Once the e-Filed returns are processed and outstanding tax demand available in e-Filing portal, assessee is facilitated to submit the response against outstanding tax demand raised by CPC/AST. CA Sandeep Kanoi | January 3, 2015 at 9:00 am | Tags: cpc, tcs, TDS | Categories: Income Tax | URL: http://wp.me/p3ulce-gJQ

|

How to submit Response to Outstanding Tax Demand

Introduction- Once the e-Filed returns are processed and outstanding tax demand available in e-Filing portal, assessee is facilitated to submit the response against outstanding tax demand raised by CPC/AST.

Process

The detailed process to submit the Response to Outstanding Tax Demand is as below

1. Logon on to incometaxindiaefiling.gov.in with your User ID, Password and Date of Birth/Incorporation.

2. Go to e-File > Response to Outstanding Tax Demand

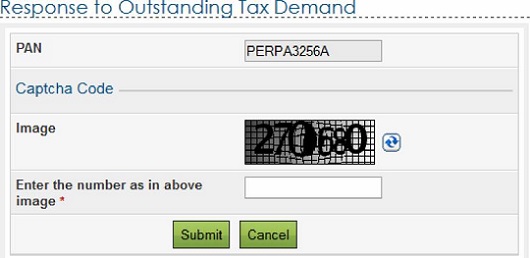

3. Enter PAN and Captcha code and click on Submit button.

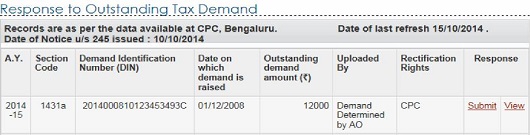

4. On successful validation if there is any Outstanding Tax Demand, the "Response to Outstanding Tax Demand" available with the following details

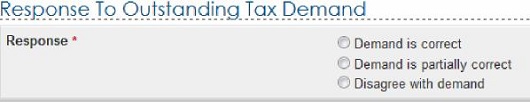

4. On successful validation if there is any Outstanding Tax Demand, the "Response to Outstanding Tax Demand" available with the following details 5. Assessee must click on 'Submit link under Response column for the respective AY in order to submit the response. Assessee has to select one of the options from the radio button.

5. Assessee must click on 'Submit link under Response column for the respective AY in order to submit the response. Assessee has to select one of the options from the radio button. 6. If assessees selects "Demand is correct", then a pop up is displayed as "If you confirm "Demand is correct' then you cannot 'Disagree with the demand'. Click on Submit. A success message is displayed and no further action is required.

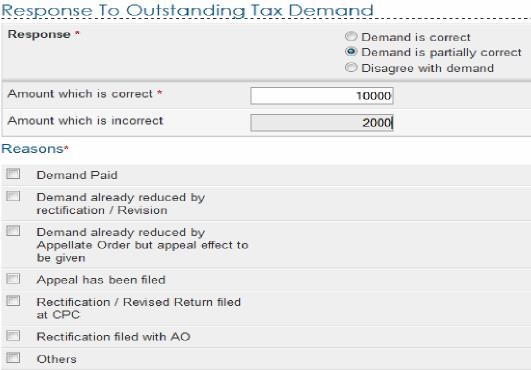

6. If assessees selects "Demand is correct", then a pop up is displayed as "If you confirm "Demand is correct' then you cannot 'Disagree with the demand'. Click on Submit. A success message is displayed and no further action is required.♠ Amount which is correct- Enter the amount which is incorrect.

If the amount entered here is equal to the demand amount, then one pop is displayed "Since the amount entered is equal to outstanding demand amount, please select the option "Demand is correct"

Note: If amount entered is equal to Outstanding demand amount than user shall not be allowed to submit with this option.

♠ Amount which is incorrect: Amount is auto filled which is the difference between the outstanding amount and Amount which is correct.

8. If amount entered is not equal to outstanding demand amount than user should mandatorily fill one or more reasons listed below-

8. If amount entered is not equal to outstanding demand amount than user should mandatorily fill one or more reasons listed below- ♠ Demand Paid –

- Demand paid and challan has CIN

- Demand paid and challan has no CIN

♠ Demand already reduced by rectification/revision

♠ Demand already reduced by Appellate Order but appeal effect to be given

♠ Appeal has been filed

- Stay petition filed with

- Stay granted by

- Instalment granted by

♠ Rectification / Revised Return filed at CPC

♠ Rectification filed with AO

♠ Others

♠ Based on the reason selected, the assessees needs to provide additional information as per the below table.

| Reason Selected | Additional Details Required |

| Demand paid and challan has CIN | BSR Code |

| Date of payment | |

| Serial Number | |

| Amount | |

| Remarks | |

| Demand paid and challan has no CIN | Date of payment |

| Amount | |

| Remarks | |

| Upload Copy of Challan | |

| Demand already reduced by rectification / Revision | Date of Order |

| Demand after rectification/ revision | |

| Details of AO | |

| Upload Rectification / Giving appeal effect order passed by AO | |

| Demand already reduced by Appellate Order but appeal effect to be given | Date of Order |

| Order passed by | |

| Reference Number of Order | |

| Demand after Appeal effect | |

| Appeal has been filed: Stay petition has been filed | Date of filing of appeal |

| Stay petition filed with | |

| Appeal has been filed: Stay has been granted | Date of filing of appeal |

| Stay granted by | |

| Upload copy of Stay | |

| Appeal has been filed: Instalment has been granted | Date of filing of appeal |

| Instalment granted by | |

| Upload copy of stay/instalment order | |

| Rectification / Revised Return filed at CPC | Filing Type |

| e-Filed Acknowledgement No. | |

| Remarks | |

| Upload Challan Copy | |

| Upload TDS Certificate | |

| Upload Letter requesting rectification copy | |

| Upload Indemnity Bond | |

| Rectification filed with AO | Date of application |

| Remarks | |

| Others | Others |

Note: Total Attachments size should be up to 50 MB.

9. If assessee selects "Disagree with the Demand" ", then assessee must furnish the details for disagreement along with reasons. Reasons are same as provided under "Demand is Partially correct".

Fill the necessary details and click on "Submit" button.

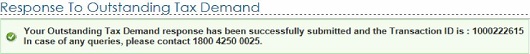

10. After assesse submits the response the success screen must be displayed along with the Transaction ID.

The success message is as follows:

11. Assessees can click on 'View' link under Response column to view the response submitted. The following details are displayed:

11. Assessees can click on 'View' link under Response column to view the response submitted. The following details are displayed:- No.

- Transaction ID – A hyper link

- Date of Response

- Response Type

- Demand position gets updated every day

- Interest demand u/s 220(2) is linked to the principal demand of the same assessment This indicates that principal demand is already adjusted/ paid and interest demand is the only outstanding value. Hence does not require any confirmation.

- If demand is shown to be uploaded by AO in the above table, rectification right is with Assessing Officer, please contact your jurisdictional Assessing Officer for the same.

- For the demand against which there is "No Submit response option" available such demand is already confirmed by the Assessing Officer. Kindly contact your Jurisdictional Assessing officer.

Advance on sale of land wasn't unexplained when sale agreement and bank certificate proved its genuineness

January 3, 2015[2014] 52 taxmann.com 437 (Delhi - Trib.)

IT: Matter of claim for deduction under section 54 remanded where deduction was denied on ground of two other properties owned by assessee but there was no clear finding regarding ownership of said two properties

IT: Where requisite documentary evidences like sale agreement, mode of advance, bank certificate and also declaration of creditors were furnished, identity and genuineness of cash credit was established

__._,_.___

No comments:

Post a Comment