama in a corruption case unrelated to the HealthSouth financial statement fraud.

Owens shared the gritty story of how and why he took part in the scheme on a pro-bono basis with the business community and others. And he encouraged auditors, investigators, and fraud examiners to resist the intimidation and other tactics he used to hide the HealthSouth fraud.

After a 25-year FBI career, Sizemore is now director of investigations for Forensic Strategic Solutions, a forensic accounting firm with offices in Birmingham, Dallas, and Washington, D.C.

"Twenty-one people pleaded guilty in that case including every CFO who had been with HealthSouth from the time it went public," he said. "The company's internal controls were virtually nonexistent."

In this article, Sizemore supplies simple but powerful analytic techniques that fraud examiners could have used to find red flags in HealthSouth's financial statements and possibly prevent this devastating scheme.

These techniques (among many) include:

- Trend analysis, which measures changes over time in a company's financial statements

- Ratio analysis, which can compare different items in a single company's current financials or contrast them with analogous items in the financials of competitors or other companies operating in similar industries

Experienced auditors and fraud examiners rely on these techniques to expose and highlight inconsistencies and variations that could be signs of fraud and indicate a need for further investigation.

OUT OF CONTROLS

HealthSouth's history had once been inspiringly positive. The company was the nation's largest provider of health-care services, with more than 48,000 employees and nearly 1,700 facilities throughout the 50 states and abroad, according to Congressional testimony by the interim chairman appointed to head HealthSouth's board of directors when the fraud was discovered in 2003.

Tragically, numerous avoidable lapses in corporate governance and auditing unnecessarily jeopardized the firm's success and cost investors $6.9 billion in lost share and bond value, according to an SEC estimate.

HealthSouth's management had been able to falsify its financial statements since the company went public in 1986 because it had overridden most internal controls and intimidated the external auditors. When the fraud was uncovered in 2003, investigators found that HealthSouth management had overstated earnings by at least $2.7 billion over a 17-year period.

However, before the scheme was exposed, members of senior management had been quietly selling their shares as quickly as they dared and falsely reporting that HealthSouth had billions of dollars in assets that didn't exist.

In August 2002, investors had heard enough when CEO and Chairman Richard Scrushy sold $25 million worth of his company shares just weeks before HealthSouth announced that cuts in Medicare reimbursements would reduce its pretax profits by $175 million. The company also said it wouldn't issue earnings guidance for the remainder of 2002. HealthSouth common shares immediately tumbled from $11.97 to $6.71.

The sudden and steep decline in the company's stock attracted the SEC's attention. Company insiders told the agency that the Medicare payment reduction actually was $20 million at most, and that management was using the additional $155 million in supposed reimbursement cuts to make up for reported earnings that never existed.

ENTER THE FEDS

As a result, the SEC charged numerous HealthSouth executives with insider trading and other violations of securities laws. The FBI, armed with search warrants, raided the company's Birmingham headquarters to look for evidence corroborating company informants' reports of the fraud. Their efforts paid off.

"During that raid, we confiscated a terabyte of digital data and three van-loads of paperwork documenting how the financial statements had been falsified," Sizemore recalled. "We were fortunate to have several cooperating witnesses from inside the organization."

Sizemore and his team had planned to search primarily for evidence of insider trading. But their informants raised the stakes when they said that the company also was committing financial statement fraud.

"They told us where to look for proof of falsified financials, and they were right," Sizemore said. "We found it."

The HealthSouth case was like many other financial statement frauds Sizemore has investigated. "Of course, management wants the company to meet analysts' expectations," he said. "But if reality doesn't cooperate, some executives will, for example, inflate their sales numbers and offset them with phony assets."

Such cases that show continuing fraud due to weak internal controls and/or ineffective audit procedures are very common despite widespread press coverage, Sizemore said. But auditors and fraud examiners are more likely to find red flags when they use the right analytical tools to assess the consistency and reasonability of financial statement data.

HEED SAS 99

Statement on Auditing Standards No. 99, "Consideration of Fraud in a Financial Statement Audit," provides guidance on identifying signs of fraud such as those in the HealthSouth case.

This guidance is especially valuable to auditors and fraud examiners who need to understand the motives and actions of an aggressive executive like Owens, who might be committing and/or hiding fraud.

In particular, the SAS says that "the auditor may identify events or conditions that indicate incentives/pressures to perpetrate fraud, opportunities to carry out the fraud, or attitudes/rationalizations to justify a fraudulent action. Such events or conditions are referred to as 'fraud risk factors.'"

Two such risk factors prevailed at HealthSouth.

First, management believed it had to meet the earnings expectations of debt and equity markets.

"When senior management told Richard Scrushy the company's earnings were less than analysts were expecting, he said, 'Fix it!' They knew what he meant," Sizemore said, "and they acted accordingly."

Second, there was a strained relationship between management and the auditors.

"Owens told me that when the auditors would ask for direct, unfettered access to the general ledger, he would threaten them with finding someone else to do the audit," Sizemore said. Owens told Sizemore the auditors always backed down because they had millions in fees at stake.

CALL TO ACTION

According to the ACFE's 2010 Report to the Nations, financial statement frauds were the longest in duration (median length: 27 months from inception to discovery) and the most costly (median loss: $4.1 million) of all those discussed in the report.

Clearly, fraud examiners and auditors should use tools such as the trend and ratio analysis mentioned above to ferret out any red flags of potential financial statement fraud. Following are examples of what these tools would have revealed, had they been used at HealthSouth.

To illustrate, Sizemore described a vertical analysis comparing data from the financial statements of HealthSouth and one of its major competitors in the 1990s, Tenet HealthCare Corporation, headquartered in Dallas. (See Exhibit 1.)

"This is something that would grab your attention," Sizemore said. "At the end of 1997, 42 percent of HealthSouth's assets were intangible, but only 27 percent of Tenet's were. That's a red flag because intangible assets are inherently difficult to value. It's a part of the financial statements where fraud could be overlooked."

Exhibit 1: Vertical Analysis | HealthSouth Corp. | Tenet HealthCare Corp. |

CYE 1997 ($000) | FYE 5/31/1998 ($000) | |

Intangible Assets | 2,243,372 | 3,417,000 |

Total Assets | 5,401,053 | 12,833,000 |

Intangible Assets as % of Total Assets | 42% | 27% |

Data source: EDGAR, www.sec.gov

Sizemore turned to horizontal analysis for a different perspective on this potentially suspicious aspect of HealthSouth's financial statements. (See Exhibit 2.)

"This analysis reveals that the company's already suspiciously high proportion of intangible assets wasn't just a one-year anomaly. It was a disturbing trend of at least three years' duration," he said. "Yet another reason to investigate whether HealthSouth's management was improperly using these intangible asset values to reduce expenses."

Exhibit 2: Horizontal Analysis | |||||||

Health South Corp. | CYE 1996 ($000) | CYE 1997 ($000) | 1996-1997 $ Change | 1996-1997 % Change | CYE 1998 ($000) | 1996-1998 $ Change | 1996-1998 % Change |

Intangible Assets | 1,094,421 | 2,243,372 | 1,148,951 | 105% | 2,959,910 | 1,865,489 | 170% |

Data source: EDGAR, www.sec.gov

Finally, Sizemore used a ratio analysis to compare HealthSouth's and Tenet's bad-debt write-offs. (See Exhibit 3.) "The less you write off, the higher your income," he said. HealthSouth wrote off only one-third as much in doubtful accounts as Tenet, which faced the same challenges HealthSouth did in collecting receivables. Why was HealthSouth apparently so much better at collections than Tenet? "That's the question this ratio presents," Sizemore said. "It's a red flag that should have been noticed and investigated."

Exhibit 3: Ratio Analysis | HealthSouth Corp. | Tenet HealthCare Corp. |

CYE 1997 ($000) | FYE 5/31/1998 ($000) | |

Provision for Doubtful Accounts | $71,468 | $588,000 |

Net Accounts Receivable | $745,994 | $1,742,000 |

Doubtful Accounts as % of Net A/R | 10% | 34% |

Data source: EDGAR, www.sec.gov

BOTTOM LINE

Under new management since 2003, HealthSouth has improved controls, cooperated with auditors, and progressed toward recovery.

However, experience shows that the right analytical tools can help auditors, investigators, and fraud examiners shine light and transparency into the dark corners of a potentially fraudulent financial statement.

BEST PRACTICES

- Be mindful that risk factors are detectable now, not just later.

- Gather facts and discover truth; don't make allegations.

- Be professionally skeptical. Thoroughly examine results of trend and ratio analyses.

- Insist on full, authoritative confirmations of data and responses to questions that arise during an audit or investigation.

- Recognize and overcome attempts by management or others to thwart audits and investigations.

RESOURCES

Commercial versions of both trend and ratio analysis software enable users to download data from a financial system for analysis in Excel. Such packages are relatively inexpensive and widely available.

Robert Tie is a New York business writer.

The Association of Certified Fraud Examiners assumes sole copyright of any article published on www.fraud-magazine.com or www.ACFE.com. ACFE follows a policy of exclusive publication. Permission of the publisher is required before an article can be copied or reproduced. Requests for reprinting an article in any form must be e-mailed to: FraudMagazine@ACFE.com.

__._,_.___

No comments:

Post a Comment